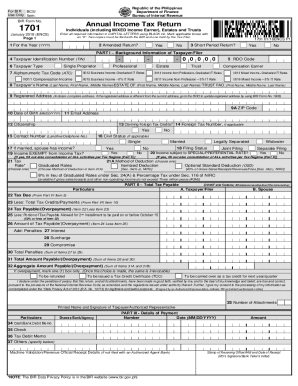

DD 1701 1974 free printable template

Get, Create, Make and Sign DD 1701

How to edit DD 1701 online

Uncompromising security for your PDF editing and eSignature needs

DD 1701 Form Versions

How to fill out DD 1701

How to fill out DD 1701

Who needs DD 1701?

Instructions and Help about DD 1701

Shut up I think my vlog post will be about VIR today how I filed my taxes because some of my friends a lot of freelance theater actors have a hard time filing I think they get confused with the program, so I'm going to do a blog tutorial on how I do my I won't like I don't know if you do a different version, but that's how I was taught by an accountant and by a AIR personnel because my mom and I used to go to VIR to file our taxes but since everything's online now we had to learn it on our own well we didn't honor a person from BA our daughter something with and that's how I've been filing my monthly taxes my IP our quarterly ID are waiting for us, so this is what I'm doing well technically I've finished my taxes already no see long ago, and I just want to fix us later I'm going to give my tutorial I really will give a tutorial later on how the file weird hi we have flowers and my kids those are my kids guys see those okay, so I got a bump that I could buy the door I got a bunch of in internals with a gulag, and I'm like I'm going to do the tutorial okay I'm using my brother's laptop because first this program does not work on Mac, so it only works on Windows and you have to download the e BIR forms I teach you the monthly thing first I teach them how to choke people things you need when you file your taxes your cor can see it yes actually your cor will tell you everything you need the file the reminders are actually here you can check which quarter like first quarter is until April 15, so it's June the 15th and then August 15 and then November 15, and then it tells you which form you have to do so for example on April 15 for 1701 Q is just and at the same time there's another one that says 1701 is due on April 15, and it also says file your monthly taxes, so that's formed two five one M so yeah guys if you get confused with like you don't know what the file went to file check out your cor because it has everything ok, so the program looks like that so first off you need to input the course your tin ok because I've used this a lot it actually automatically inputs everything else, and then you choose which form so for example two five one M, so that's your monthly percentage tax return, and then you open that okay so once you have that you have to make sure that this is on calendar okay see that, so you click on it well I choose the first one now that you actually put that you can already put an amount and once you've done that you click validate so validation successful click on edit if you wish to modify your entries, but I don't have to if you want to set this to be I already just have to click final copy which I will not do so click final copy and then the next page will actually say are you are registered VAR online user or something like that click now and then after that I think it will automatically send to VIR, and then you'll have the confirmation on your email they'll send you a confirmation letter on your income yes, so that is for...

People Also Ask about

What is the difference between BIR Form 1700 and 1701?

What is the penalty for 1701?

What is BIR Form 1701 and 1701A?

What is the filing date for 1701?

How to file BIR Form 1701 online?

What is a BIR Form 1701?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in DD 1701?

Can I create an electronic signature for signing my DD 1701 in Gmail?

How do I fill out DD 1701 using my mobile device?

What is DD 1701?

Who is required to file DD 1701?

How to fill out DD 1701?

What is the purpose of DD 1701?

What information must be reported on DD 1701?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.