Who needs BIR Form No. 2307?

A BIR Form No. 2307 is an essential document for both employees doing freelance jobs on the side and employers who accept project-based or freelance employees and freelancers.

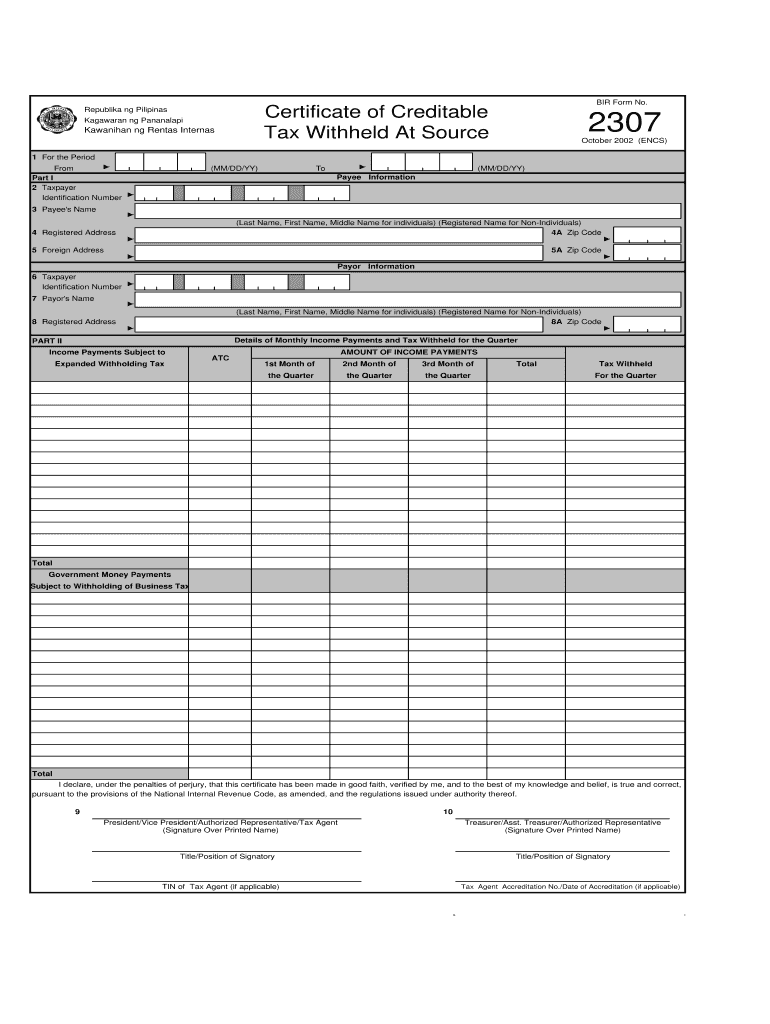

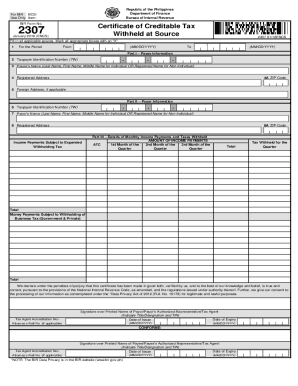

What is BIR Form No. 2307 Used for?

BIR Form No. 2307 is also called a Certificate of Creditable Tax Withheld At Source. This Form is an obligation of the mayor and/or employer — withholding tax agent to the payee.

Is BIR Form No. 2307 Accompanied by Other Forms?

This form must be filed together with the Quarterly/Annual Income Tax Return —?? BIR Forms 1701Q / 1701 for individuals, or BIR Form 1702Q/ 1702 for non-individuals.

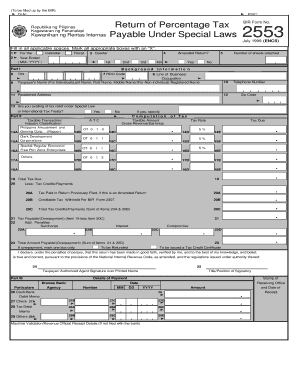

For Percentage Taxes on Government Money Payments this Certificate has to be attached to the Quarterly Percentage Tax return (BIR Form No. 2551M and 2551Q).

For VAT Withholding — This Certificate is to be attached to the Monthly VAT Declaration (BIR Form No. 2550M) and Quarterly VAT Return (BIR Form No. 2550Q).

When is BIR Form No. 2307 due?

For Expanded Withholding Tax must be filed on or before the 20th day of the month following the close of the taxable quarter.

For both Percentage Tax On Government Money Payments and VAT Withholding the Form has to be issued on or before the 10th day of the month following the month in which withholding was made.

What Information Should be Provided in BIR Form No. 2307?

The taxpayer has to indicate the following information:

- Taxable (accounting) period

- Payee information including Name, Address, Taxpayer Identification Number

- Mayor information including Name, Address, Taxpayer Identification Number

- Income Payments Subject to Expanded Withholding Taxpayer

- Money Payments Subject to Withholding of Business Tax (Government & Private)

Where do I send BIR Form No. 2307?

This shall be filed while sending the income tax return form with an Authorized Agent Bank located within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register or where the taxpayer has his legal residence or place of business in the Philippines.

If there are no Authorized Agent Banks where the taxpayer is registered, Form should be filed either with the Revenue District Office or Municipal Treasurer of the Revenue District Office where the taxpayer is required to register or where the taxpayer has his legal residence or place of business in the Philippines.

If the taxpayer has neither legal residence nor place of business in the Philippines, a BIR Form No. 2307 should be filed with the Office of the Commissioner or Revenue District No. 39.