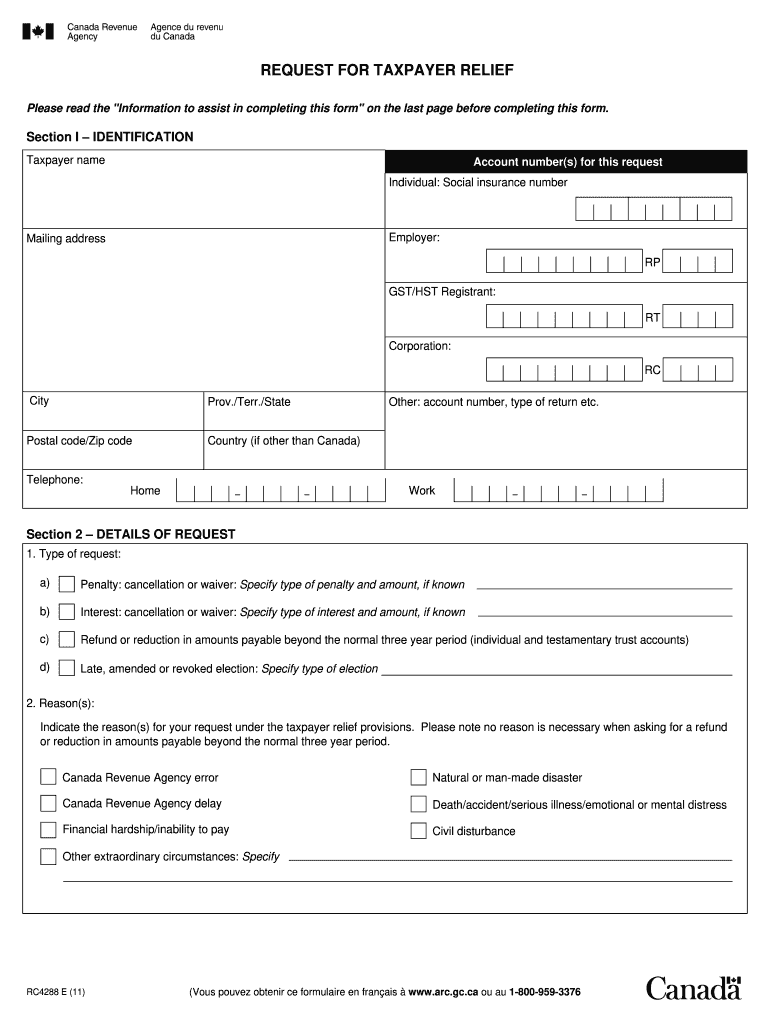

Who needs Form RC4288?

RC4288 Form is the Canada Revenue Agency (CRA) form that is officially called Request for Taxpayer Relief. Logically, the form must be completed by an individual who need to obtain relief from penalties or interest for not filing taxes in a timely manner due to some reasonable and understandable grounds. The acceptable excuses for not filing taxes when expected may include the following circumstances or misfortune beyond the taxpayer’s control:

-

Natural or human-made disasters (fire, hurricane, flood, etc.)

-

Civil disorders or strikes;

-

Severe illness or accident; or

-

Serious emotional or mental distress, such as death of a family member.

The grounds for taxpayer relief do not include many, still they are not necessarily limited to the ones mentioned above, as penalties and interest may also be waived if they were caused primarily by the CRA actions (disruption in services or erroneous information from the tax department in the form of incorrect written answers, errors in published information, or undue delays in resolving an objection or an appeal or in completing an audit). Besides, interest may be also partially waived if a taxpayer is unable to pay taxes because of financial hardship, yet it must be well-grounded.

Is the CRA Request for Taxpayer Relief Form accompanied by any other documents?

As it has been mentioned the submission of Form RC4288 must have some reasons, therefore there is a necessity to attach all the possible relevant information to the completed RC4288 request. The attachments may be the following (depending upon the particular case):

-

Copies of correspondence between the taxpayer and the CRA

-

Doctor’s certificate

-

Death certificate

-

Police report

-

Insurance statement, etc.

How to fill out the CRA Form 4288?

Canada RC4288 Form must clarify the following details:

-

Taxpayer's personal data (full name, address, account number for the request)

-

Type and reasons for relief request

-

Supporting documentation

-

Certification

Where to send the completed CRA Form RC4288?

The destination address of the completed Taxpayer’s Relief Request Form depends on the taxpayer’s province or territory of residence a DN is indicated on the last age of the fillable RC4288 Request form itself.