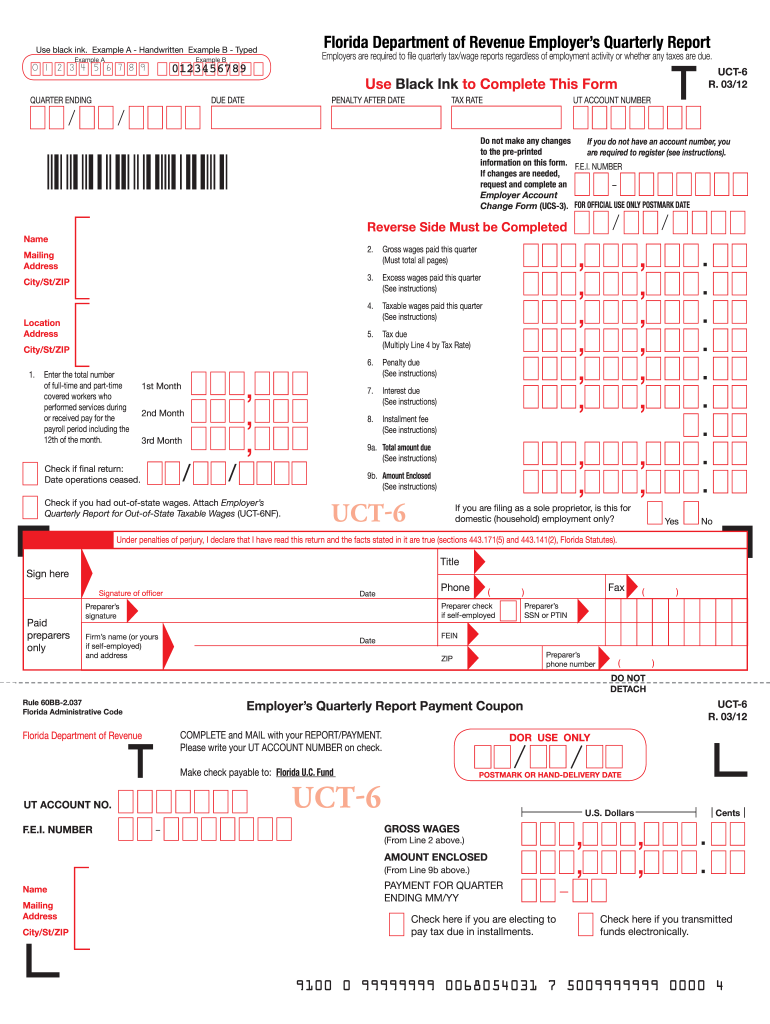

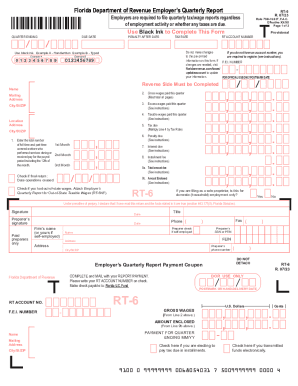

Who needs a Form UCT-6?

Florida obliges all employers to pay unemployment insurance for each of its employees. Payments should be credited every three months to the Florida Department of Revenue with the UCT-6 as a mandatory supplement.

What is Form UCT-6 for?

Form UCT-6 specifies the employee’s gross wages paid this quarter, and an amount of insurance fee is to be paid on the basis of that figure.

Is Form UCT-6 accompanied by other forms?

If the submitter has offices of the company in other states, this form must be accompanied by a completed UCT-6NF form. No other additions are required.

When is Form UCT-6 due?

You should file this form at the end of the first month, coming just after the reporting quarter (for example, end of April for the first quarter of January, February and March).

How do I fill out Form UCT-6?

Filling out the UCT-6 is quite simple. You should enter the total gross wages for the quarter (including the officers or owners of the business if they are on salary). Enter the total amount exceeding $8,000 earned by each employee during the quarter. You should subtract from this amount of all out-of-state wages and earnings over $8,000. The resulting amount will be the taxable amount. Also, you have to enter a social security number of each employee.

Where do I send Form UCT-6?

Mail reply address for completed form to be sent is: Unemployment Tax, Florida Department of Revenue, 5050 W Tennessee St Bldg L, Tallahassee FL 32399-0180