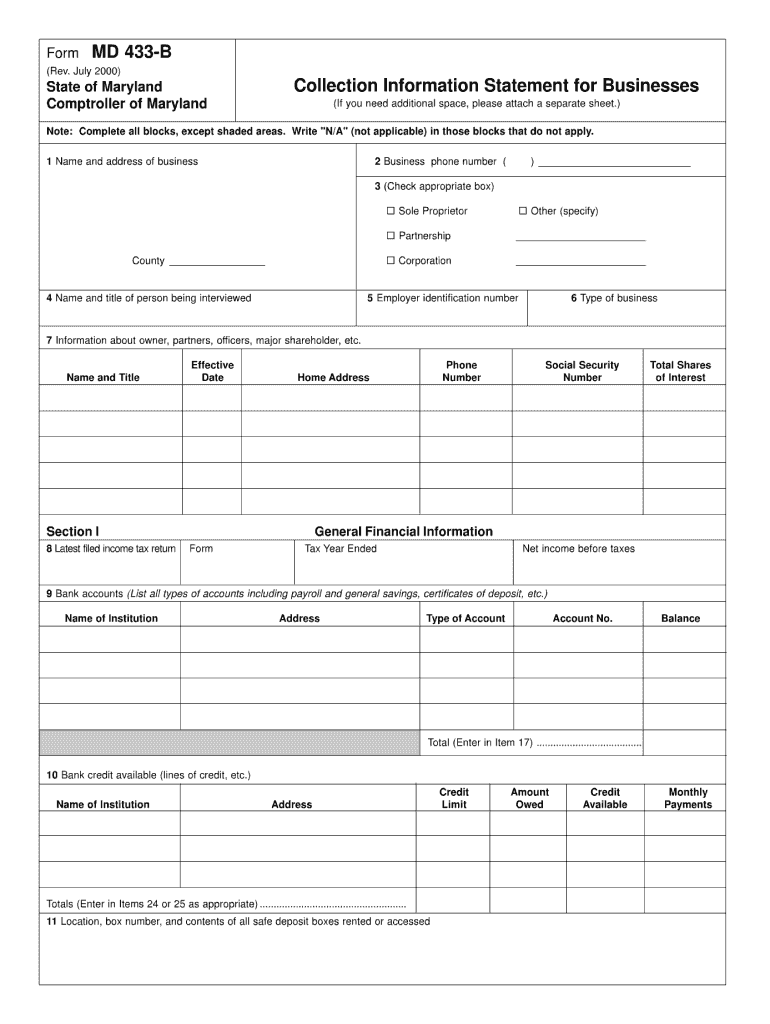

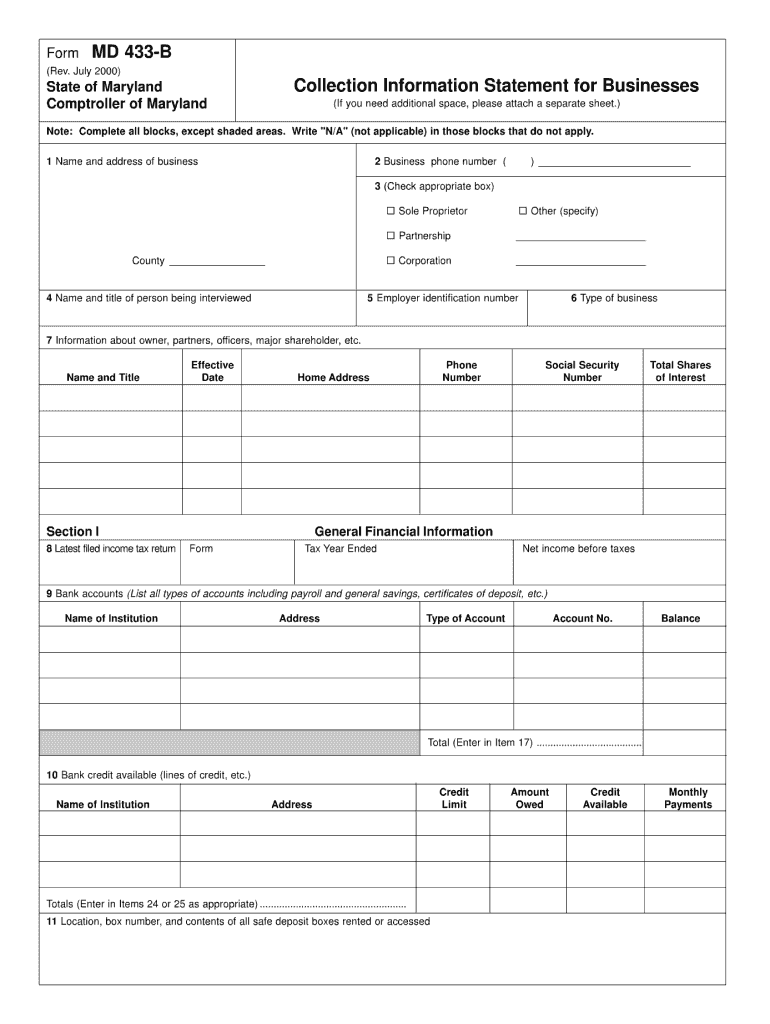

MD Comptroller MD 433-B 2000-2024 free printable template

Show details

1 2 3 Lowell Finley, SON 104414 LAW OFFICES OF LOWELL FINLEY 1604 SOLANO AVENUE BERKELEY, CALIFORNIA 94707-2109 TEL: 510-290-8823 FAX: 510-526-5424 4 Attorneys for Plaintiffs and Petitioners 5 SUPERIOR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your maryland 433 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland 433 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland 433 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit md 433 b form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out maryland 433 form

01

To fill out Maryland 433, you first need to gather all the necessary information and documents. This includes personal identification details such as your name, date of birth, and social security number.

02

Next, you need to provide information about your income, assets, and expenses. This may include details about your employment, bank accounts, property, vehicles, and any other valuable assets you possess.

03

You will also need to disclose any outstanding debts, including credit card balances, loans, and any other financial obligations you have.

04

Maryland 433 requires you to specify your monthly income and expenses. This involves listing your sources of income and providing accurate figures for your monthly expenses, such as rent/mortgage payments, utilities, transportation costs, and healthcare expenses.

05

Additionally, you may be required to provide supporting documentation such as pay stubs, tax returns, bank statements, and proof of any exemptions or deductions you are entitled to.

06

Carefully review the completed Maryland 433 form to ensure accuracy and completeness before submitting it to the relevant authority or organization.

07

As for who needs Maryland 433, it is primarily used by individuals who are applying for certain financial assistance programs, such as debt relief or bankruptcy, where a detailed assessment of their financial situation is required. It is also used by individuals who are involved in legal proceedings related to financial matters.

08

In summary, Maryland 433 is needed by individuals seeking financial assistance or involved in legal processes to provide a comprehensive overview of their financial situation. It requires detailed information about income, assets, expenses, and debts.

Fill md b information : Try Risk Free

People Also Ask about maryland 433

What is Form 433-B OIC collection information statement for businesses?

What if Maryland taxes are withheld in error?

What is the difference between 433-A and 433-B?

What is Form 433-B used for?

What is a 433-B?

What is IRS form 433-B used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is maryland 433 b?

Maryland 433(b) refers to a section of the Maryland Code related to the taxation of retirement income. Specifically, it addresses the taxation of distributions from certain retirement plans, such as Individual Retirement Accounts (IRAs) and employer-sponsored retirement plans. Maryland residents may be subject to state income tax on these distributions, although certain exemptions and deductions may apply. The exact details and provisions of Maryland 433(b) can be found in the relevant section of the Maryland Code.

Who is required to file maryland 433 b?

I am unable to find any specific information regarding a Maryland 433(b) form. However, typically, the IRS Form 433-B is used by businesses to provide financial information when negotiating an installment agreement with the IRS. If you are referring to the Maryland state equivalent of this form, it is advisable to consult with a tax professional or contact the Maryland State Department of Assessments and Taxation for clarification on filing requirements.

How to fill out maryland 433 b?

To fill out Maryland Form 433B, follow these steps:

1. Start by downloading the form from the Maryland Court's website or obtain a copy from a local courthouse.

2. Provide your personal information, including your name, address, telephone number, and email address.

3. Indicate the jurisdiction and case number related to your bankruptcy case.

4. Section I: List all household members, providing their names, ages, occupations, and sources of income.

5. Section II: Outline your monthly income. Include all sources of income, such as employment, self-employment, rental income, and any other regular sources of funds. Subtract any tax withholdings, deductions, or other adjustments to calculate your net monthly income.

6. Section III: Detail monthly expenses, including housing expenses, utilities, transportation costs, health insurance premiums, child support obligations, installment payments, and any other regular expenses. Subtract total expenditures from total income to calculate your monthly disposable income.

7. Section IV: Identify any assets you own, such as real estate, vehicles, bank accounts, retirement accounts, investments, and any other valuable assets. Provide detailed information, including the fair market value and any existing liens or loans against these assets.

8. Section V: List all unsecured debts you owe, such as credit card debts, medical bills, personal loans, and any other debts not secured by collateral. Provide detailed information about each debt, the creditor's name and contact information, the outstanding balance, and any monthly installments.

9. Section VI: Declare any property transfers or monetary gifts you made in the past two years.

10. Section VII: List any pending lawsuits, legal claims, or potential inheritances.

11. Sign and date the form, certifying its accuracy and completeness. If applicable, have your bankruptcy attorney review and sign the form as well.

Remember to double-check all the provided details for accuracy before submitting the form as any errors or inaccuracies may impact your bankruptcy case.

What is the purpose of maryland 433 b?

I could not find any specific information about a form or document called "maryland 433 b." It is possible that this is a reference to a specific form or instruction related to Maryland state tax or legal matters. Without further context or details, it is challenging to determine the exact purpose. If you can provide more information or clarify the context, I can try to assist you further.

What information must be reported on maryland 433 b?

Maryland Form 433-B, also known as the Personal Property Tax Return, is used to report personal property owned by a business or individual in Maryland for taxation purposes. The information that must be reported on Form 433-B includes:

1. Identification Information: This includes the name, address, and federal identification number of the business or individual filing the return.

2. Declaration of Personal Property: A detailed listing of all personal property owned by the business or individual, including a description of the property, its cost, year of acquisition, and its fair market value as of January 1st of the tax year.

3. Depreciation Schedule: If applicable, the Form 433-B requires a depreciation schedule for depreciable personal property, providing information such as the year of acquisition, the original cost, depreciation claimed to date, and the current depreciated value.

4. Declaration of Exempt Property: If any personal property qualifies for an exemption from taxation, it must be identified and the reason for the exemption must be stated.

5. Signature and Date: The form must be signed and dated by the business owner or authorized representative certifying that the information provided is true and accurate.

It's important to note that the specific requirements and instructions for filling out Form 433-B may vary, so it is recommended to review the instructions provided with the form or consult a tax professional for assistance.

What is the penalty for the late filing of maryland 433 b?

The penalty for the late filing of Maryland Form 433B, which is used for requesting an extension of time to file a Maryland income tax return, is generally 1% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest will be charged on any unpaid tax from the original due date until the tax is paid in full.

How do I make changes in maryland 433?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your md 433 b form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in maryland collection information statement without leaving Chrome?

md comptroller 433 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit 433 b statement on an Android device?

You can make any changes to PDF files, like 433 b collection information statement, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your maryland 433 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Collection Information Statement is not the form you're looking for?Search for another form here.

Keywords relevant to md collection information

Related to md form 433

If you believe that this page should be taken down, please follow our DMCA take down process

here

.