Get the free 2012 schedule c - irs

Show details

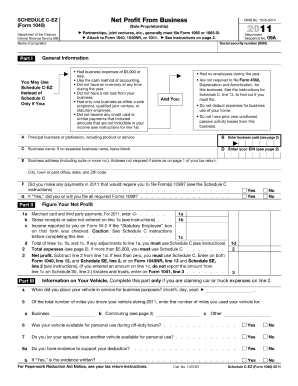

Attach to Form 1040 1040NR or 1041. See instructions on page 2. Attachment Sequence No. 09A Social security number SSN DRAFT AS OF December 27 2012 DO NOT FILE Part I General Information You May Use Schedule C-EZ Instead of Only If You Had business expenses of 5 000 or less. If no separate business name leave blank. E Business address including suite or room no. Address not required if same as on page 1 of your tax return. City town or post office state and ZIP code Did you make any payments...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 schedule c

Edit your 2012 schedule c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 schedule c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 schedule c online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012 schedule c. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 schedule c

How to fill out 2012 schedule c?

01

Gather all necessary financial records for the year 2012, including income and expenses related to your self-employment or sole proprietorship.

02

Start by entering your personal information at the top of the form, such as your name, address, and social security number.

03

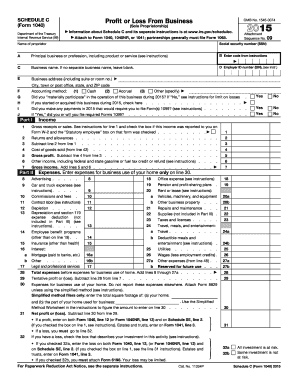

Next, report your business income on Line 1. This includes any money you earned from your self-employment or sole proprietorship during the year.

04

Calculate your business expenses and report them on the corresponding lines. These may include costs for supplies, equipment, travel, advertising, and more. Be sure to keep detailed records to support your deductions.

05

Subtract your total expenses from your total income to calculate your net profit or loss. Enter this amount on Line 31.

06

If you have a net profit, you'll need to calculate and report your self-employment tax on Schedule SE. Follow the instructions provided to determine the amount you owe.

07

Once you have filled out all the necessary information, review the form for accuracy and make any necessary corrections.

08

Sign and date the form before submitting it to the appropriate tax authorities, along with any required payments or attachments.

Who needs 2012 schedule c?

01

Self-employed individuals who operated a business or engaged in a profession as a sole proprietor during the year 2012.

02

Independent contractors who received income from various sources and were not treated as employees for tax purposes.

03

Individuals who operated a single-member LLC or partnership without electing to be taxed as a corporation.

04

Small business owners who wanted to report their business income and deductions separately from their personal tax return using Schedule C.

Note: It is important to consult with a tax professional or refer to the official IRS guidelines for accurate and personalized information regarding filling out the 2012 Schedule C form, as tax regulations may vary.

Fill

form

: Try Risk Free

People Also Ask about

Is there a limit on Schedule C losses?

For taxable years beginning in 2021, the threshold amounts are $262,000 (or $524,000 in the case of a joint return). A "trade or business" can include, but is not limited to, Schedule F and Schedule C activities and other business activities reported on Schedule E.

What is a Schedule C on a 1040 for 2012?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

How many years can you claim a loss on Schedule C?

Claiming a business loss on your tax return isn't something you can do year after year. Staying in the red might be good for cutting your taxes, but the IRS advises you have to show a profit at least three out of the last five years, counting the current year.

How do I list DoorDash on my taxes?

A 1099-NEC form summarizes Dashers' earnings as independent contractors in the US. It's provided to you and the IRS, as well as some US states, if you earn $600 or more in 2022. If you're a Dasher, you'll need this form to file your taxes.

Who provides Schedule C?

Who files a Schedule C? Schedule C is for two types of businesses: sole proprietors or single-member limited liability corporations (LLCs). Schedule C is not for C corporations or S corporations.

Do I need to fill out a Schedule C for DoorDash?

You will file Schedule C to report your business income and expenses to the IRS. On the Schedule C form, you record all your business income (Grubhub, Postmates, DoorDash, and UberEATS income) and business tax deductions (expenses).

How many years can my business lose money?

The IRS only allows a business to claim losses for three out of five tax years. After this, and if you have not proven that your business is now making money, the IRS can prohibit a business from claiming losses on its taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2012 schedule c online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 2012 schedule c to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit 2012 schedule c on an Android device?

You can make any changes to PDF files, like 2012 schedule c, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete 2012 schedule c on an Android device?

Complete your 2012 schedule c and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is schedule c?

Schedule C is a form used by sole proprietors to report business income and expenses.

Who is required to file schedule c?

Individuals who operate a business as a sole proprietor are required to file Schedule C.

How to fill out schedule c?

Schedule C should be filled out by providing information about business income, expenses, and deductions.

What is the purpose of schedule c?

The purpose of Schedule C is to calculate the net profit or loss from a business operation.

What information must be reported on schedule c?

On Schedule C, information such as gross income, expenses, and deductions related to the business must be reported.

Fill out your 2012 schedule c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Schedule C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.