Get the free farm profit and loss statement template

Show details

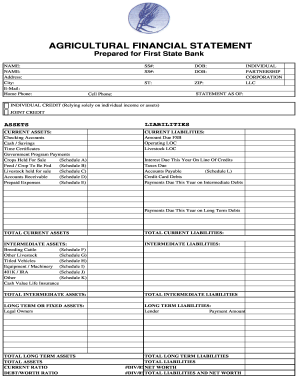

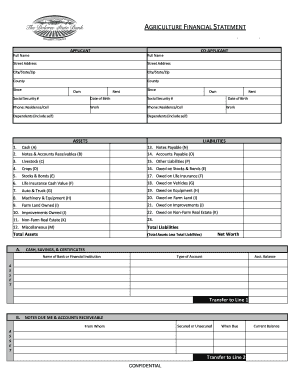

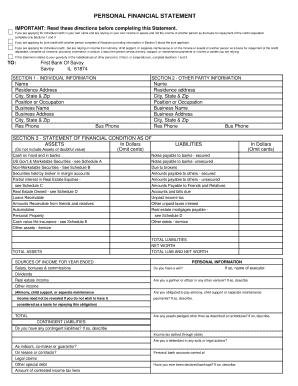

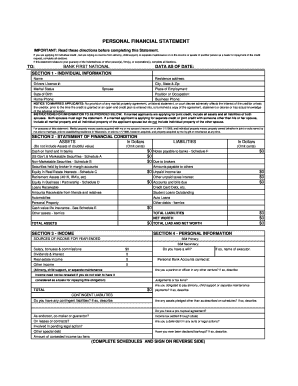

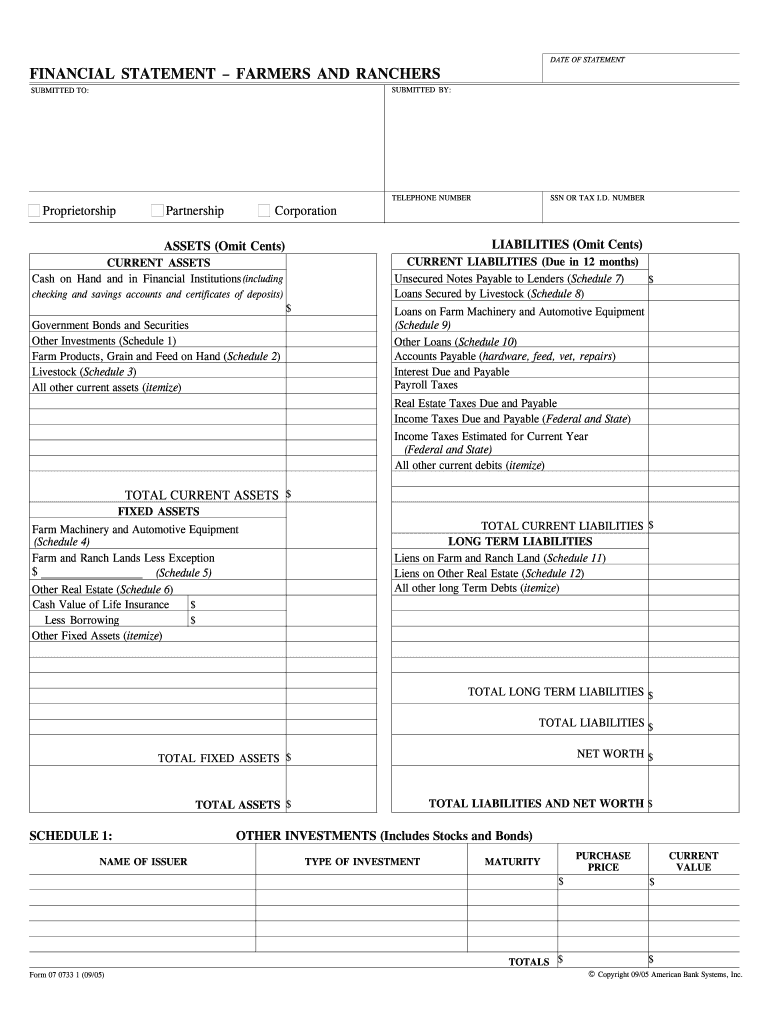

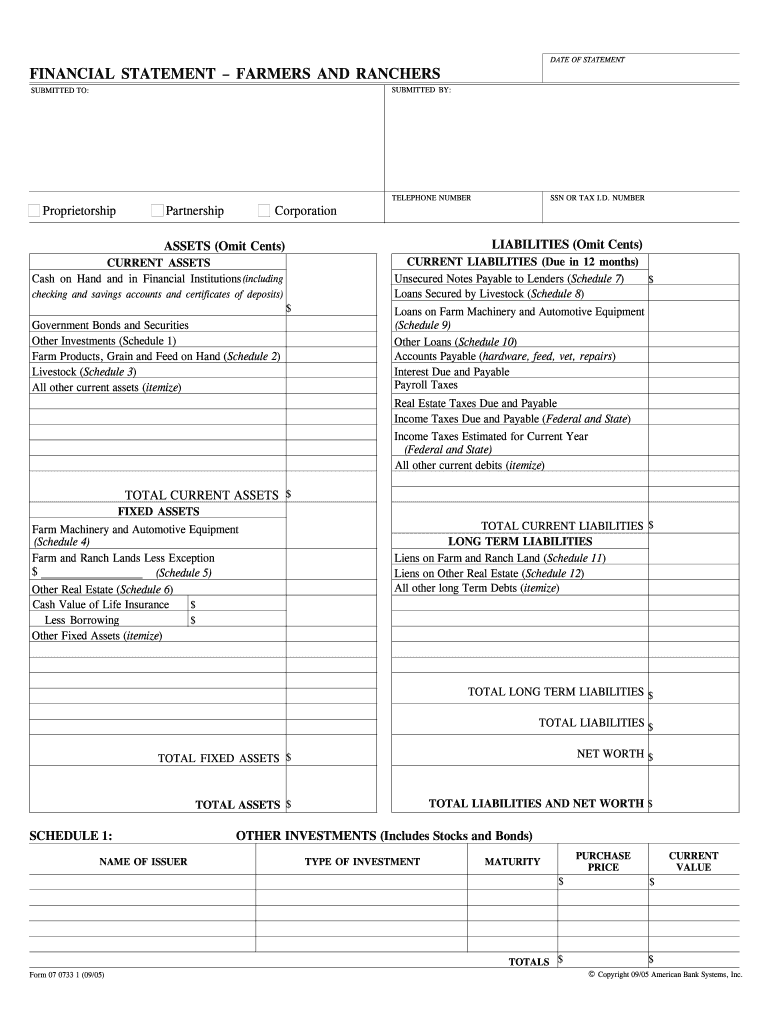

DATE OF STATEMENT FINANCIAL STATEMENT FARMERS AND RANCHERS SUBMITTED BY TELEPHONE NUMBER Proprietorship Partnership SSN OR TAX I. D. NUMBER Corporation LIABILITIES Omit Cents ASSETS Omit Cents CURRENT LIABILITIES Due in 12 months Unsecured Notes Payable to Lenders Schedule 7 Loans Secured by Livestock Schedule 8 CURRENT ASSETS Cash on Hand and in Financial Institutions including checking and savings accounts and certificates of deposits Government Bonds and Securities Other Investments...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm financial statement form

Edit your farm profit and loss statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm profit and loss statement template excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agriculture financial statement form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit farm income statement example form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm balance sheet template form

How to Fill Out Farm Profit and Loss:

01

Start by gathering all relevant financial records related to the farm, including income and expenses from all sources such as crop sales, livestock sales, government subsidies, and other farm-related activities.

02

Organize the information into appropriate categories such as revenue, cost of goods sold, operating expenses, and non-operating expenses. This will help in accurately determining the farm's profitability.

03

Calculate the farm's revenue by adding up all sources of income. This can include sales of crops, livestock, eggs, milk, or any other agricultural product.

04

Determine the cost of goods sold by considering expenses directly associated with producing or acquiring the agricultural products. This may include seed costs, feed costs, fertilizer expenses, or any other inputs used in the farming operation.

05

Calculate the farm's operating expenses, which include costs relating to labor, utilities, repairs and maintenance, insurance, taxes, and other expenses incurred in running the farm.

06

Deduct the cost of goods sold and operating expenses from the farm's revenue to arrive at the gross profit.

07

Consider any non-operating expenses or income which might include interest paid on loans, rental income from leased land or equipment, or any other financial transactions not directly related to the farm operations.

08

Subtract non-operating expenses from the gross profit to calculate the net profit or loss of the farm.

09

Review the completed profit and loss statement for accuracy and make any necessary adjustments.

10

Farm owners, managers, and agricultural professionals need farm profit and loss statements to assess the financial performance of the farm, make informed decisions about production practices, marketing, and resource allocation, and to meet lending or financial reporting requirements.

Fill

how to fill out farm 07

: Try Risk Free

People Also Ask about farm balance sheet template excel

What is the content of a typical farm financial statement?

A farm income statement is one of three important financial statements used for reporting a farms financial performance over a specific period of time. This statement focuses on four key items – revenue, expenses, gains and losses.

What goes on a farm balance sheet?

The balance sheet is a report of the farm business's financial position at a given moment in time. It lists assets, liabilities, and net worth (owner's equity), and represents a snapshot of the farm business as of a certain date.

What are the 5 major accounts?

The 5 primary account categories are assets, liabilities, equity, expenses, and income (revenue)

What are the five 5 basic financial statements?

Here's why these five financial documents are essential to your small business. The five key documents include your profit and loss statement, balance sheet, cash-flow statement, tax return, and aging reports.

What are the basic financial statements?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

How do you write a simple financial statement?

Follow these steps to create a great financial report: Step 1 – Make a Sales Forecast. Step 2 – Create a Budget for Expenses. Step 3 – Create a Cash Flow Statement. Step 4 – Estimate Net Profit. Step 5 – Manage Assets and Liabilities. Step 6 – Find the Breakeven Point.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit farm balance sheet pdf from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including farm income and expense worksheet pdf. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I fill out farm accounting format on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your farm income statement by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit agriculture income statement on an Android device?

The pdfFiller app for Android allows you to edit PDF files like printable blank profit and loss statement pdf. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is farm profit and loss?

Farm profit and loss refers to the financial statement that summarizes the income earned and expenses incurred by a farm during a specific period. It helps farmers evaluate their economic performance.

Who is required to file farm profit and loss?

Farmers and ranchers who report income, expenses, and profits from their agricultural activities for tax purposes are generally required to file farm profit and loss statements.

How to fill out farm profit and loss?

To fill out a farm profit and loss statement, gather all income sources and expenses related to the farm, categorize them appropriately, and summarize the total income and total expenses, subtracting expenses from income to determine profit or loss.

What is the purpose of farm profit and loss?

The purpose of farm profit and loss is to provide farmers and stakeholders with a clear understanding of the farm's financial health, aiding in decision-making, tax reporting, and evaluating operational efficiency.

What information must be reported on farm profit and loss?

The information that must be reported includes total farm income, cash and non-cash expenses, operating costs, asset sales, and any other income or losses associated with the farm's operations.

Fill out your farm profit and loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farms Financial Model Template is not the form you're looking for?Search for another form here.

Keywords relevant to sample farm financial statements

Related to agriculture farm balance sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.