Get the free worth worksheet sample

Get, Create, Make and Sign net worth form print

Editing worth calculation printable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out worth calculation sample form

How to fill out Net-Worth Calculation Worksheet

Who needs Net-Worth Calculation Worksheet?

Video instructions and help with filling out and completing worth worksheet sample

Instructions and Help about calculation worksheet sample

How to calculate and monitor your net worth periodically monitoring your net worth is a good way to get a quick snapshot whether you are improving or financial situation overtime your net worth is simply what you own minus what you owe what you own are your assets and what you owe are your liabilities we'll start with a simple example before we dig a little deeperlet'’s suppose Jeremy wants to calculate Isis net worth he#39’ll start by listing all his assets he has a $300,000 home a$20,000 cars $5,000 in a checking accountant $15,000 in his tax-free savings account adding up all his assets what he owns comes to three hundred and forty thousand dollars next he'll list all his liabilities he has a $200,000 balance remaining on his mortgage his car alone has a balance of $15,000 he carries$3,000 on his credit cards from month to month, and he has a student loan of27,000 dollars adding up all his liabilities what he owes comes to two hundred and forty-five thousand dollar snow when we take what he owns three hundred and forty thousand dollars and subtract what he owes two hundred andforty-five thousand dollarsJeremy'’s net worth is nineties a thousand dollars now that we know the basics of calculating net worth let'think about how we can use it perhaps once per year Jeremy could recalculate his net worth to see if his financial situation is improving or not the following year his house has appreciated to three hundred and ten thousand dollars, but his car is depreciated to seventeen thousand five hundred dollars he still has five thousand dollars in his checking account, but he tapped into his FSA, and it's nonempty the new total for his assets is three hundred and thirty-two thousand five hundred dollars he's reduced the balance owing on his mortgage to one hundred ninety thousand dollars the carload is now twelve thousand five hundred dollars, and he paid off his credit card by opening up a line of credit he also used his line credit to pay for a vacation and a new roof for the house so the balance Paris $20,000 his student loan is now$24,000 and his liabilities now total two hundred and forty-six thousand five hundred dollars his new net worth is eighty-six thousand dollars which is nine thousand dollars worse than last year generally speaking you'll want to focus on increasing your net worth during you're working career by either increasing the value of the assets side or decreasing the value of the liability side here are a few more things to keeping mind number one large assets may fluctuate in value and result in decrease in net worth even though you'redoing all the right things with managing your money for example the value Jeremy#39’s house may decrease by twenty thousand dollars in a year which would be a drag on his net worth the same could happen with a long term investment portfolio which can go up and down in value over the short term number Torres registered retirement savings plans have a future tax liability attached to them...

People Also Ask about net worth form fill

What is the format for calculating net worth?

How do you calculate your net?

How do you calculate net income on a worksheet?

How do you calculate income for mortgage underwriting worksheet?

How do you calculate income for mortgage qualification?

How do mortgage underwriters calculate income?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send net worth worksheet pdf for eSignature?

How do I make changes in net worth statement format pdf?

How do I edit calculation worksheet make on an Android device?

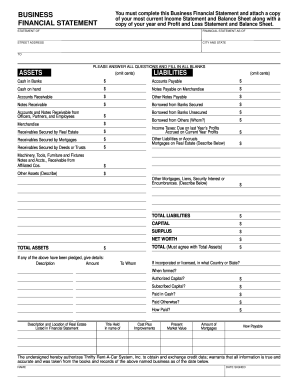

What is Net-Worth Calculation Worksheet?

Who is required to file Net-Worth Calculation Worksheet?

How to fill out Net-Worth Calculation Worksheet?

What is the purpose of Net-Worth Calculation Worksheet?

What information must be reported on Net-Worth Calculation Worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.