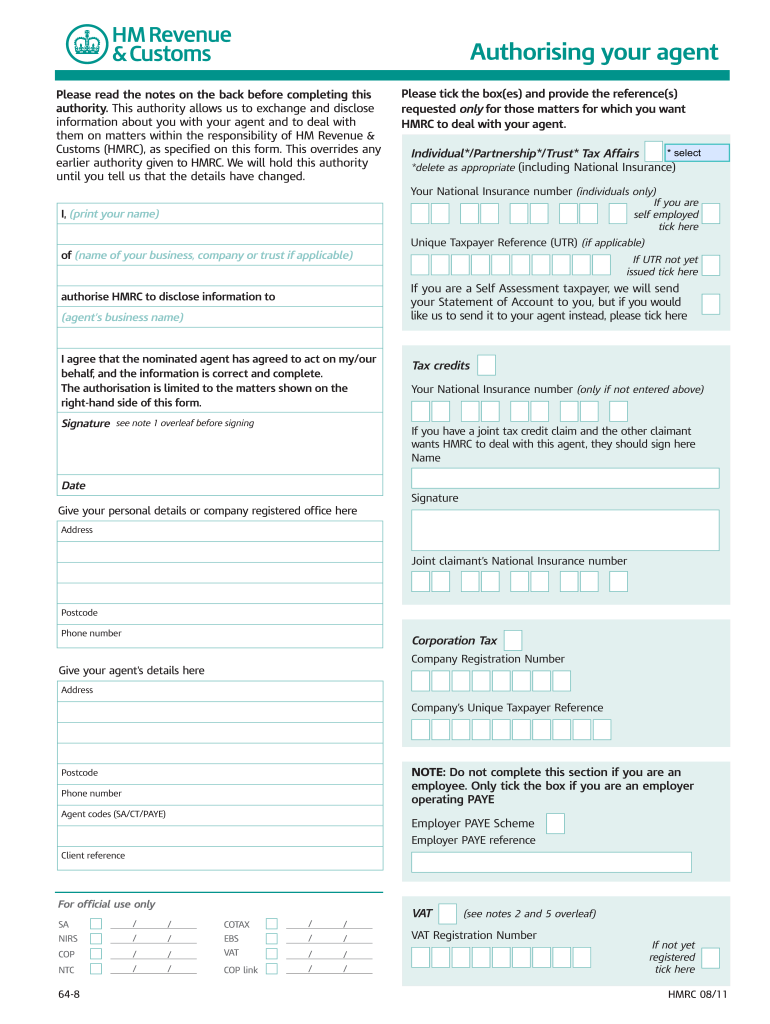

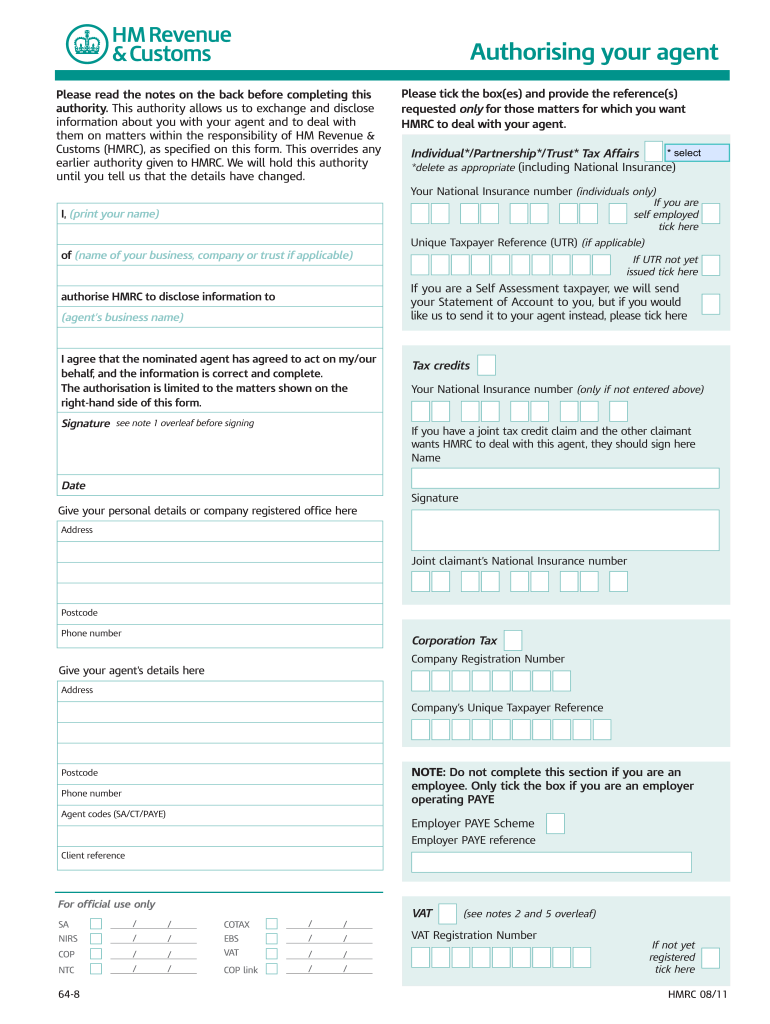

UK HMRC 64-8 2011 free printable template

Get, Create, Make and Sign UK HMRC 64-8

How to edit UK HMRC 64-8 online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC 64-8 Form Versions

How to fill out UK HMRC 64-8

How to fill out UK HMRC 64-8

Who needs UK HMRC 64-8?

Instructions and Help about UK HMRC 64-8

Music all right guys come on let's go fifteen minutes we got to be on set background actors I didn't offer accurate rope immediately follow me all right guys come on put a little of a hustle in that step let's go all right keep coming guys let's go we are here hey Cinderella you need help with that we can call my grandmother bye guys let's go let's go everybody I need everybody to move a little faster here let's go hey I told you guys I need Santa to go to Studio C talk to the director come on let's hit learn Sarah I'm totally impressed there that's good Dan all right lets eighty-six to chew and put Santa with Jesus and Gumbo that's the only thing that makes sense you what the hell are you doing you're supposed to be dead not asleep I have no real in this box I feel like the race was at the Kentucky Derby Music — ethnic lighten them up lose the ponytail banana you look like an actor in a banana suit I need you to be the banana feel the banana come on folks let's move this thing let's make this thing pop welcome to the set of totally Sarah well not the set really we call this place holding it's the cold gray room where they cram all of us extras you see being an extra or background artiste it's the lowest of the low in the film industry, and we're often treated like it, we get sixty-four dollars for eight hours and work don't bother somebody else please when I losers lepers morons or mental defectives at least not most of us there are all sorts of extras first you got your lifers they've been waiting years for their big do I look sexy of course you do today might be your big break sugar then you got your networkers and with a beep crap nigga meet you how are you going to fit all business cards and headshot then you got your creeper but was L my name is baron OCS hardly fashion photographer talent agent I'd like to introduce you to my casting company ladies beware and over here you have the sleepers these guys they're here to milk the clock the side goes I'm pretty sure they're still on parole and then the newbies oh my god oh my god every supposed be on the set right now should I go talk to that guy Eric what up what was always done too many questions, and then you got this totally delusional Music and finally this bunch of misfits they're acceptable you get all types most are somewhat normal he finds your own people settle in, but it's easy to get stuck that's where I'm at right now just stunk this is how your day starts as an extra 530 am call time to check in with this ray of sunshine I only saw me they were looking I know they didn't say anything about you listen pal I don't know if they saw you just leave get away from my desk go I don't care oh wow Eric how's it Roland somebody call for a bump whatever dawg just take the voucher and do it right okay take one and go please do not fill it out here go move I don't care who is a hello everybody did you guys see how Julia LeBron was looking at me yesterday on passions of the heart oh, oh yeah...

People Also Ask about

How long does it take to get 64-8 form?

How to fill out a 64-8 form?

What is a 64-8 form?

Can I still use old 64-8?

How long does a 64-8 take to process?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete UK HMRC 64-8 online?

Can I create an electronic signature for signing my UK HMRC 64-8 in Gmail?

How do I edit UK HMRC 64-8 on an Android device?

What is UK HMRC 64-8?

Who is required to file UK HMRC 64-8?

How to fill out UK HMRC 64-8?

What is the purpose of UK HMRC 64-8?

What information must be reported on UK HMRC 64-8?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.