Get the free sample request letter for issuance of tax declaration

Get, Create, Make and Sign authorization letter to pay real property tax philippines form

How to edit authorization letter for tax refund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization letter for tax declaration form

How to fill out authorization letter to file:

Who needs authorization letter to file:

Video instructions and help with filling out and completing sample request letter for issuance of tax declaration

Instructions and Help about authorization letter tax declaration

Laws calm legal forms guide the 4506 — tea form is United States Internal Revenue Service tax form used for ordering transcripts or past tax return information from the IRS free of charge the form is often used when seeking a loan as proof of income the 4506 — tea form can be obtained through the IRS s website or by obtaining the documents through a local tax office the tax return request form is a one-page form which asks for your basic information in box 1 provide your name or the name of the individual who is requesting a copy of their tax return for this taxpayer put their social security number in box 1 B if the tax return was filed jointly it is required that you have the joint filers name and social security number which must be supplied in box to their social security number must also be entered in box to be put your current mailing address in box 3 ensure that it is a complete address as this is where your requested transcript will be sent if the address on your tax return is different from your current address put your address as it would appear on your tax return in box 4 you can use the 4506 — t form to supply a third party with your tax return if this is what you want to do and have the transcript sent directly to the third party supply the third parties name address and telephone number in box five on line six you must select the type of tax return which you are requesting such as a 1040 return 1065 return or 1120 return you must next select the type of transcript you want to receive which can be an account transcript a return transcript or a record of account each has different information and format so ensure you select the form you need for each 4506 — t form you can request up to four years of tax returns if you need more than four years you must file an additional 4506 — t form sign and date the bottom of the form if jointly filed the other filer must sign and date as well your form is now ready to be submitted to the IRS keep a copy for your records to watch more videos please make sure to visit laws com

People Also Ask about sample of authorization letter to get tax declaration

How do I get an IRS authorization letter?

Why would Revenue Canada send me a letter?

How do I authorize someone on my CRA account?

What is a tax authorization letter?

What is a CRA letter of authority?

Can I file taxes on behalf of someone else?

How do I authorize third party to discuss return?

How long does it take to get CRA authorization?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample authorization letter for tax declaration to be eSigned by others?

How do I execute authorization letter sample to get tax declaration online?

How do I edit authorization letter sample for tax declaration on an iOS device?

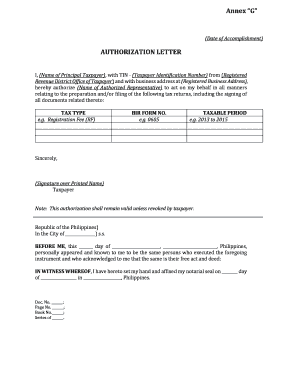

What is authorization letter for tax?

Who is required to file authorization letter for tax?

How to fill out authorization letter for tax?

What is the purpose of authorization letter for tax?

What information must be reported on authorization letter for tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.