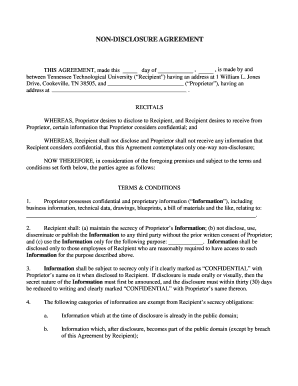

Canada T2125 2011 free printable template

Show details

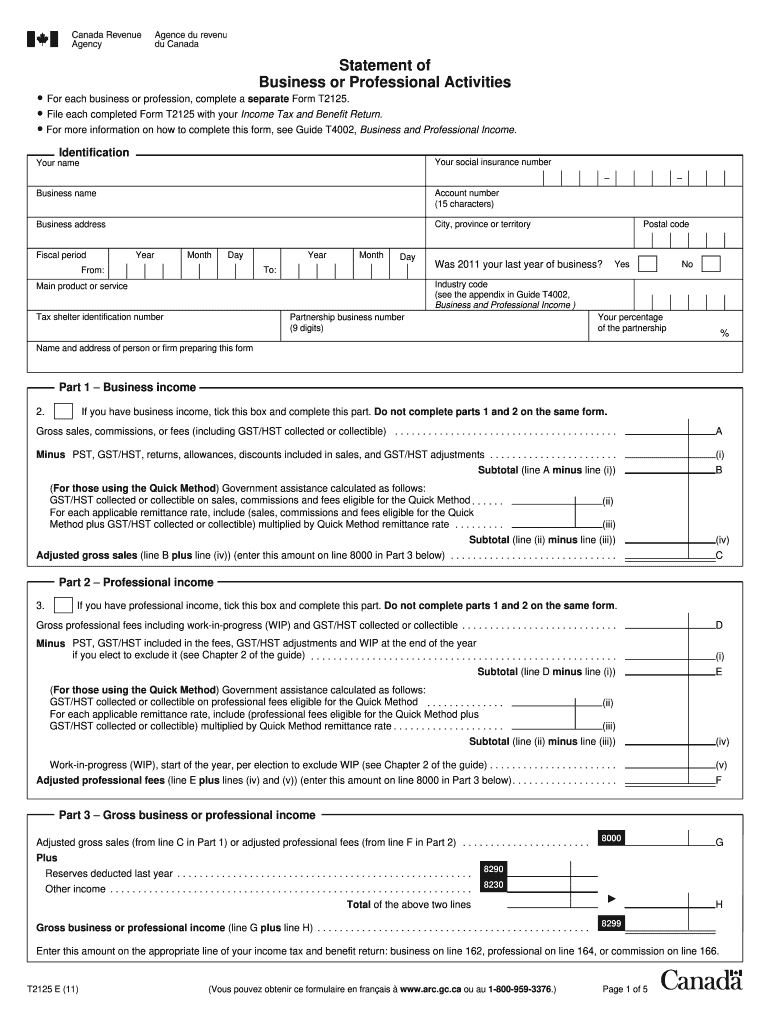

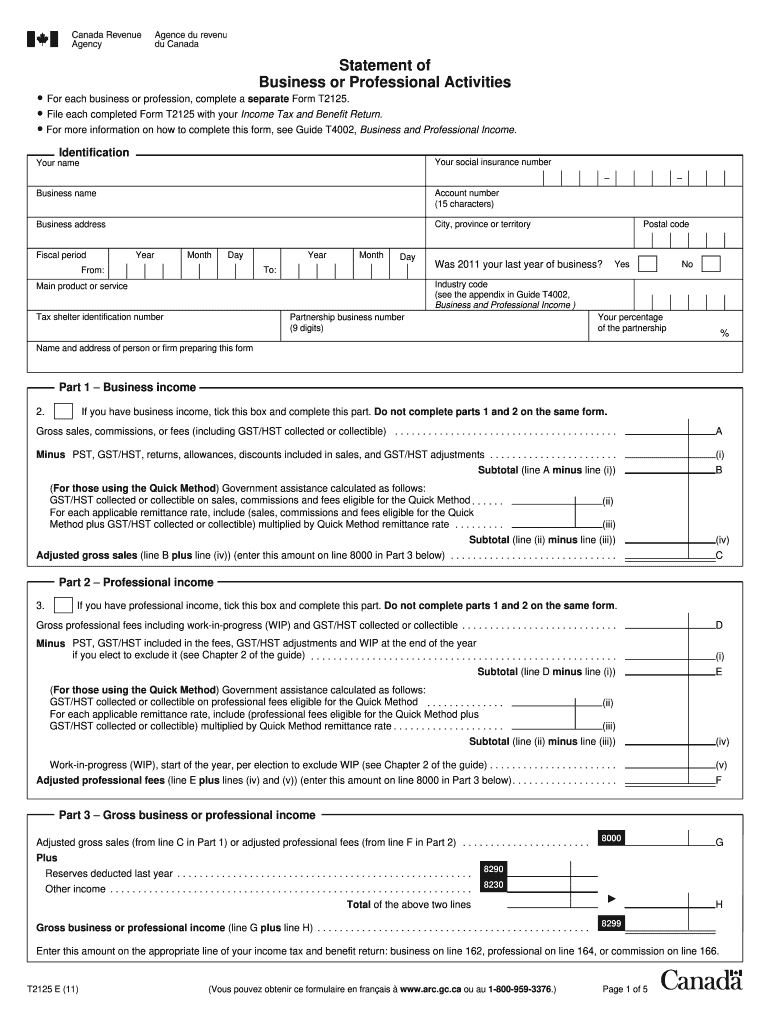

File each completed Form T2125 with your Income Tax and Benefit Return. For more information on how to complete this form see Guide T4002 Business and Professional Income. Identification Your name Your social insurance number Business name Account number 15 characters Business address City province or territory Fiscal period Year Month Day To From Postal code Was 2011 your last year of business Yes No Industry code see the appendix in Guide T4002 Business and Professional Income Main product...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T2125

Edit your Canada T2125 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2125 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T2125 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T2125. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2125 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2125

How to fill out Canada T2125

01

Gather all necessary financial records, including income and expenses related to your business.

02

Download the Canada T2125 form from the Canada Revenue Agency (CRA) website.

03

Fill out the identification section with your name, business name, and contact information.

04

Provide your business income details, including total sales and any other income you received.

05

List all business expenses in the respective categories, such as vehicle expenses, office supplies, and advertising.

06

Calculate your net income by subtracting total expenses from your total income.

07

Fill out the section on your business type and any other relevant details.

08

Review the completed form for accuracy and completeness before filing.

09

Submit the T2125 form along with your income tax return to the CRA by the deadline.

Who needs Canada T2125?

01

Self-employed individuals or freelancers who earn income from a business or profession.

02

Partnerships that generate business income.

03

Anyone who has to report business income on their personal tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is a T2125 form?

You can use Form T2125, Statement of Business or Professional Activities, to report your business and professional income and expenses. This form can help you calculate your gross income and your net income (loss), which are required when you complete your Federal Income Tax and Benefit Return.

Who needs to fill out a T2125?

Who needs to file a T2125? If you run a sole proprietorship or you are part of a business partnership with five or fewer partners, the T2125 is for you. If you have more than five partners, you'll need to file a T5013 Partnership Information Return filing requirements.

Can you file a T2125 without a business number?

When you receive self-employment income (including contractor income) you must report it on a form T2125. You may need to complete this form even if you didn't know you have a business. You don't need a business number (or to have registered with the CRA) to complete this form.

How do I file a 1099 NEC without a business?

How do I enter my 1099-NEC without entering a business? The IRS considers consulting or contractor income as business income that needs to be entered on a Schedule C. If you have self-employment income from a 1099-NEC, which is the case with most Form 1099-NECs, you'll need to report the income on Schedule C.

What is the difference between business income and professional income T2125?

Business income is income from any activity you do for a profit and includes sales, commissions, or fees. For example, income earned as a plumber is considered business income. Professional income is the same except that your income is from a profession that has a governing body.

Do you need to have a business to be self-employed?

You don't have to have a formal company, such as a partnership, S corporation or limited liability company, to be self-employed. The simplest business structure is a sole proprietorship, and those don't have much structure at all.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Canada T2125 online?

pdfFiller has made it easy to fill out and sign Canada T2125. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit Canada T2125 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Canada T2125 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the Canada T2125 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Canada T2125 in minutes.

What is Canada T2125?

Canada T2125 is a tax form used to report income and expenses from a business or professional activity for self-employed individuals in Canada.

Who is required to file Canada T2125?

Individuals who are self-employed, including sole proprietors and partners in a partnership, are required to file Canada T2125 to report their business income and expenses.

How to fill out Canada T2125?

To fill out Canada T2125, self-employed individuals must provide details about their business income, expenses, and various deductions. This includes information on revenue, capital cost allowance, and other relevant business expenditures.

What is the purpose of Canada T2125?

The purpose of Canada T2125 is to provide the Canada Revenue Agency (CRA) with a complete overview of a self-employed individual's business income and expenses for accurate tax assessment.

What information must be reported on Canada T2125?

Information that must be reported on Canada T2125 includes gross income from the business, details of expenses such as advertising, office supplies, and vehicle expenses, as well as information related to capital gains and losses, and any other relevant financial data related to the business.

Fill out your Canada T2125 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2125 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.