Get the free nys tax exempt form

Show details

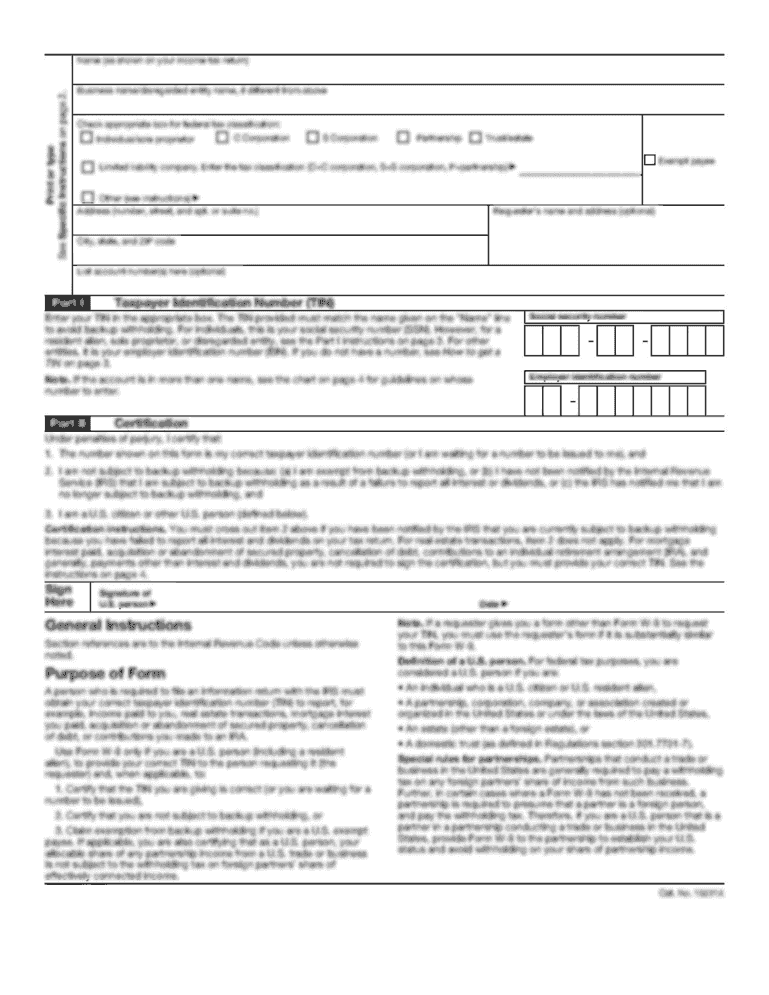

State of New York Department of Taxation and Finance — Sales Tax Bureau ... An Exempt Organization Certification (ST-119.1) must be presented to your ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st 119 1 pdf form

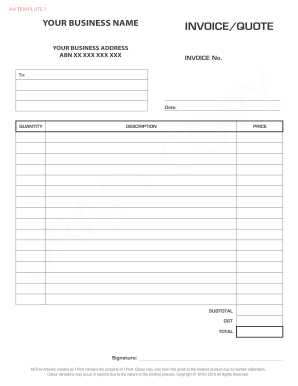

Edit your st 119 1 form pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt form new york form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nys tax exempt form st 119 1 pdf online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax exempt form nys. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

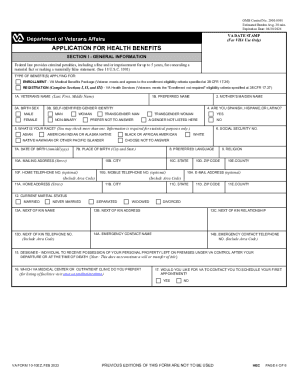

How to fill out st 119 1 form pdf

How to fill out tax exempt form NY:

01

Obtain the tax exempt form NY from the official website of the New York Department of Taxation and Finance or request a physical copy from their office.

02

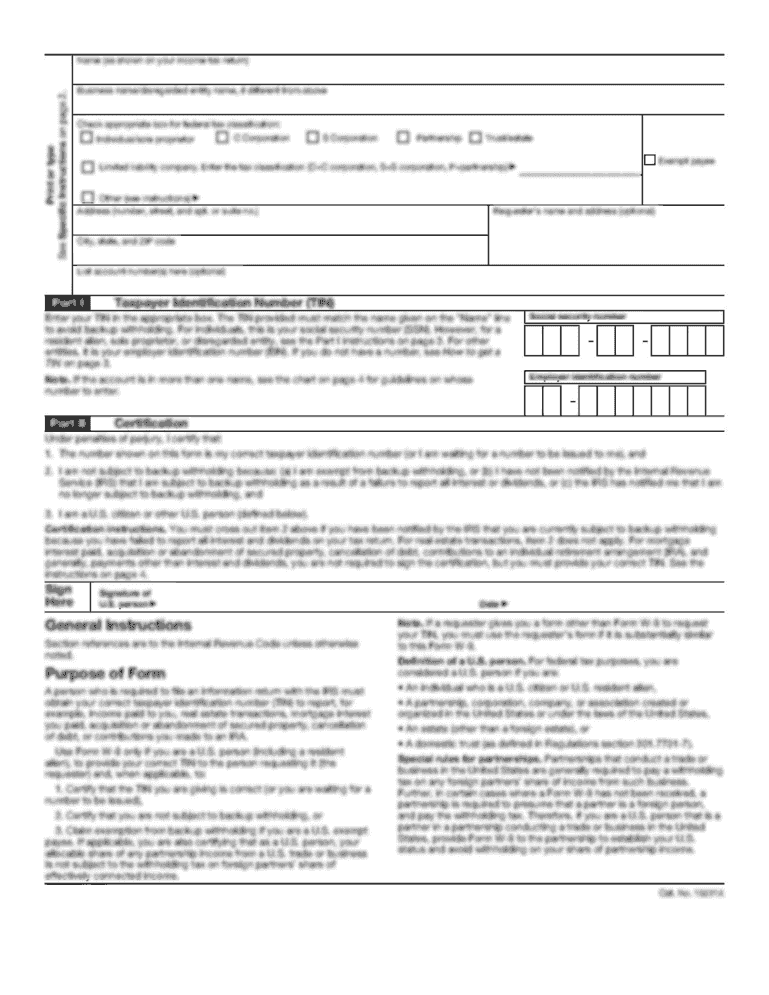

Fill in your personal information accurately, including your full name, address, social security number or employer identification number, and contact details.

03

Indicate the reason for claiming tax exemption by selecting the appropriate category for exemption, such as nonprofit organization, government entity, or religious institution.

04

Provide necessary documentation to support your claim for exemption, such as a copy of your organization's IRS determination letter or relevant certificates.

05

Complete the sections related to the specific tax types you are seeking exemption from, such as sales tax, income tax, or property tax. Follow the instructions provided for each section carefully to avoid any errors.

06

Review the completed form thoroughly to ensure all information is accurate and all required fields have been filled out properly.

07

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

08

Submit the tax exempt form NY to the appropriate authority. This could be the vendor, seller, or the New York Department of Taxation and Finance, depending on the specific situation.

Who needs tax exempt form NY:

01

Nonprofit organizations: Nonprofit organizations that qualify for tax-exempt status under section 501(c)(3) of the Internal Revenue Code may need to fill out tax exempt form NY to claim exemption from various taxes, such as sales tax or income tax.

02

Government entities: Federal, state, or local government agencies may require tax exempt form NY to assert their exemption from certain taxes.

03

Religious institutions: Churches, synagogues, mosques, temples, and other religious organizations may need to complete tax exempt form NY to establish their exemption from certain taxes.

It is important to note that the specific requirements for tax exemption may vary depending on the nature of the organization and the type of taxes being claimed for exemption. It is recommended to consult with a tax professional or the New York Department of Taxation and Finance for detailed guidance based on your specific circumstances.

Fill

st 119 1 tax exempt form

: Try Risk Free

People Also Ask about ny state sales tax exemption form

What is a NYS certificate of authority?

The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. Generally, the seller collects the tax from the purchaser and remits it to New York State.

What is the purpose of a certificate of Authority?

A Certificate of Authority shows that you are authorized to do business in a state other than your original formation state. A Certificate of Authority is a requirement in most states. It's important to note that the name of the document can vary from state to state.

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

What is the tax exempt form for NYS?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Are you exempt from 2023 withholding?

You Can Claim a Withholding Exemption Looking ahead to next year, you qualify for an exemption in 2023 if (1) you had no federal income tax liability in 2022, and (2) you expect to have no federal income tax liability in 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nys tax exempt form in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your nys tax exempt form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get nys tax exempt form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific nys tax exempt form and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the nys tax exempt form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your nys tax exempt form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is ny exemption certificate?

The NY exemption certificate is a legal document that allows certain entities or individuals to make tax-exempt purchases. It serves as proof that the buyer qualifies for exemption from sales tax on specific goods or services.

Who is required to file ny exemption certificate?

Entities such as non-profit organizations, government agencies, and certain businesses that purchase goods or services for resale or other exempt purposes are typically required to file the NY exemption certificate.

How to fill out ny exemption certificate?

To fill out the NY exemption certificate, you need to provide the purchaser's name and address, the seller's name and address, a description of the property or services being purchased, and the purchaser's reason for claiming the exemption. Additionally, include any relevant tax identification numbers.

What is the purpose of ny exemption certificate?

The purpose of the NY exemption certificate is to facilitate tax-exempt sales and purchases by documenting the eligibility of the buyer to make such transactions without incurring sales tax.

What information must be reported on ny exemption certificate?

The NY exemption certificate must report the purchaser's name, address, exemption reason, description of the property or services, seller's name and address, and any applicable identification numbers. It's essential to include a declaration of the exempt status of the buyer.

Fill out your nys tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys Tax Exempt Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.