Get the free farm profit and loss statement template

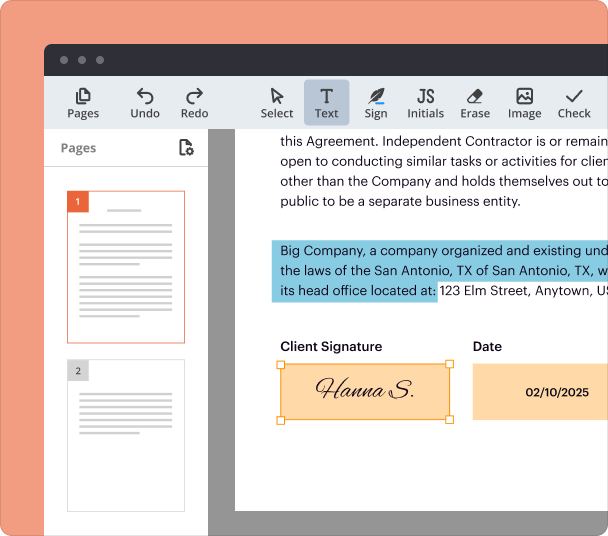

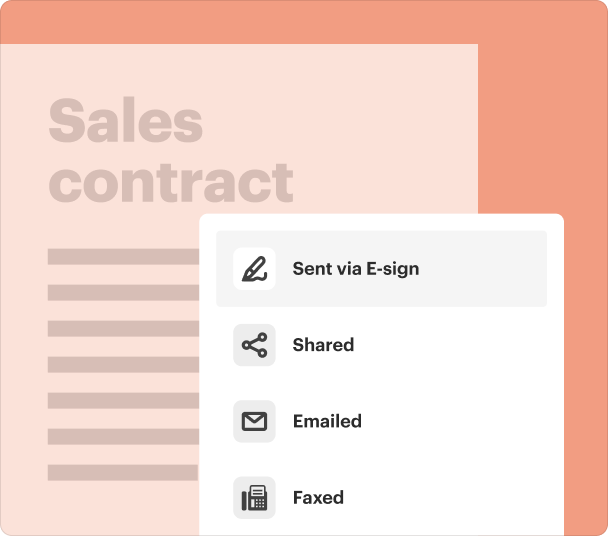

Fill out, sign, and share forms from a single PDF platform

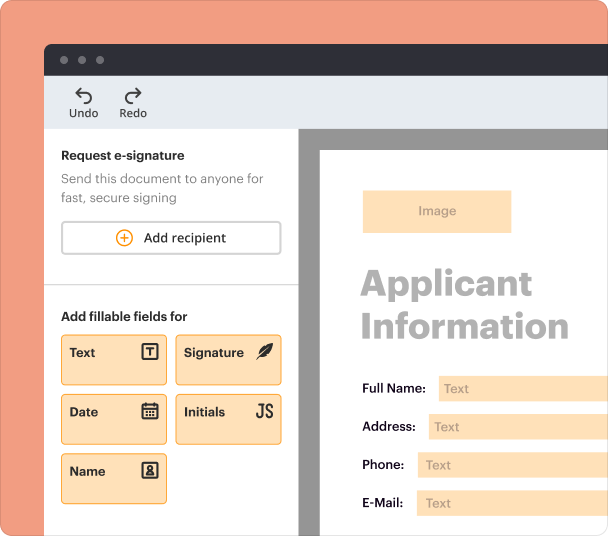

Edit and sign in one place

Create professional forms

Simplify data collection

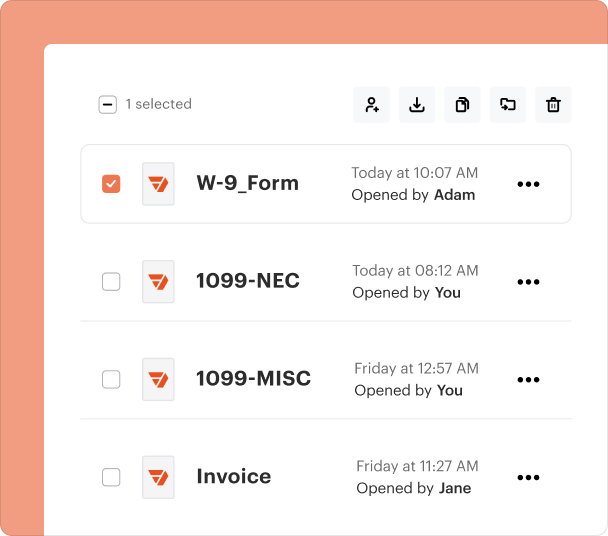

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

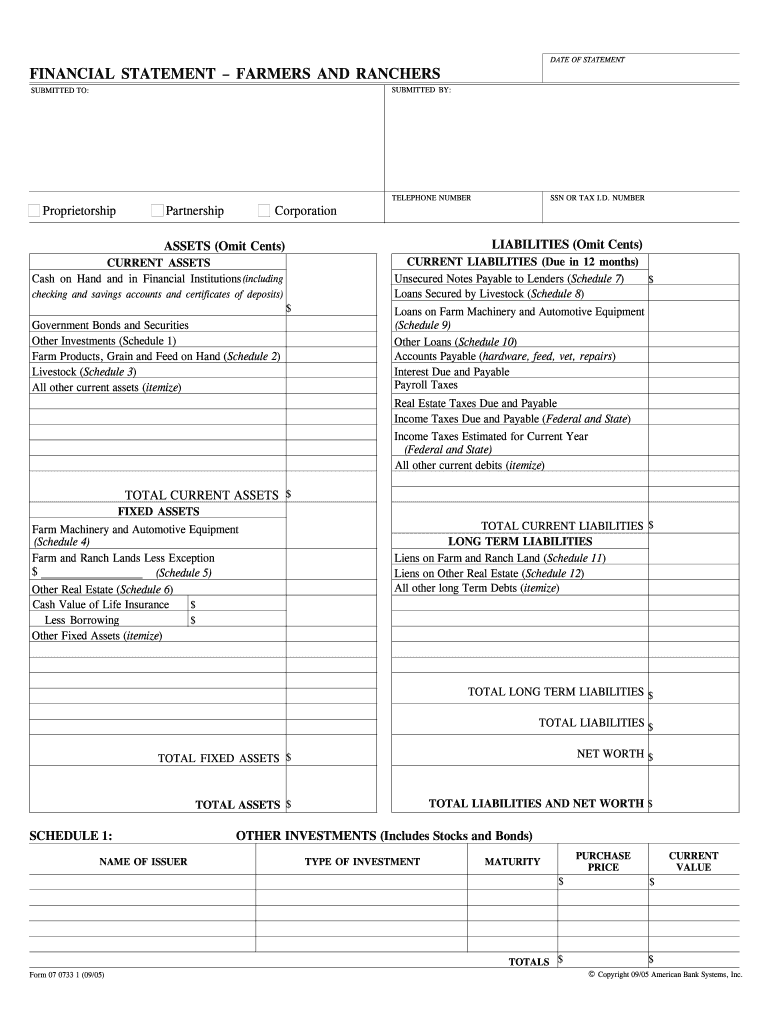

Understanding the Farm Profit and Loss Form

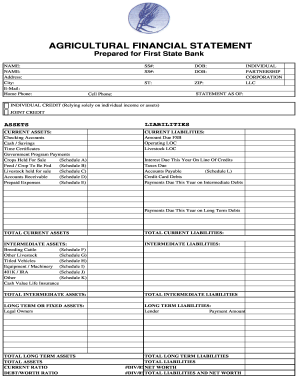

What is the farm profit and loss form?

The farm profit and loss form is a specialized document designed to help farmers and ranchers track their financial performance over a specified period. This form is essential for assessing the profitability of farming operations by detailed calculations of income and expenses. It provides a clear picture of financial health, enabling better decision-making for future agricultural practices.

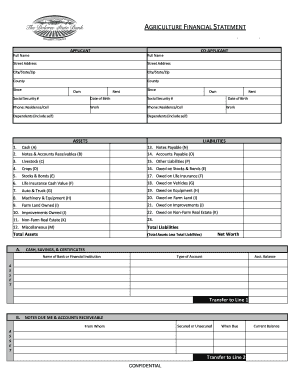

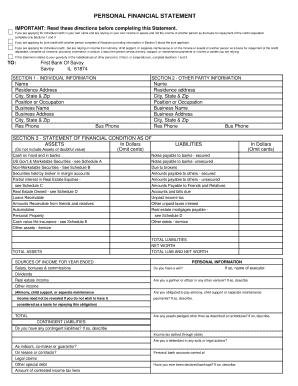

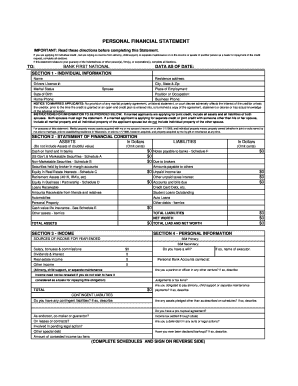

Key features of the farm profit and loss form

This form includes several key features that enhance its utility. It typically lists both current and long-term assets and liabilities, helping users to understand their financial position. Additionally, it offers sections for recording various income sources, such as crop sales and livestock sales, alongside expenses related to machinery, veterinary services, and supply costs.

When to use the farm profit and loss form

Farmers should use the farm profit and loss form at the end of each fiscal year or farming season. This timing allows for an accurate reflection of the financial year, enabling farmers to identify profitable areas and those needing improvement. Additionally, it should be used when applying for loans or assistance, as lenders often require documentation of a farm's financial status.

How to fill the farm profit and loss form

Filling out the farm profit and loss form requires a systematic approach. Start by gathering all relevant financial records, including sales receipts, invoices, and expense statements. Then, enter information about total revenues from all sources and categorize expenses accurately. It is important to ensure that all numerical entries are free of errors and that totals are calculated correctly for both income and expenses.

Best practices for accurate completion

To ensure accuracy, farmers should keep detailed records throughout the year. Regularly updating income and expense entries can prevent last-minute scrambles before completing the form. It is also advisable to review the form with a financial advisor or accountant who specializes in agricultural economics, as they can provide insights on maximizing profit and minimizing loss.

Common errors and troubleshooting

Common mistakes when filling out the farm profit and loss form include miscalculating totals, omitting categories of income or expense, and using incorrect current values for assets. To troubleshoot these errors, it is best to double-check each entry against financial records and perform a thorough review before finalizing the document. This approach can help avoid discrepancies that could impact financial assessments.

Frequently Asked Questions about Farm Profit And Loss

Who needs the farm profit and loss form?

Farmers, ranchers, and agricultural businesses that need to assess their financial health and performance should use this form.

What information is required to fill out this form?

Users must provide details about their income sources, expense categories, assets, and liabilities in a structured manner.

pdfFiller scores top ratings on review platforms