SEC 1746 2006-2025 free printable template

Show details

Subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or. 240.13d-1(g), check the following box. Note: Schedules filed ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form schedule 13d

Edit your schedule 13d blank form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule 13d blank form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule 13d blank form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule 13d blank form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule 13d blank form

How to fill out SEC 1746

01

Obtain Form SEC 1746 from the official SEC website or relevant authority.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details of the transaction or issue you are reporting.

04

Include any required supporting documentation as indicated in the instructions.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the form according to the instructions provided, either electronically or by mail.

Who needs SEC 1746?

01

Individuals or entities conducting business subject to SEC regulations.

02

Those involved in financial transactions or investments that require disclosure.

03

Complainants reporting fraud, misconduct, or issues related to securities.

Fill

form

: Try Risk Free

People Also Ask about

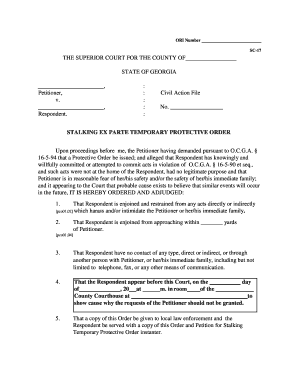

What triggers a 13G filing?

The obligation to file a beneficial ownership report on either Schedule 13D or Schedule 13G is triggered by the acquisition of a class of equity securities that are registered under Section 12 of the Exchange Act (see Practice Note, Periodic Reporting and Disclosure Obligations: Overview).

What is a Schedule 13D filing?

A Schedule 13D is a document that must be filed with the Securities and Exchange Commission (SEC) within 10 days of the purchase of more than 5% of the shares of a public company by an investor or entity. It is sometimes referred to as a beneficial ownership report. 1.

What is the purpose of a 13D transaction?

Purpose of Transaction - This is the most important portion of the 13D filing. It allows you to see why they are buying shares in the company, whether it be for acquisition, hostile takeover, proxy battle, or simply because they believe it is undervalued.

What triggers 13D?

The obligation to file a beneficial ownership report on either Schedule 13D or Schedule 13G is triggered by the acquisition of a class of equity securities that are registered under Section 12 of the Exchange Act (see Practice Note, Periodic Reporting and Disclosure Obligations: Overview).

What is the difference between SEC 13G and 13D?

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

What is the purpose of a transaction Schedule 13D?

Schedule 13D reports the acquisition and other information within 10 days after the purchase. The schedule is filed with the SEC and is provided to the company that issued the securities and each exchange where the security is traded.

What is the purpose of Schedule 13D?

Schedule 13D reports the acquisition and other information within 10 days after the purchase. The schedule is filed with the SEC and is provided to the company that issued the securities and each exchange where the security is traded.

Who needs to file a Schedule 13D?

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Who is required to file a 13D?

Schedule 13D is a required SEC filing for entities acquiring more than 5% of the stock of a public company.

Is a 13D good for a stock?

The Schedule 13D filing can be useful for other investors because the filing requires the acquiring owner to give the purpose of the transaction. Sometimes activist investors can acquire a stake in a company in an effort to influence management to pursue a new strategy or capital allocation plan.

What is the difference between a 13G and 13D filing?

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule 13d blank form for eSignature?

Once you are ready to share your schedule 13d blank form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my schedule 13d blank form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your schedule 13d blank form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete schedule 13d blank form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your schedule 13d blank form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

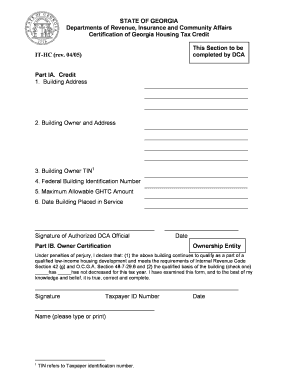

What is SEC 1746?

SEC 1746 is a form that provides the Securities and Exchange Commission (SEC) with information regarding the financial condition and operations of certain entities, specifically focusing on disclosures related to the securities industry.

Who is required to file SEC 1746?

Entities involved in the securities industry, including broker-dealers and certain investment companies, are required to file SEC 1746.

How to fill out SEC 1746?

To fill out SEC 1746, the filer must gather relevant financial data, comply with reporting requirements set forth by the SEC, and complete the form according to the SEC's guidelines, ensuring accuracy and completeness of the information provided.

What is the purpose of SEC 1746?

The purpose of SEC 1746 is to ensure transparency in the financial practices of entities in the securities industry by collecting necessary financial information for regulatory oversight.

What information must be reported on SEC 1746?

Information required on SEC 1746 includes financial statements, disclosures about the entity's operations, compliance with regulatory requirements, and any other pertinent data that the SEC mandates.

Fill out your schedule 13d blank form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 13d Blank Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.