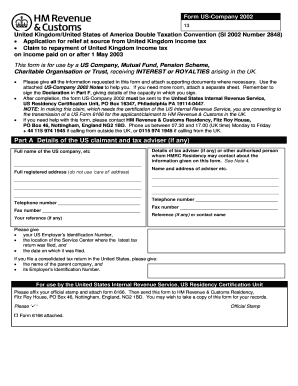

Get the free form us company 2002 2010 - hmrc gov

Show details

A copy of your letter to the competent authority should be attached to the claim form US-Company 2002. If you do not wish to work out the repayment and do not enter an amount at Part F.4 a of the form US-Company 2002 HMRC will work out any repayment Gross Interest UK tax due. Tax vouchers There is no need to send tax vouchers with the completed form US-Company 2002 but you should keep them in case they are needed later to support it. Please quote our reference number for example 13/A/123456...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form us company 2002

Edit your form us company 2002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form us company 2002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form us company 2002 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form us company 2002. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form us company 2002

How to fill out form US Company 2002?

01

Begin by gathering all the necessary information and documents needed to complete the form. This may include the company's name, address, employer identification number (EIN), and any other requested details.

02

Fill out the basic information section of the form. This typically includes fields for providing the company's legal name, address, and contact information. Ensure that all the information is accurate and up-to-date.

03

Proceed to the financial details section. Here, you may need to provide information regarding the company's profits, losses, and any deductions or credits applicable. It is essential to double-check the accuracy of the financial information provided.

04

Look for any additional sections or schedules that may be required based on your company's specific situation. These sections could include details about specific transactions or activities carried out by your company.

05

Carefully review the completed form for any errors or omissions. Make sure all the fields are filled in accurately and completely. It is also advised to proofread the information provided to avoid any spelling or grammatical mistakes.

06

Attach any necessary supporting documents that are required to be submitted along with the form. These documents may vary depending on the purpose of the form and the specific requirements outlined in the instructions.

07

Once you have ensured the form and accompanying documents are complete and accurate, submit the form to the appropriate authority or department. Follow any specific submission instructions provided in the form's guidelines.

Who needs form US Company 2002?

01

Business owners and operators in the United States who operate as a corporation or limited liability company (LLC) commonly require form US Company 2002.

02

Individuals or entities seeking to report and document their company's financial information and activities may need to fill out form US Company 2002.

03

Form US Company 2002 is typically used by companies to provide essential information for tax purposes, governmental compliance, or to fulfill reporting requirements to regulatory bodies.

It is important to note that specific circumstances and legal requirements can dictate who needs to fill out form US Company 2002. Consulting a tax professional or legal advisor familiar with your specific circumstances is advisable to determine whether this form is applicable to your situation.

Instructions and Help about form us company 2002

Fill

form

: Try Risk Free

People Also Ask about

What is the U.S. Israel Tax Treaty protocol?

The United States- Israel Income Tax Treaty provides a mutual agreement procedure by which a resident of either the United States or Israel can request assistance from the competent authority in obtaining relief from actions of one or both treaty countries that the taxpayer believes are inconsistent with the treaty.

What is the U.S. and UK double tax treaty?

The U.S./U.K. tax treaty—formally known as the “Convention between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital Gains”

What is the 21 2 tax treaty?

In respect of grants, scholarships and remuneration from employment not covered by Article 21(1), Article 21(2) of the Treaty provides that an Indian student or business apprentice is entitled during his or her education or training to the same exemptions, reliefs or reductions in respect of taxes available to

What are the benefits of the Mexico tax treaty?

One primary benefit of the US-Mexico Tax Treaty is the relief from double taxation. In other words, the double taxation relief allows a person to claim a credit for taxes paid in the other country to avoid double-taxation. This helps to avoid and/or minimize having to pay tax in both jurisdictions on the same income.

What is the Article 22 tax treaty?

A Contracting State may not impose any tax on dividends paid by a company which is not a resident of that State, except insofar as: a) the dividends are paid to a resident of that State; or b) the dividends are attributable to a permanent establishment or a fixed base situated in that State.

Who qualifies for US tax treaty benefits?

In general, in order to be eligible for a tax treaty in the US, a person must meet the following criteria: 1) be a resident of a country that has a tax treaty with the US, 2) be a Non-Resident Alien for Tax Purposes in the United States, 3) currently be earning qualifying income in the United States, and 4) have a US

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form us company 2002?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form us company 2002 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit form us company 2002 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign form us company 2002. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit form us company 2002 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form us company 2002 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is form us company?

Form US company is a form that needs to be filled out by certain individuals or entities with specific types of income or transactions related to the US.

Who is required to file form us company?

Individuals or entities with specific types of income or transactions related to the US are required to file form US company.

How to fill out form us company?

Form US company can be filled out electronically or by mail, following the instructions provided by the IRS.

What is the purpose of form us company?

The purpose of form US company is to report certain types of income or transactions related to the US to the IRS.

What information must be reported on form us company?

Form US company requires information about income or transactions related to the US, such as capital gains, dividends, or interest.

Fill out your form us company 2002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Us Company 2002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.