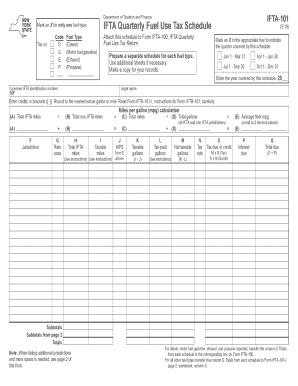

NY DTF IFTA-101 (Formerly IFTA-101-MN) 2008 free printable template

Get, Create, Make and Sign NY DTF IFTA-101 Formerly IFTA-101-MN

How to edit NY DTF IFTA-101 Formerly IFTA-101-MN online

Uncompromising security for your PDF editing and eSignature needs

NY DTF IFTA-101 (Formerly IFTA-101-MN) Form Versions

How to fill out NY DTF IFTA-101 Formerly IFTA-101-MN

How to fill out NY DTF IFTA-101 (Formerly IFTA-101-MN)

Who needs NY DTF IFTA-101 (Formerly IFTA-101-MN)?

Instructions and Help about NY DTF IFTA-101 Formerly IFTA-101-MN

Hi I'm Patti Boston I'm the owner of evil sizer transportation services I'm here today going to teach you how to fill out your mileage and fuel trip report so let's get started hi this is penny Boston with Even sizer transportation services out of Littleton Colorado today I want to focus on the mileage and fuel trip report this is a report that you will fill out every time you leave on a trip you'll enter your miles by state and the gallons that you purchase, so you'll have the information needed to fill out your IFTA and your mileage tax reports at the end of each quarter, or we could do those for you, we also provide that service here at OT our fuel tax com but in the meantime I'd like to teach you how to fill this report out it is very simple, but I'm sure there's always questions that arise when you're getting ready to leave on a trip this is very important auditors will ask for this report, so it needs to be complete and legible, so there's no misunderstanding between you and the Auditor the last thing you want to do is to get audited over a mistake from your penmanship, or you can also type it will provide a fill-in form on the website that maybe when you come back from your trip you'd like to type it in and have that in your records as well you just want to make sure that everything is complete, so we're going to start up at the top left where it says company name, and we're going to enter our company name today for simplicity we will just put our name equal-sized or transportation and then for the address we'll just go ahead and put our mailing address and if you want us to do your fuel taxes this is the address that you would use trip number is a sequential number that just allows you to keep your trip sheets in order it's best to stay organized keep them in order by date you can use a date, or you can simply start with one then maybe the next trip sheet would be to and so forth so your tractor number you should have an assignment for each tractor that you own, so we'll just put 101 that's a typical number and then a trailer let's just do 54 101 the date the trip began we'll just say today April 2 12 2012 and on this trip we're going to do a trip from Littleton to Dallas, so that would technically be a 2-day trip, so we'll go ahead and put the date if that date should change just go ahead and mark it in there you may not want to mark the end of date until you've actually arrived you want all the information to be as accurate as possible next is the drivers name today it's going to be myself, so I will put penny Boston, and then I would sign we have my handwritten signature right there so origin we're going to start out today in Littleton Colorado we're going to end up in Dallas Texas starting odometer this is really critical that this piece of information is in here that's why it's in a bold bolded box we want to hop in the truck quickly write down the odometer reading, and it should match the ending odometer reading of the previous...

People Also Ask about

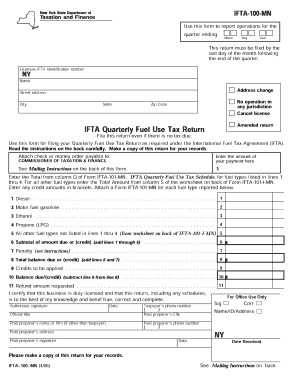

What is the IFTA 100 MN form?

How to file IFTA in Minnesota?

How do I get my IFTA in Minnesota?

Is NY part of IFTA?

What is the meaning of IFTA?

How do I file fuel tax in NY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY DTF IFTA-101 Formerly IFTA-101-MN online?

Can I create an electronic signature for the NY DTF IFTA-101 Formerly IFTA-101-MN in Chrome?

How do I fill out the NY DTF IFTA-101 Formerly IFTA-101-MN form on my smartphone?

What is NY DTF IFTA-101 (Formerly IFTA-101-MN)?

Who is required to file NY DTF IFTA-101 (Formerly IFTA-101-MN)?

How to fill out NY DTF IFTA-101 (Formerly IFTA-101-MN)?

What is the purpose of NY DTF IFTA-101 (Formerly IFTA-101-MN)?

What information must be reported on NY DTF IFTA-101 (Formerly IFTA-101-MN)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.