Get the free include your name and address at the top text add the date of writing

Show details

To order official IRS forms, call 1-800-TAX-FORM (1-800-829-3676) or Order Information .... and you are still receiving these payments, see Form 1040-ES (or ... amount in this box is not SE income

We are not affiliated with any brand or entity on this form

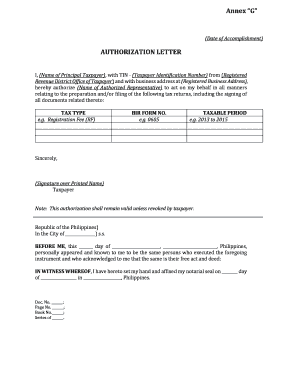

Get, Create, Make and Sign authorization letter to get tax declaration form

Edit your authorization letter for tax declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization letter for tax refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit authorization letter for tax declaration philippines online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit authorization letter to claim tax declaration form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax declaration letter sample form

How to fill out authorization letter to file:

01

Start by writing your full name and contact information at the top of the letter.

02

Include the recipient's name, title, and contact information below your information.

03

Begin the letter with a formal salutation, such as "Dear [Recipient's Name]," followed by a brief introduction of yourself and your relationship to the matter at hand.

04

Clearly state the purpose of the authorization letter, specifying that you are granting permission for someone to file documents on your behalf.

05

Include the name and contact information of the person you are authorizing to file. Be sure to mention any specific documents or forms they are authorized to submit.

06

Clearly state the duration of the authorization, whether it is a one-time permission or if it extends for a specific period of time.

07

Sign the letter at the bottom, and include the date of signing.

08

Provide any other necessary details or instructions that are pertinent to your situation.

09

Keep a copy of the authorization letter for your records.

Who needs authorization letter to file:

01

Individuals who are unable to personally file documents due to physical or geographical limitations may need an authorization letter to appoint someone to act on their behalf.

02

Businesses or organizations may require an authorization letter to allow employees or representatives to file important documents.

03

In certain legal or administrative processes, it may be necessary for a third party to submit documents on behalf of someone else, requiring an authorization letter to confirm their permission.

Fill

authorization letter sample philippines

: Try Risk Free

People Also Ask about how to fill out authorization letter for tax the granter's signature and date

How do I get an IRS authorization letter?

Here's how to do it: Authorize in your online account - Certain tax professionals can submit a Power of Attorney authorization request to your online account. Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

Why would Revenue Canada send me a letter?

We may review your tax return You may receive a letter or phone call telling you your income tax and benefit return is being reviewed. If you're registered for email notifications, we will send you an email telling you your letter is available in My Account. In most cases it's simply a routine check.

How do I authorize someone on my CRA account?

By signing Form AUT-01, Authorize a Representative for Offline Access, you are authorizing the representative to have access to information regarding trust accounts. Send the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

What is a tax authorization letter?

Overview. A tax information authorization gives that person the legal right to review some confidential taxpayer information. A TIA relationship does not allow the representative to act on a taxpayer's behalf to resolve their tax issues with FTB.

What is a CRA letter of authority?

Your employee will have to give you a letter of authority from a tax services office in order for you to reduce the amount of tax you deduct from the remuneration that you pay to the employee.

Can I file taxes on behalf of someone else?

The IRS says you can file a tax return for someone else as long you have their permission to do so. Here are a few important things to know before you begin offering your services to others: You can file tax returns electronically for up to five people. The taxpayer will be held responsible if anything is incorrect.

How do I authorize third party to discuss return?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person

How long does it take to get CRA authorization?

Alternative process for individuals Even with this information provided, the CRA may still contact you to verify your representative's authorization request. Your representative's request for authorization will generally be processed within five days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample authorization letter to get tax declaration to be eSigned by others?

To distribute your authorization letter to claim tax refund, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute tax authorization letter online?

With pdfFiller, you may easily complete and sign tax declaration authorization letter online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit authorization letter to pay tax declaration on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tax refund authorization letter on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is authorization letter for tax?

An authorization letter for tax is a document that allows an individual or entity to grant permission to another person or organization to act on their behalf regarding tax-related matters, such as filing tax returns or communicating with tax authorities.

Who is required to file authorization letter for tax?

Individuals or entities who wish to appoint another person or organization to handle their tax affairs, such as tax professionals or accountants, are required to file an authorization letter for tax.

How to fill out authorization letter for tax?

To fill out an authorization letter for tax, include the names and addresses of both the granter and the authorized person, specify the tax matters being addressed, provide the relevant tax identification numbers, and include signatures along with the date.

What is the purpose of authorization letter for tax?

The purpose of an authorization letter for tax is to legally empower another individual or organization to act on behalf of the granter in dealings with tax authorities, ensuring that tax matters can be handled efficiently and accurately.

What information must be reported on authorization letter for tax?

The information that must be reported on an authorization letter for tax includes the names and addresses of both parties, specific tax matters being authorized, tax identification numbers, and the granter's signature and date.

Fill out your include your name and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization For Tax Declaration is not the form you're looking for?Search for another form here.

Keywords relevant to tax declaration sample

Related to sample tax declaration philippines

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.