Get the free life estate table - dcf state fl

Show details

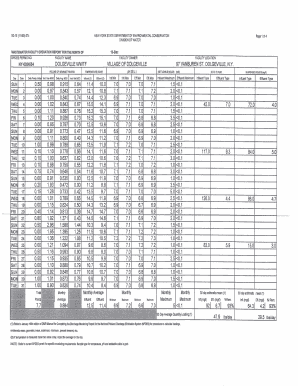

Life Estate and Remainder Interest Tables Purpose The Life Estate and Remainder Interest Table are used to determine the value of life estate or remainder interest held in real property. Instructions 1. Find the line for the individual s age as of their last birthday. 2. For the life estate interest multiply the figure in the life estate column for the individual s age by the equity value of the property. 3. For the remainder interest multiply the figure in the remainder interest column for...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life estate table

Edit your life estate table form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life estate table form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life estate table online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life estate table. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life estate table

How to fill out irs life estate tables:

01

Gather all necessary information: Before starting to fill out the IRS life estate tables, make sure you have all the required information at hand. This may include the relevant property details, such as fair market value, the date of transfer, and the applicable interest rates.

02

Understand the purpose: Familiarize yourself with the purpose of the IRS life estate tables. These tables are used to calculate the value of a life estate, which is a property interest that lasts until the death of a specified individual. The tables help determine the present value of the property based on the life expectancy of the life tenant.

03

Consult the appropriate IRS publication: To properly fill out the IRS life estate tables, refer to the relevant IRS publication. The most commonly used publication for this purpose is IRS Publication 1457, which provides the necessary instructions and tables.

04

Input the required information: Follow the instructions provided in the publication to input the required information into the tables. This typically includes the current age of the life tenant, the applicable interest rate, and other relevant factors.

05

Calculate the present value: Once all the necessary information is entered, use the tables to calculate the present value of the life estate. The result will depend on the specific factors and variables involved, such as the age of the life tenant and the applicable interest rate.

Who needs IRS life estate tables:

01

Individuals planning to transfer property: Individuals who are considering transferring property while retaining a life estate may need to consult the IRS life estate tables. These tables help determine the value of the life estate, which can be important for estate planning purposes.

02

Estate planning attorneys: Estate planning attorneys often utilize the IRS life estate tables to assist their clients in determining the value and feasibility of including a life estate in their estate plans. These tables are a valuable resource for calculating the present value of a life estate.

03

Tax professionals: Tax professionals, such as accountants or tax advisors, may need to use the IRS life estate tables to accurately calculate the taxable value of a life estate for tax reporting purposes. These professionals ensure compliance with IRS regulations and assist clients in making informed financial decisions.

In summary, filling out the IRS life estate tables requires gathering relevant information, understanding their purpose, consulting the appropriate publications, inputting the necessary data, and calculating the present value. These tables are beneficial for individuals planning property transfers, estate planning attorneys, and tax professionals involved in tax reporting and financial planning.

Fill

form

: Try Risk Free

People Also Ask about

How do you use mortality tables?

In its most basic form, a mortality table consists of two columns of numbers. The first column is a listing of all ages from 0 to 120. The second column contains a q value for that age, which is the probability of a person that age dying in that year. The death probabilities at most ages are very low.

What mortality table is used by insurance companies?

A period life table is based on the mortality experience of a population during a relatively short period of time.

How often are mortality tables updated?

These actuarial tables are revised every 10 years to account for the most recent mortality experience.

What is the mortality rate for insurance?

What is Mortality Rate? A mortality rate measures the number of deaths in a specific population over a specific period of time. Tracking mortality rates allows life insurance providers to better estimate life expectancy, a key metric they use in determining life insurance premiums.

What is the 90CM mortality table?

Table 90CM is based on data from the 1990 U.S. census. It is a unisex table: men and women have the same mortality. The table shows the number of survivors at each age out of a population of 100,000 at age 0.

What is the mortality table for insurance companies?

A mortality table gives probabilities based on deaths per thousand, or the number of people per 1,000 living who are expected to die in a given year. Life insurance companies use mortality tables to help determine premiums and to make sure the insurance company remains solvent.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify life estate table without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your life estate table into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in life estate table?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your life estate table to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit life estate table straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit life estate table.

What is life estate table?

A life estate table is a document used to outline the rights and responsibilities of a person who holds a life estate in a property. It typically includes details about the life tenant's rights to occupy and use the property, and how those rights are affected by the death of the life tenant.

Who is required to file life estate table?

Typically, the person who holds the life estate, also known as the life tenant, is required to file the life estate table. This may also include the property owner who establishes the life estate.

How to fill out life estate table?

To fill out a life estate table, you need to provide information such as the name of the life tenant, the name of the property, the duration of the life estate, and any restrictions or obligations that apply to the life tenant. It is also advisable to include signature fields for all parties involved.

What is the purpose of life estate table?

The purpose of a life estate table is to clearly document the terms of the life estate arrangement, ensuring that all parties understand their rights and obligations concerning the property, and providing a legal reference if disputes arise.

What information must be reported on life estate table?

The life estate table must report information such as the name and contact information of the life tenant, the description and location of the property, the start and end date of the life estate, any conditions or limitations related to the life estate, and signatures of involved parties.

Fill out your life estate table online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Estate Table is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.