Get the free satisfaction of mortgage new york pdf form

Show details

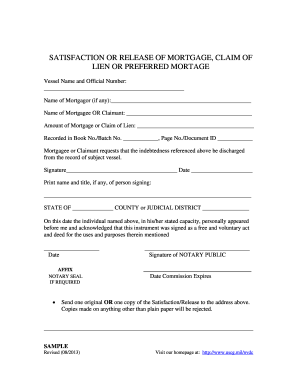

The space above is reserved for REGISTER OF DEEDS SATISFACTION OF MORTGAGE In consideration of the payment of the debt secured by the Mortgage executed by as Mortgagor/Borrower and recorded on the Book/Film Page day of in in the office of the Register of Deeds of Sedgwick County Kansas the undersigned hereby releases said Mortgage which formerly encumbered the described real property LEGAL DESCRIPTION STREET ADDRESS Dated this.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your satisfaction of mortgage new form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your satisfaction of mortgage new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing satisfaction of mortgage new york pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit satisfaction of mortgage form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out satisfaction of mortgage new

How to fill out satisfaction of mortgage new:

01

Obtain the necessary forms from your mortgage lender or download them from their website.

02

Provide accurate and up-to-date information about your mortgage, including the loan number, property address, and borrower's names.

03

Verify that all outstanding loan balances and interest accrued are correctly stated on the form.

04

Fill out the required sections of the satisfaction of mortgage form, such as the borrower's contact information, the date of satisfaction, and the notary section if applicable.

05

In some cases, you may need to attach supporting documents, such as a copy of the mortgage note or a paid-in-full letter from the lender.

06

Review the form for any errors or omissions before signing it.

07

If a notary public is required, make sure to sign the form in their presence and have them notarize it.

08

Submit the completed satisfaction of mortgage form to the appropriate entity, which is usually the county recorder's office or the mortgage lender.

Who needs satisfaction of mortgage new:

01

Homeowners who have successfully paid off their mortgage loan.

02

Individuals or companies who are refinancing their mortgage with a new lender and need to show proof that the previous mortgage has been satisfied.

03

Title insurance companies or real estate attorneys who require the satisfaction of mortgage as part of the closing process for property transactions.

Fill form : Try Risk Free

People Also Ask about satisfaction of mortgage new york pdf

What is an example of a mortgage satisfaction?

What is recorded on a satisfaction of the mortgage document?

What is a satisfaction of mortgage document?

What is satisfaction of mortgage in NY?

How do you write a satisfaction of a mortgage?

What is a satisfaction document?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is satisfaction of mortgage new?

Satisfaction of mortgage is a legal document used to formally acknowledge and record that a mortgage has been fully paid off and released. It serves as evidence that the debt has been settled, and the property is no longer encumbered by the mortgage. Satisfaction of mortgage is typically filed with the appropriate government agency, such as the county recorder's office, to clear the mortgage lien from the public record. The phrase "satisfaction of mortgage new" may refer to the most recent or recent instance of such a document being filed.

Who is required to file satisfaction of mortgage new?

The person or entity that is responsible for filing a satisfaction of mortgage is typically the lender or the mortgagee.

How to fill out satisfaction of mortgage new?

To fill out a satisfaction of mortgage form, follow these steps:

1. Obtain the form: Contact your lender or mortgage company to request a satisfaction of mortgage form. They may provide it electronically or ask you to pick it up in person.

2. Enter the relevant information: Carefully read the instructions on the form and provide all the required information. This typically includes:

- Borrower's name: The name of the individual or entity that borrowed the mortgage.

- Lender's name: The name of the institution or person who provided the mortgage loan.

- Loan details: Enter the loan number, original loan amount, and the date the mortgage was recorded.

- Property details: Provide the address of the property that the mortgage was taken out on.

- Recording information: Include the county and state where the mortgage was recorded, as well as the recording number.

3. Sign and date: Once you have completed filling in all the necessary information, sign and date the satisfaction of mortgage form.

4. Notarize the form: Depending on your jurisdiction, you may need to have the form notarized. Check with your local government office or a notary public to find out if notarization is required.

5. Submit the form: After completing and notarizing the satisfaction of mortgage form, submit it to the appropriate office or entity. This could be the county clerk's office, the lender, or another designated authority.

6. Pay any required fees: Some jurisdictions may charge a fee for filing a satisfaction of mortgage. Ensure that you include the necessary payment with your submission, if applicable.

Note: It is crucial to consult with legal professionals or local authorities to ensure you complete the satisfaction of mortgage form accurately and according to the specific requirements in your jurisdiction.

What is the purpose of satisfaction of mortgage new?

The purpose of a Satisfaction of Mortgage (also known as a Release of Mortgage) is to acknowledge that a mortgage loan has been fully paid off and discharged. It serves as a legal document providing evidence that the borrower has fulfilled their financial obligation and cleared the mortgage lien on the property. Once the mortgage is satisfied, the document is typically recorded with the appropriate government office to update the property records and remove the mortgage lien from the title. This allows the homeowner to have clear ownership of the property without any encumbrances or claims by the lender.

What information must be reported on satisfaction of mortgage new?

When reporting the satisfaction of a mortgage, the following information typically needs to be included:

1. Mortgagor Information: The name and contact details of the borrower or mortgagor should be included.

2. Mortgagee Information: The name and contact information of the lender or mortgagee should be stated.

3. Mortgage Details: The details of the mortgage should be provided, including the mortgage amount, loan number, and the date when the mortgage was initially executed.

4. Property Details: The address and legal description of the property that was subject to the mortgage should be mentioned.

5. Satisfaction Statement: The document should clearly state that the mortgage has been fully satisfied and discharged.

6. Execution: The satisfaction of mortgage form should be signed and dated by an authorized representative of the mortgagee, typically either a bank officer or a notary public.

7. Recording Information: If required by law, the document should mention the recording information, such as the book and page number, or any other reference, indicating where the original mortgage was recorded.

Note: The specific requirements for reporting the satisfaction of a mortgage can vary depending on the jurisdiction. It is crucial to consult the applicable laws and regulations in your particular region.

How can I modify satisfaction of mortgage new york pdf without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including satisfaction of mortgage form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit satisfaction of mortgage template on an iOS device?

Create, modify, and share satisfaction of mortgage new york pdf using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out satisfaction of mortgage form on an Android device?

Use the pdfFiller mobile app to complete your satisfaction of mortgage template on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your satisfaction of mortgage new online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Satisfaction Of Mortgage Template is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.