TN QIT A Guide For The Trustee 2009-2026 free printable template

Show details

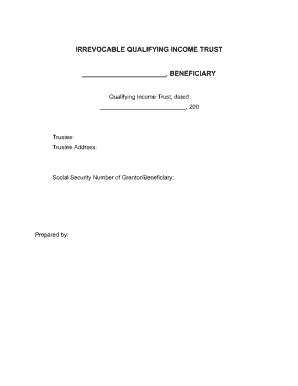

QUALIFIED INCOME TRUST (QIT): A GUIDE FOR THE TRUSTEE You have agreed to serve as the Trustee for a Qualified Income Trust (QIT). This guide tells you more about the Qualified Income Trust. Definitions:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign qualified income trust form

Edit your nashville qualified income trust lawyer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your qualified income trust tennessee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit qit form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit miller trust tennessee form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out qit trust form

How to fill out TN QIT A Guide For The Trustee

01

Read the instructions carefully before starting to fill out the form.

02

Gather all necessary documents, including financial statements and identification.

03

Begin with Section 1 and enter the trustee's name and contact information.

04

Fill out Section 2 by providing details of the trust, including date of creation and beneficiary information.

05

Complete Section 3 by entering the assets held in the trust with corresponding values.

06

In Section 4, detail any liabilities associated with the trust.

07

Finish with Section 5 by signing and dating the document in the designated area.

08

Ensure all sections are complete and double-check for accuracy before submission.

Who needs TN QIT A Guide For The Trustee?

01

Trustees managing a trust that is subject to the TN Qualified Income Trust requirements.

02

Individuals seeking to understand their obligations and responsibilities as trustees.

03

Attorneys helping clients with estate planning and trust administration.

04

Beneficiaries wanting to verify the proper management of the trust.

Fill

miller trust form

: Try Risk Free

People Also Ask about income only trust jefferson city tn

What is a qualified income trust for TennCare?

A QIT is a type of irrevocable trust for people who have a little too much monthly income to qualify for Medicaid/TennCare benefits – and “a little” may be as small an amount as $1!

How do I set up a QIT account in Texas?

How do I set up a Qualified Income Trust? A lawyer creates the trust documents, which are then signed and notarized by both the settlor (beneficiary) or the settlor's (beneficiary's) agent under a power of attorney, and the trustee.

What is a Medicaid Qualifying Income Trust Tennessee?

A Miller Trust, or Qualified Income Trust (QIT), is a tool which may be used by individuals whose monthly income is too high to qualify for Medicaid/TennCare benefits but too low to pay for care in a long-term care facility.

How do I set up a QIT in Tennessee?

To create a QIT, the applicant or his/her agent under a power of attorney and the Trustee must sign a trust document that names a Trustee of the account. The Trustee must be someone other than the applicant. Once the trust document is signed, the Trustee takes the trust document to a bank that accepts QITs.

What is a qualifying income trust in TN?

A qualified income trust (QIT), also known as a Miller trust, is a special trust that allows Tennessee residents to qualify for Medicaid and TennCare CHOICES, even if their gross monthly income exceeds Medicaid's income cap.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my qualified income trust qit directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your TN QIT A Guide For form Trustee along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete TN QIT A Guide For form Trustee online?

Filling out and eSigning TN QIT A Guide For form Trustee is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the TN QIT A Guide For form Trustee in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your TN QIT A Guide For form Trustee and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is TN QIT A Guide For The Trustee?

TN QIT A Guide For The Trustee is a resource that provides guidance for trustees managing Trusts in Tennessee, outlining the responsibilities and legal requirements involved in the administration of qualified income trusts.

Who is required to file TN QIT A Guide For The Trustee?

Trustees of Qualified Income Trusts (QITs) in Tennessee are required to file the TN QIT A Guide For The Trustee to comply with state regulations.

How to fill out TN QIT A Guide For The Trustee?

To fill out TN QIT A Guide For The Trustee, trustees need to provide detailed information regarding the trust's structure, assets, beneficiaries, and any income reporting requirements, often following specified forms provided by the state.

What is the purpose of TN QIT A Guide For The Trustee?

The purpose of TN QIT A Guide For The Trustee is to ensure that trustees follow legal guidelines in managing QITs, promote proper administration, and facilitate compliance with both state and federal laws.

What information must be reported on TN QIT A Guide For The Trustee?

Information that must be reported on TN QIT A Guide For The Trustee includes trust identification details, trustee contact information, account statements, trust income, and distributions, as well as other relevant financial data.

Fill out your TN QIT A Guide For form Trustee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN QIT A Guide For Form Trustee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.