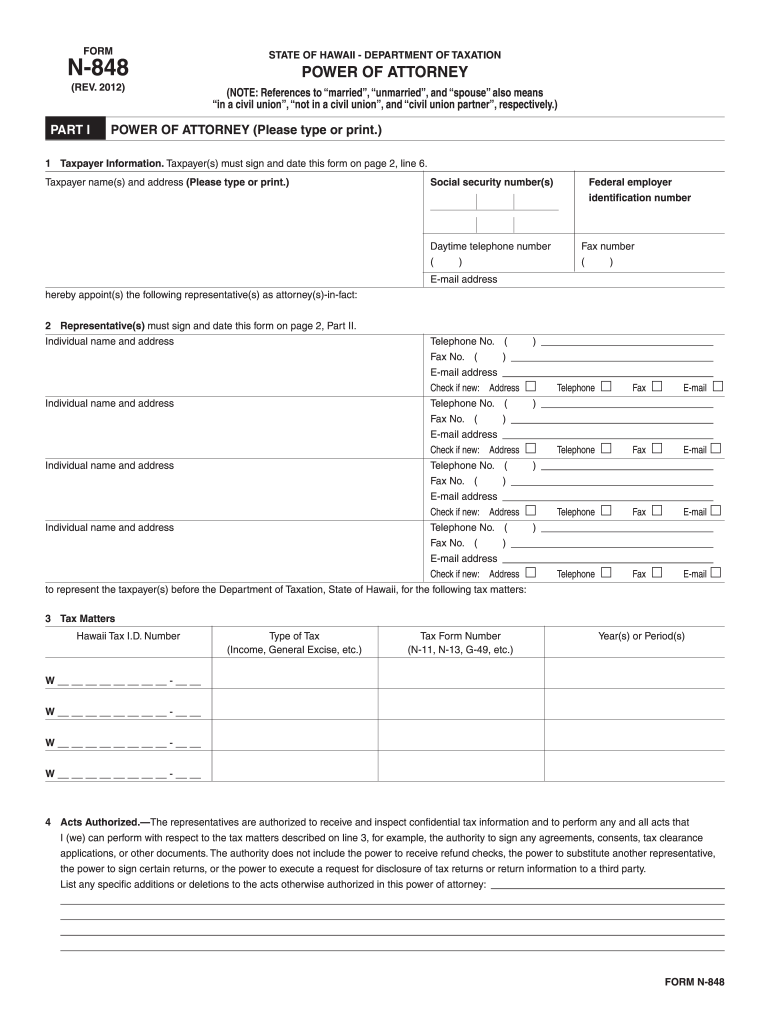

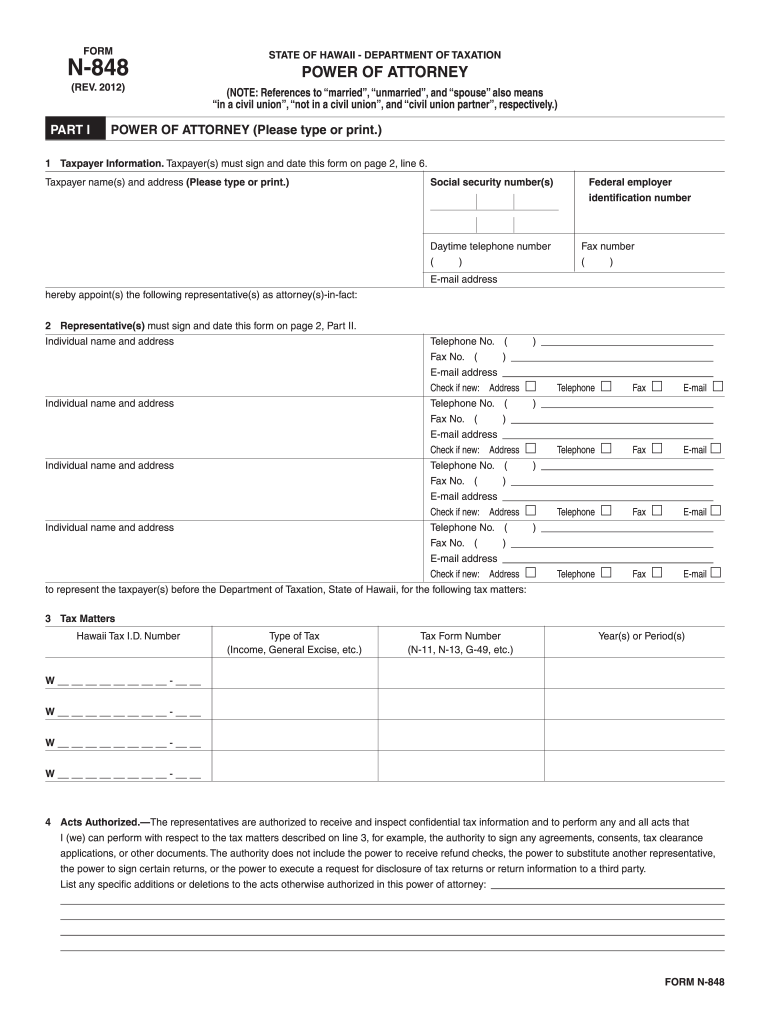

HI DoT N-848 2012 free printable template

Get, Create, Make and Sign HI DoT N-848

How to edit HI DoT N-848 online

Uncompromising security for your PDF editing and eSignature needs

HI DoT N-848 Form Versions

How to fill out HI DoT N-848

How to fill out HI DoT N-848

Who needs HI DoT N-848?

Instructions and Help about HI DoT N-848

Here is a step by step little fella guide on how to use the IRS w-9 form individuals and business entities use this form to provide their taxpayer identification number to entities that will pay them income during the tax year the employer uses your w9 for payroll purposes but doesn't send the form to the Internal Revenue Service instead they use the information to prepare employee paychecks during the year and w-2 forms at the end of the year let's take a closer look at how to actually fill it out using pitiful our online editor fill number one is your full name number two is your business name it is to be filled out only if it differs from the one mentioned above the next field is a checkbox to show the federal tax classification of the submitter on the one of the following should be checked in our case this is individual / sole proprietor or single-member LLC number four are the exemptions if you are exempt from backup withholding and/or the foreign account Tax Compliance Act reporting you should enter any codes that may apply to you generally individuals including sole proprietors are not exempt from backup withholding so in our case this is not applicable numbers five and six are the address please note that it should be your business address if you don't have one just indicate your home address that's it here it comes the next block take a look it requires is a social security number or employer identification number the letter can be indicated only if you've requested and already received one finally you have to sign and date the form luckily to do that with period filler you don't need to print out the form just sign and data directly in the editor pressing the signature fields you can add the signature immediately in the editor or choose the previously used one and last is the date it is added automatically once you press the appropriate field that's it your w-9 form is done thanks for being with us check out new PDF filler content on our YouTube channel

People Also Ask about

How do I file a f1040?

Should I use 1040 or 1040EZ?

What is the income tax return for single and joint filers with no dependents?

What is a 1040EZ?

What is a simple federal tax return form designed for uses by single and joint filers with no dependents?

What is the Internal Revenue Service form used to request a taxpayer identification number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit HI DoT N-848 online?

How do I edit HI DoT N-848 in Chrome?

Can I edit HI DoT N-848 on an iOS device?

What is HI DoT N-848?

Who is required to file HI DoT N-848?

How to fill out HI DoT N-848?

What is the purpose of HI DoT N-848?

What information must be reported on HI DoT N-848?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.