SG IRAS IR8A 2013 free printable template

Show details

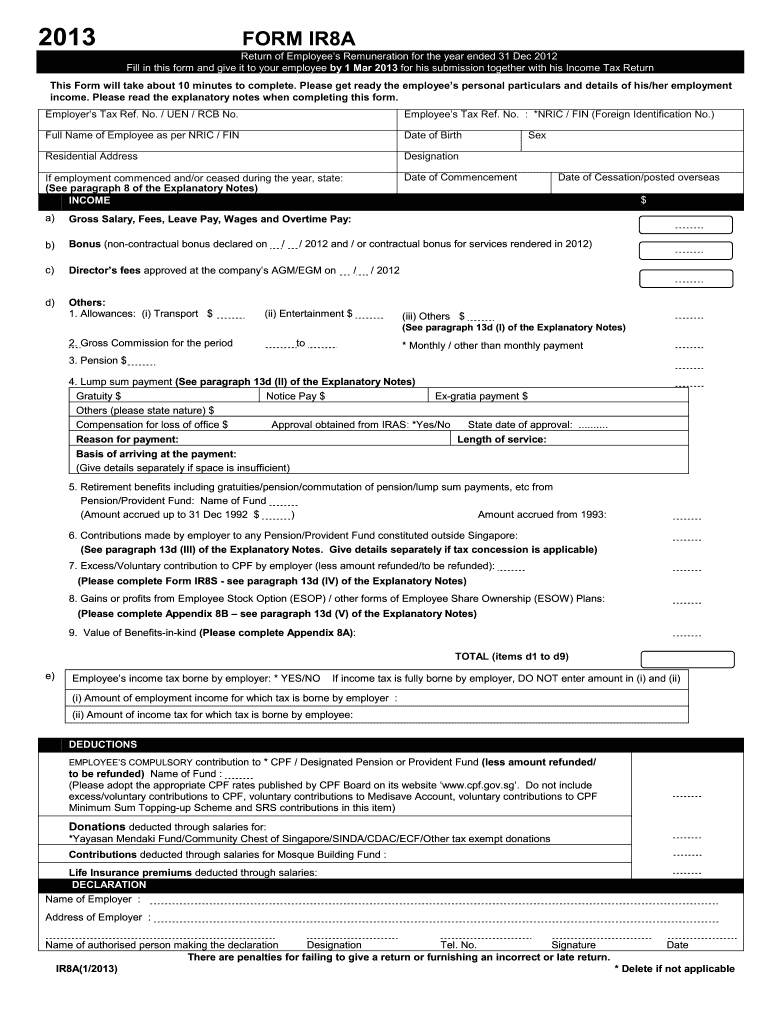

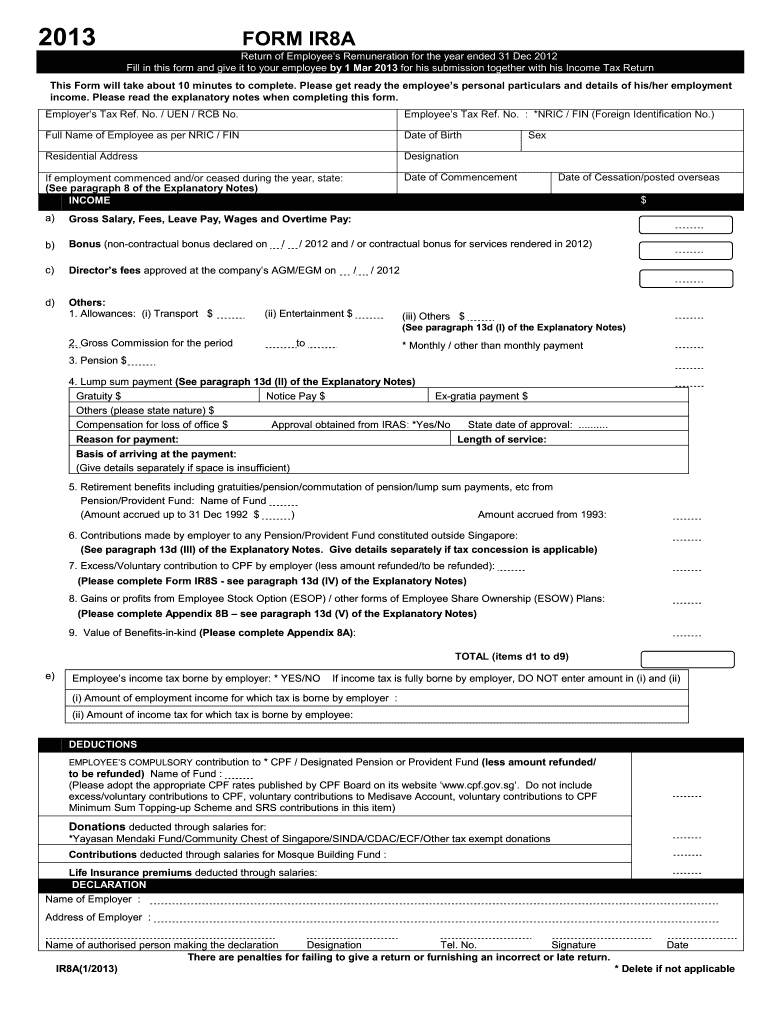

FORM IR8A Return of Employee s Remuneration for the year ended 31 Dec 2012 Fill in this form and give it to your employee by 1 Mar 2013 for his submission together with his Income Tax Return This Form will take about 10 minutes to complete.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SG IRAS IR8A

Edit your SG IRAS IR8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SG IRAS IR8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SG IRAS IR8A online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SG IRAS IR8A. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SG IRAS IR8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SG IRAS IR8A

How to fill out SG IRAS IR8A

01

Gather necessary documents: Collect your salary statements, tax documents, and any other financial records.

02

Access the IR8A form: Visit the SG IRAS website to download or access the IR8A form online.

03

Fill in personal details: Input your personal information such as name, NRIC/FIN number, and address.

04

Report income: Enter your total employment income, including bonuses, allowances, and any other taxable income.

05

Fill in deductions: If applicable, provide details on any allowable deductions or exemptions.

06

Verify information: Double-check all entries for accuracy to ensure compliance with IRAS requirements.

07

Submit the form: Follow the submission guidelines provided by IRAS, either electronically or via mail.

Who needs SG IRAS IR8A?

01

Individuals who are employees in Singapore and need to report their annual employment income for tax purposes.

02

Employers who are required to submit the IR8A form for their employees to the IRAS.

Fill

form

: Try Risk Free

People Also Ask about

What is the payroll tax withholding in Singapore?

The general withholding tax rate for NRPs is a flat 15% of gross income except in the following cases: Payment to non-resident company directors are subjected to 22% withholding tax. This applies to all forms of income (salary, bonus, director's fees, accommodation, gains from stocks and shares, and other payments)

Is benefit in kind taxable in Singapore?

Benefits-in-kind are non-cash benefits of monetary value that you provide for your employees. Generally, all gains and profits derived by an employee during his/her time of employment with a company are taxable, unless they are specifically exempt from income tax or are covered by an existing administrative concession.

What is the meaning of ir8e?

This form contains Return of Employee's Remuneration. It is provided to the employees by their employer. It contains the information necessary to complete the employees' income tax return.

What is the employer payroll tax rate in Singapore?

Is there an employer payroll tax contribution in Singapore? Employers are required to contribute 17% of monthly wages into Singapore's social security scheme, the Central Provident Fund (CPF). How does the payroll tax system of Singapore work? There are no payroll taxes in Singapore.

What is the income tax borne by employer in Singapore?

Income tax Non-residents are taxed at a flat rate of 22% (employment income is taxed at the higher number of either a flat rate of 15% or at the resident rates with personal allowances). Any salary used for relevant employment expenses, charitable donations, and relief funding such as course fees, exempts income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SG IRAS IR8A in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your SG IRAS IR8A along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the SG IRAS IR8A electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SG IRAS IR8A in seconds.

Can I create an eSignature for the SG IRAS IR8A in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your SG IRAS IR8A directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is SG IRAS IR8A?

SG IRAS IR8A is a tax form used in Singapore for reporting the annual employment income of employees to the Inland Revenue Authority of Singapore (IRAS).

Who is required to file SG IRAS IR8A?

Employers in Singapore are required to file SG IRAS IR8A for all of their employees who are receiving remuneration, including salaries, bonuses, and other benefits.

How to fill out SG IRAS IR8A?

To fill out SG IRAS IR8A, employers need to provide details such as the employee's personal information, salary, allowances, and any other taxable items received within the assessment year.

What is the purpose of SG IRAS IR8A?

The purpose of SG IRAS IR8A is to ensure that the income tax is accurately calculated and reported to IRAS, which facilitates the tax assessment process for employees.

What information must be reported on SG IRAS IR8A?

The information that must be reported on SG IRAS IR8A includes the employee's name, identification number, employment period, total income earned, any deductions, and particulars of other taxable benefits.

Fill out your SG IRAS IR8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SG IRAS ir8a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.