NC E-585 FAQ 2011 free printable template

Show details

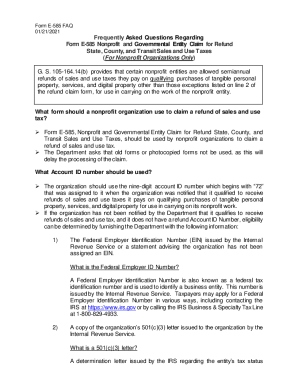

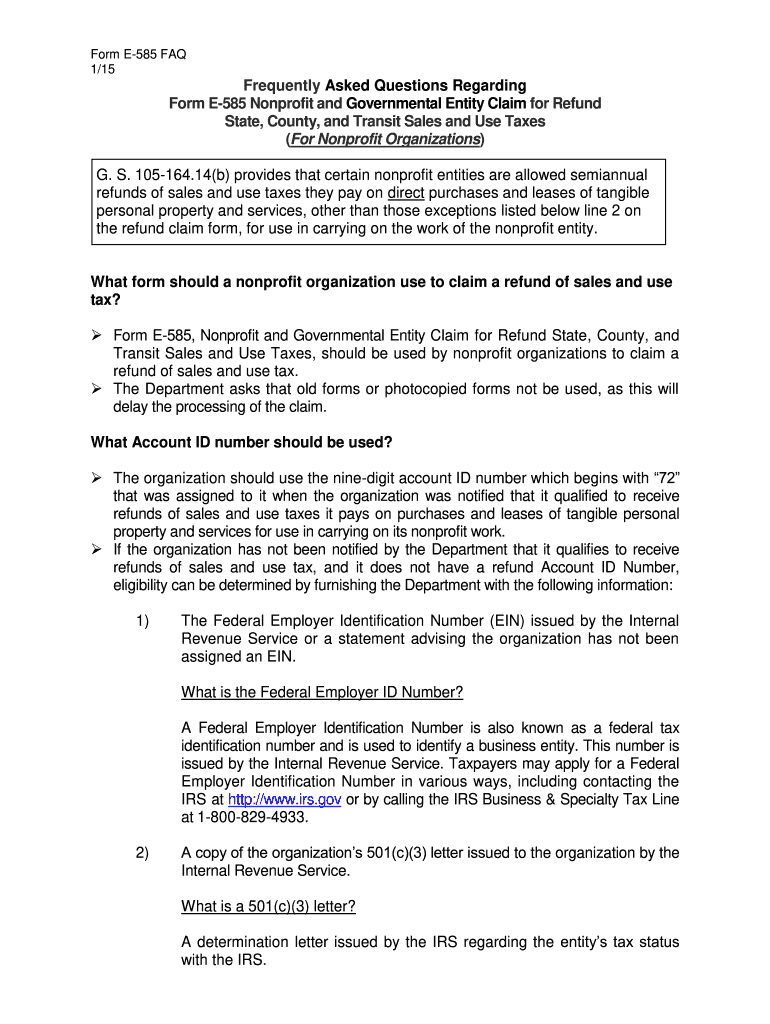

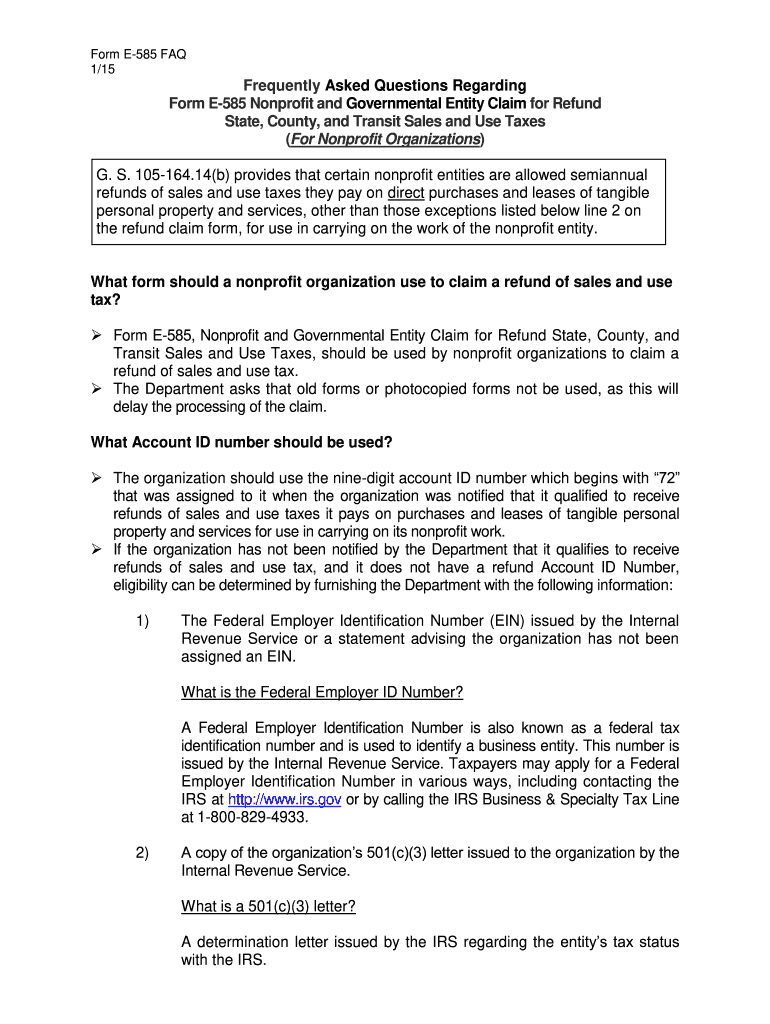

Form E-585 FAQ 9/11 Frequently Asked Questions Regarding Form E-585 Nonprofit and Governmental Entity Claim For Refund State and County Sales and Use Taxes (For Nonprofit Organizations) G. S. 105-164.14(b)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form e 585pdffillercom 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e 585pdffillercom 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form e 585pdffillercom 2011 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form e 585pdffillercom 2011. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

NC E-585 FAQ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form e 585pdffillercom 2011

How to fill out form e 585pdffillercom 2011:

01

Start by downloading the form e 585pdffillercom 2011 from the official website or any trusted source.

02

Open the downloaded form using a PDF reader on your computer or mobile device.

03

Begin by entering the required personal information, such as your name, address, and contact details, in the designated fields.

04

Provide any additional information that is requested on the form, such as your social security number or taxpayer identification number.

05

If the form requires you to make any declarations or statements, carefully read and follow the instructions provided. Fill in the necessary details accurately and truthfully.

06

Double-check all the information you have entered to ensure it is correct and complete.

07

If there are any sections or fields that do not apply to your situation, leave them blank or mark them as "N/A" (not applicable).

08

Review the entire form once again to make sure you have not missed any important sections or instructions.

09

Once you are satisfied with the information provided, save a copy of the completed form on your device or print it out for submission, depending on the instructions provided by the relevant authority.

Who needs form e 585pdffillercom 2011:

01

Individuals who have a specific tax-related requirement or obligation in the given year may need to fill out form e 585pdffillercom 2011. This could include individuals who need to declare certain income sources, claim specific deductions, or report specific transactions.

02

Business owners or self-employed individuals may need to fill out this form if they have earnings or expenses that need to be reported to the tax authorities.

03

It is advisable to consult with a tax professional or refer to the relevant tax regulations or guidelines to determine whether you need to fill out this specific form and for what purpose.

Instructions and Help about form e 585pdffillercom 2011

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form e 585pdffillercom?

Form e 585pdffillercom is a document used for reporting certain information related to financial transactions.

Who is required to file form e 585pdffillercom?

Individuals or entities who have engaged in specified financial transactions may be required to file form e 585pdffillercom.

How to fill out form e 585pdffillercom?

Form e 585pdffillercom can be filled out by providing the requested information accurately and completely in the designated fields.

What is the purpose of form e 585pdffillercom?

The purpose of form e 585pdffillercom is to provide transparency and compliance in financial transactions.

What information must be reported on form e 585pdffillercom?

Form e 585pdffillercom requires reporting details such as the type of financial transaction, amount involved, parties involved, and other relevant information.

When is the deadline to file form e 585pdffillercom in 2023?

The deadline to file form e 585pdffillercom in 2023 is typically on April 15th, but it is advisable to check for any updates or extensions.

What is the penalty for the late filing of form e 585pdffillercom?

The penalty for late filing of form e 585pdffillercom can vary, but it may include fines or other repercussions imposed by the relevant authorities.

How do I complete form e 585pdffillercom 2011 online?

Easy online form e 585pdffillercom 2011 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the form e 585pdffillercom 2011 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form e 585pdffillercom 2011 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit form e 585pdffillercom 2011 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form e 585pdffillercom 2011. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your form e 585pdffillercom 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.