NY FT 946/1046 2006 free printable template

Show details

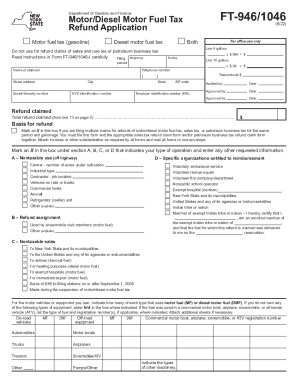

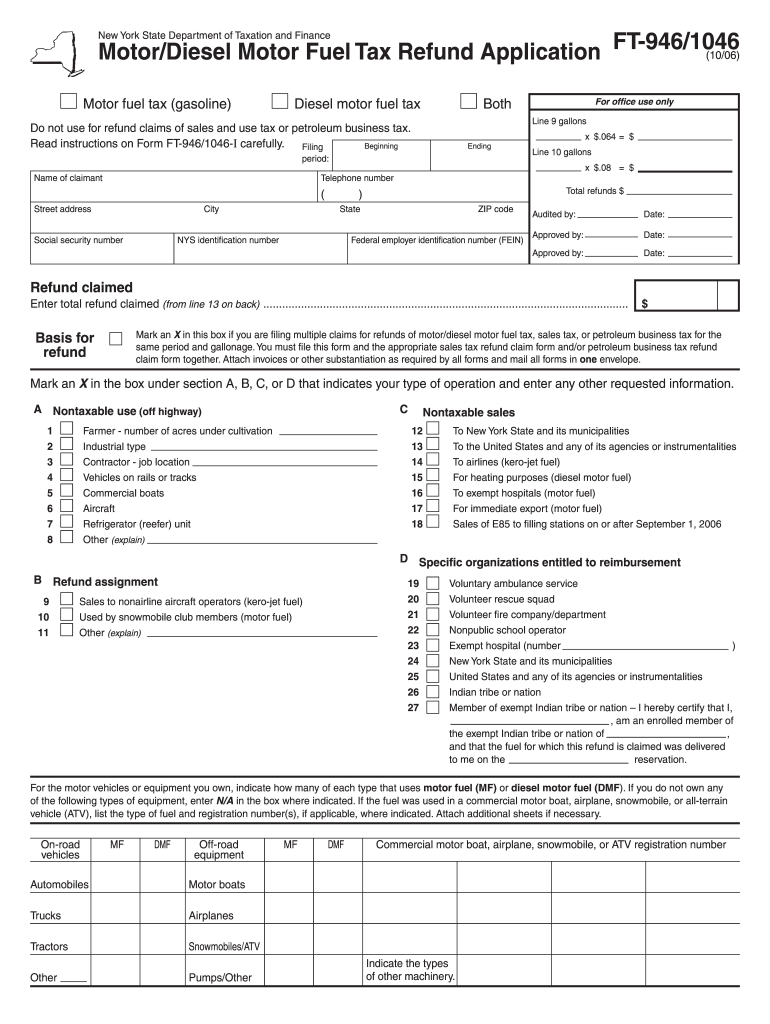

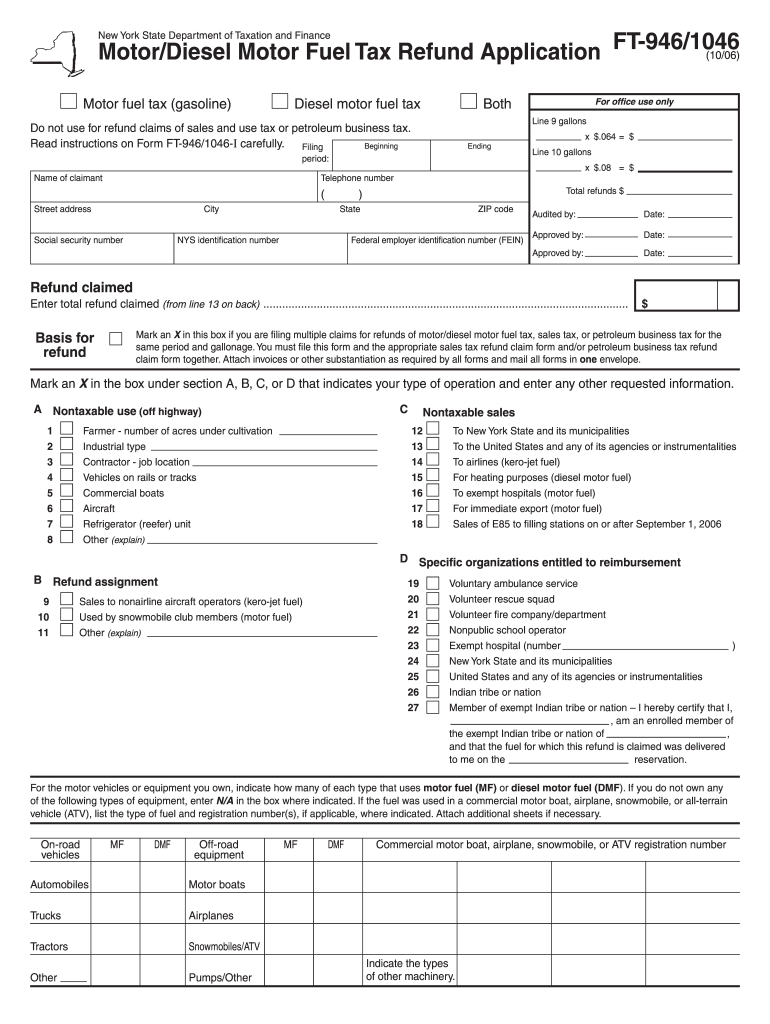

Read instructions on Form FT-946/1046 I carefully. Beginning Filing period Name of claimant Ending City x. 10/06 Motor/Diesel Motor Fuel Tax Refund Application FT-946/1046 New York State Department of Taxation and Finance Motor fuel tax gasoline Diesel motor fuel tax Both Line 9 gallons Do not use for refund claims of sales and use tax or petroleum business tax. Page 2 of 2 FT-946/1046 10/06 Column A Motor fuel Enter separately in Columns A or B ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY FT 9461046

Edit your NY FT 9461046 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY FT 9461046 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY FT 9461046 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY FT 9461046. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY FT 946/1046 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY FT 9461046

How to fill out NY FT 946/1046

01

Obtain the NY FT 946/1046 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security Number or identification number.

03

Enter your financial information for the reporting period, such as income, deductions, and credits.

04

Provide any necessary supporting documentation as indicated on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form in the designated area.

07

Submit the form as instructed, either electronically or by mail, before the filing deadline.

Who needs NY FT 946/1046?

01

Individuals and businesses that are required to report certain tax information to New York State.

02

Taxpayers who have specific financial transactions or income that fall under the categories outlined in the NY FT 946/1046.

03

Anyone looking to apply for tax credits or deductions specific to New York State tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

When can I do my tax return 2022?

When to file your tax return. Officially, the new financial year starts on July 1, 2022, which is technically the first day you can lodge your tax return.

When can I file my 2023 tax return?

The 2023 eFile Tax Season starts in January 2023: prepare and eFile your IRS and State 2022 Tax Return(s) by April 18, 2023. If you miss this deadline, you have until October 16, 2023. If you owe taxes, you should at least e-File a Tax Extension by April 18, 2023.

When can I file my 2022 UK tax return?

The tax return deadline for the 2021 to 2022 tax year is 31 October 2022 for those completed on paper forms, and 31 January 2023 for online returns.

When can I submit my 2023 tax return South Africa?

Income tax return filing dates The deadline for Provisional taxpayers is 23 January 2023.

When can I file my taxes for 2022 in 2022?

For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

When tax return 2022 uk?

The tax return deadline for the 2021 to 2022 tax year is 31 October 2022 for those completed on paper forms, and 31 January 2023 for online returns.

When can I file my 2022 23 tax return?

So, if you wish to submit a return for the 2021/22 tax year, you must do so by 5 October 2022. The second self-assessment deadline of the year falls on 31 October. It is the deadline for paper tax returns. If you want to submit your return offline, you must do so by midnight on this date.

When to file tax return uk?

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. Find out if you are eligible to pay this way. HMRC must receive a paper tax return by 31 January if you're a trustee of a registered pension scheme or a non-resident company.

When can I file my 21 22 tax return UK?

As soon as the tax year ends, you can complete your tax return at a time that suits you. HMRC accepts completed tax returns for the 2021 to 2022 tax year between 6 April 2022 and 31 January 2023.

When can I do my tax Australia 2022?

Lodge your tax return by 31 October 2022 You have until 31 October 2022 to lodge your tax return, unless we have allowed you to lodge it later, or you have a later due date because a registered tax agent prepares your tax return.

How soon can you file your 2022 tax return?

Generally, the IRS will accept 2022 returns as soon as e-file is open. You'll have until the annual due date to file your return on time. If you need more time, you can file an extension and the IRS will accept 2022 returns until the extension deadline, which is generally Oct. 15.

How soon will I get my tax refund 2022?

ing to the IRS, the best way to avoid delays on your tax refund is to file an accurate tax return using e-file software to file electronically and opting to receive your refund via direct deposit. Most filers who use this method should receive their refunds within 21 days of submitting their return online.

When can you submit your tax return for 2022?

With less time to file your returns, it is important that taxpayers begin collating the necessary information and documentation so that deadlines are met. The 2022 tax filing season, which opened on 1 July, runs until 24 October 2022 for non-provisional taxpayers, making it a shorter season than previous years.

When can I file my taxes for 2022 in 2023?

Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

When can I file tax return 2022?

Lodge your tax return by 31 October 2022 You have until 31 October 2022 to lodge your tax return, unless we have allowed you to lodge it later, or you have a later due date because a registered tax agent prepares your tax return.

When can I file my 2022 SARS tax return?

Filing Season for non-provisional taxpayers is now closed. The deadline for Provisional taxpayers is 23 January 2023.

Can I file ITR for AY 2022 23 now?

However, for majority of individual taxpayers, the last date for filing income tax return for AY 2022-23 was July 31,2022.

Will I get a bigger tax refund in 2023?

(WWLP/Nexstar) — Taxpayers may need to prepare for smaller tax refunds in 2023. ing to the Internal Revenue Service, refunds could be smaller because taxpayers didn't receive stimulus payments this tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY FT 9461046 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NY FT 9461046 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit NY FT 9461046 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing NY FT 9461046.

Can I edit NY FT 9461046 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like NY FT 9461046. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NY FT 946/1046?

NY FT 946/1046 refers to the New York State Forms for reporting and filing certain types of financial transactions, including those related to certain tax credits or incentives.

Who is required to file NY FT 946/1046?

Individuals or entities that engage in specific financial activities or benefit from certain tax credits in New York State are required to file NY FT 946/1046.

How to fill out NY FT 946/1046?

To fill out NY FT 946/1046, you should complete the required sections of the form, providing accurate financial details, personal identification information, and any necessary supporting documentation as specified by the New York State Department of Taxation and Finance.

What is the purpose of NY FT 946/1046?

The purpose of NY FT 946/1046 is to ensure compliance with New York State financial reporting requirements and to properly claim eligible tax credits or deductions.

What information must be reported on NY FT 946/1046?

The information that must be reported on NY FT 946/1046 typically includes identification information, details of the financial transactions or activities, and any relevant tax credit details as required by the form's instructions.

Fill out your NY FT 9461046 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY FT 9461046 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.