Canada NR73 E 2012 free printable template

Show details

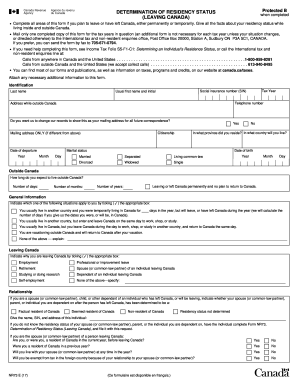

DETERMINATION OF RESIDENCY STATUS (LEAVING CANADA)

Complete all areas of this form if you plan to leave or have left Canada, either permanently or temporarily. Give all the facts about your residency

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada NR73 E

Edit your Canada NR73 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada NR73 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada NR73 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada NR73 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada NR73 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada NR73 E

How to fill out Canada NR73 E

01

Obtain the Canada NR73 E form from the Canada Revenue Agency (CRA) website.

02

Provide your personal information, including your name, address, and Social Insurance Number (SIN).

03

Indicate your residency status by selecting either 'resident' or 'non-resident'.

04

Complete the section regarding your ties to Canada, including details about property, family, and business links.

05

Fill out the section that asks about your intended length of stay outside Canada.

06

If applicable, provide information about your income and tax obligations in Canada and other countries.

07

Sign and date the form to confirm that the information provided is accurate.

08

Submit the form to the CRA either by mail or electronically as instructed.

Who needs Canada NR73 E?

01

Individuals who want to determine their residency status for tax purposes while living outside Canada.

02

People who have moved out of Canada and need to report their residency status to the CRA.

03

Canadians who spend significant time outside the country and need to clarify their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Is T3 and T5 the same?

A T3 slip is issued for mutual fund trusts (which most are) and a T5 slip is issued for corporate class mutual funds. T5 slips are required to be issued by the end of February, but T3 slips are not required to be issued until the end of March.

What is a NR73 form?

Form NR73, Determination of Residency Status (Leaving Canada) Form NR74, Determination of Residency Status (Entering Canada) Income Tax Folio S5-F1-C1, Determining an Individual's Residence Status.

What is the difference between a T3 and T5 tax slip?

A T3 slip is issued for mutual fund trusts (which most are) and a T5 slip is issued for corporate class mutual funds. T5 slips are required to be issued by the end of February, but T3 slips are not required to be issued until the end of March.

What is line 73 on a Canadian tax return?

Go to the line that corresponds to your taxable income. If there is an Ontario health premium amount on that line, enter that amount on line 73.

What is the difference between T5 and T3 tax?

For an investment in a mutual fund trust, ETF, or segregated fund contract, you'll receive a T3: Statement of Trust Income Allocations and Designations tax slip. For an investment in a mutual fund corporation, you'll receive a T5: Statement of Investment Income tax slip.

Is NR73 necessary?

It is not necessary to fill out the forms, unless the individual were asked by the Revenue Canada Agency. The purpose of completing an NR-73 is if an individual wants opinion on residency status, which is determined case by case (i.e., for each individual based on their individual circumstances).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada NR73 E to be eSigned by others?

Once your Canada NR73 E is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit Canada NR73 E online?

With pdfFiller, the editing process is straightforward. Open your Canada NR73 E in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out Canada NR73 E on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your Canada NR73 E by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is Canada NR73 E?

Canada NR73 E is a form used by non-residents of Canada to determine their residency status for tax purposes when they have recently left Canada or are considering leaving.

Who is required to file Canada NR73 E?

Individuals who are non-residents of Canada and have left or are leaving Canada and need to confirm their residency status for tax obligations are required to file Canada NR73 E.

How to fill out Canada NR73 E?

To fill out Canada NR73 E, individuals need to provide personal information such as their name, address, Social Insurance Number (SIN), and details about their presence in Canada, including dates of residence, ties to Canada, and reasons for leaving.

What is the purpose of Canada NR73 E?

The purpose of Canada NR73 E is to help the Canada Revenue Agency (CRA) determine an individual's residency status for tax purposes, which affects their tax obligations in Canada.

What information must be reported on Canada NR73 E?

The form requires information such as the individual's full name, contact information, residency history, purpose for leaving Canada, and any significant residential ties they may have with Canada.

Fill out your Canada NR73 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada nr73 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.