Get the free aig annuity beneficiary change form - csupomona

Get, Create, Make and Sign aig annuity beneficiary change

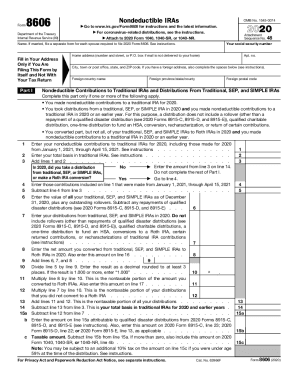

How to edit aig annuity beneficiary change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aig annuity beneficiary change

How to fill out an AIG Change of Beneficiary form:

Who needs an AIG Change of Beneficiary?

Instructions and Help about aig annuity beneficiary change

Hi I'm Jenna I'm here to assist you in filling out the beneficiary change form from pensions and benefits USA this form is used for making changes in the selection of beneficiaries who receive proceeds from insurance plans offered by pensions and benefits these may include coverage provided for you by P and B such as the pensioners' death benefit plan the pastor's life insurance plan or additional plans in which you are enrolled this document allows P and B in our insurance underwriter Aetna to expedite the disposition of funds after your passing as insurance proceeds payments to beneficiaries from these sources bypass probate in most cases this allows proceeds to be distributed fairly quickly speaking of speeding at the process to help expedite claims we recommend you complete one beneficiary designation change form for each plan in which you are enrolled it is important to review them periodically as there are changes in your life such as marriage birth divorce death and so on before we begin here are a few guidelines that will benefit you and help us number one please type or print your responses in ink and make sure your handwriting is easily read this is a legal document, and it's important that everyone who deals with it can clearly understand your wishes number two if you make a mistake just start over with a new form they're available in fillable forms at PB USA org and are easily printed out on your own printer the use of liquid paper are marking through a mistake gives the appearance of a change and might result in your wishes being questioned you want to avoid the appearance that anyone other than you completed this form number three be sure to sign and date your form before returning it to us an unsigned undated form is not a legal document also be aware that typically the insurance company won't approve a form which is signed by a power of attorney in number four if you wish to list a will estate or trust as a beneficiary this is not the correct form for you in such case email us that help at PB USA org in preparing to complete this form here are a few things to consider before you start number one give careful thought to whom you choose to be aware there is no legally binding requirement that would compel the beneficiary of your proceeds to carry out your wishes even if you have a prior agreement with them for instance if you choose to make a friend the beneficiary with the understanding he will use the money to care for your infant children that person may choose to honor or disregard your wishes without legal consequences so be careful about whom you select number two minor children should not be listed as beneficiaries an insurance company cannot pay a benefit to a minor child doing this would result in cumbersome legal procedures that could cost time and money in most cases it's best to leave the benefits to your spouse and let him or her take care of the children number three do not list yourself it's important that you don't...

People Also Ask about

Can you change your beneficiary at any time?

How to fill out beneficiary designation change form?

Can you change beneficiary over the phone?

What is a beneficiary change form?

Who is qualified to change the beneficiary?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send aig annuity beneficiary change to be eSigned by others?

How do I fill out aig annuity beneficiary change using my mobile device?

How do I complete aig annuity beneficiary change on an iOS device?

What is aig annuity beneficiary change?

Who is required to file aig annuity beneficiary change?

How to fill out aig annuity beneficiary change?

What is the purpose of aig annuity beneficiary change?

What information must be reported on aig annuity beneficiary change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.