Get the free a self employed person should acceptable in securing ss number

Show details

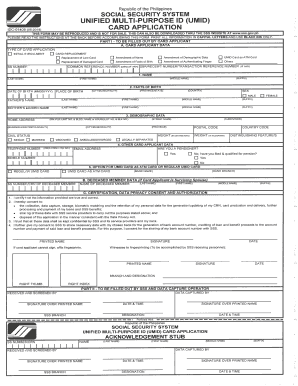

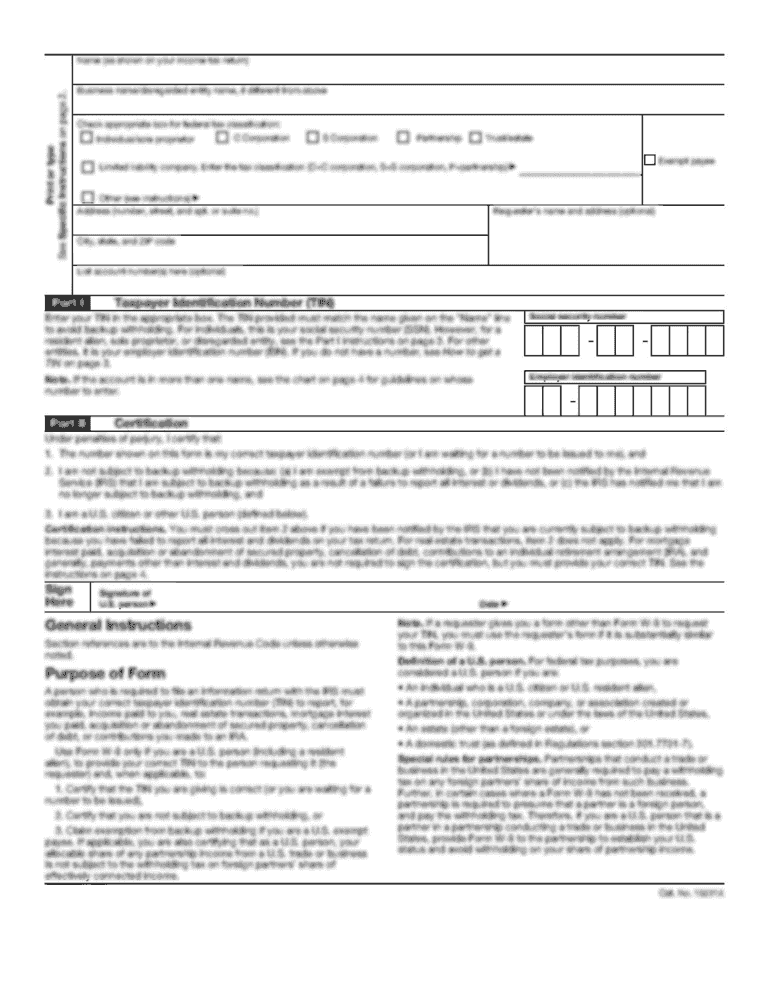

SOCIAL SECURITY SYSTEM GIVEN NAME MIDDLE NAME PLACE OF BIRTH DATE OF BIRTH SURNAME REV. 7/91 FORM BRG-103 SELF-EMPLOYED DATA RECORD RS-1 SS NUMBER ADDRESS TEL NO. CIVIL STATUS SEX SINGLE FEMALE MARRIED WIDOW/ER DATE OF SS NUMBER PREVIOUSLY ASSIGNED COVERAGE IF ANY YEAR PROFESSION/ BUSINESS STARTED PROFESSIONAL/ BUSINESS CODE POSTAL CODE SSS USE ONLY MALE RESIDENCE OFFICE MONTHLY NET EARNINGS YEARLY TAX ACCOUNT NUMBER P AGE FATHER CHILDREN MOTHER SPOUSE BENEFICIARY/IES NAME RELATIONSHIP OTHER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is sss form for sss for the first time

Edit your how can i apply for sss from self employed after the contribution is paid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is sss form for acceptable in securing ss number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is sss form for date of birth acceptable in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit a self employed person should accomplish sss form rs 1 prc card seaman's book. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sss form rs 1 self employed data record

How to fill out sss requirements for self:

01

Gather all necessary documents such as valid IDs, proof of residence, and birth certificate.

02

Fill out the SSS membership form completely and accurately.

03

Submit the filled-out form along with the required documents to the nearest SSS branch or through their online portal.

Who needs sss requirements for self:

01

Individuals who are self-employed or running their own businesses.

02

Freelancers and professionals who are not employed by a company.

03

Any individual who wants to avail of the benefits and services provided by the Social Security System (SSS).

Fill

a self employed person should accomplish and submit ss number ss form rs 1 should be

: Try Risk Free

What is sss form for self employed?

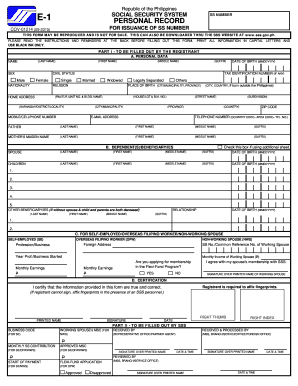

A self-employed person should accomplish and submit Self-Employed Data Record (SS Form RS-1). If he/she has no existing SS number, SS Form RS-1 should be submitted with the original/certified true copy and photocopy of any of the primary or any two (2) of the secondary documents acceptable in securing SS number.

People Also Ask about sss self employed application form

Can I apply for SSS without work?

You must first be employed in an occupation subject to and reported for SSS coverage. However, once you become a covered SSS member, you become a member for life.

How can I apply for SSS for the first time?

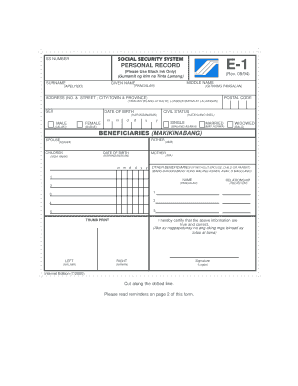

A person registering with the SSS for the first time as a prospective employee should accomplish Personal Record (SS Form E-1) and submit it with the original/certified true copy and photocopy of any of the primary or any two (2) of the secondary documents, one of which with photo and date of birth, acceptable in

How much is SSS monthly contribution 2022?

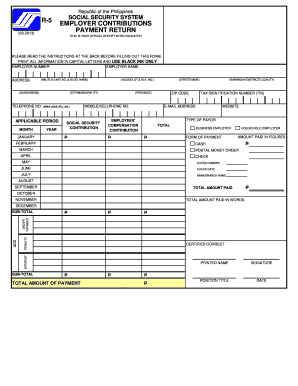

With regards to SSS Contribution, the Social Security System (SSS) has published a new circular dated December 13, 2022, SSS Circular No. 2022-033 announcing the increase of social security (SS) contribution rate to 14% starting the month of January 2023 per SSC Resolution No 751-s 2022 dated November 25, 2022.

How much is the minimum contribution for SSS self-employed?

If you are self-employed (SE) or a voluntary member (VM), you must pay the full 12%, based on the monthly earnings that you declared at the time of registration (for SE), or the MSC that you set for yourself (for VM, such as members separated from employment).

Is SSS mandatory in the Philippines?

All employed persons under the age of 60 who earn a monthly income of more than ₱1,000 are required to contribute to the three social insurance funds previously mentioned.

Can I apply for SSS without a job?

You must first be employed in an occupation subject to and reported for SSS coverage. However, once you become a covered SSS member, you become a member for life.

What are the requirements for applying SSS?

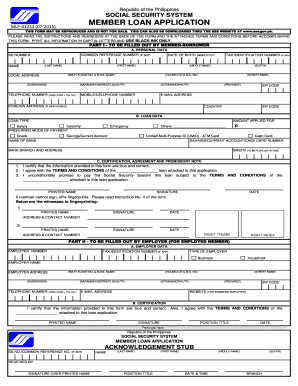

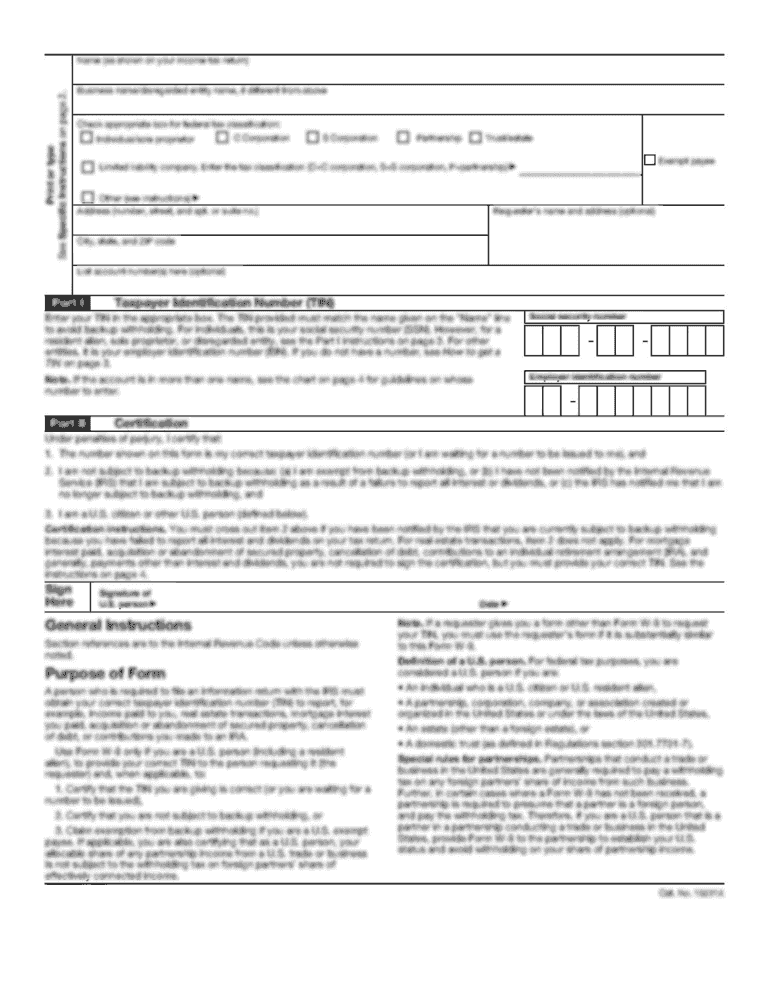

Application Requirements Member Loan Application Form. SSS digitized ID or E-6 (acknowledgement stub) with any two valid IDs, one of which with recent photo. Unexpired Driver's License. Professional Regulation Commission (PRC) ID card. Passport. Postal ID. School or Company ID. Tax Identification Number (TIN) card.

Who is required to have SSS?

Under Republic Act (RA) No. 8282, all employees in the private sector must apply with SSS to ensure protection for workers and their families. SSS contributions depend on the monthly salary of the employee and the computed contribution amount will be shared by both the employee and the employer.

Is SSS membership mandatory?

Under the newly-enacted RA No. 11199, or Social Security Act of 2018, all OFWs are now mandatorily covered by the SSS.

How can I apply for SSS from self-employed?

Just login to the My. SSS portal and generate a Payment Reference Number (PRN). Choose “Voluntary'' or “OFW” as your membership type. This will automatically change your status after the contribution is paid.

What is the requirements for SSS?

Application Requirements Member Loan Application Form. SSS digitized ID or E-6 (acknowledgement stub) with any two valid IDs, one of which with recent photo. Unexpired Driver's License. Professional Regulation Commission (PRC) ID card. Passport. Postal ID. School or Company ID. Tax Identification Number (TIN) card.

Can you apply for SSS without a job?

You must first be employed in an occupation subject to and reported for SSS coverage. However, once you become a covered SSS member, you become a member for life.

Is it okay not to get SSS?

A self-employed person who fails to register with the SSS may be subjected to fines and/or imprisoned.

Who is eligible to apply for SSS?

A self-employed person, regardless of trade, business or occupation, with an income of at least P1,000 a month and not over 60 years old, should register with the SSS.

How much is the monthly contribution in SSS for self-employed?

If you are self-employed (SE) or a voluntary member (VM), you must pay the full 12%, based on the monthly earnings that you declared at the time of registration (for SE), or the MSC that you set for yourself (for VM, such as members separated from employment).

How much is the SSS contribution for individually paying?

How Much is My SSS Contribution? For 2021, SSS set its contribution rate at 13% of the monthly salary credit (MSC) that's up to ₱25,000. Employers and employees share the current rate where 8.5% of contributions come from employers, and employees give 4.5% worth of contributions to SSS.

What are the requirements for SSS self-employed?

How to Register in SSS as Self-Employed Member? A self-employed person should accomplish SSS Form RS-1 (Self-Employed Data Record) and submit it together with a photocopy of any of the following baptismal, birth certificate, driver's license, passport, Professional Regulation Commission (PRC) Card, Seaman's Book.

Is SSS mandatory for self-employed?

- Coverage in the SSS shall be compulsory upon such self-employed persons as may be determined by the Commission under such rules and regulations as it may prescribe, including but not limited to the following: 1. All self-employed professionals; 2. Partners and single proprietors of businesses; 3.

What is the age limit to apply for SSS?

at least 60 years old and separated from employment or has ceased to be an SE/OFW/Household Helper (optional retirement); at least 65 years old whether still employed/SE, working as OFW/Household Helper or not (technical retirement);

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sss requirements for self employed to be eSigned by others?

Once your rs1 form sss is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit what is sss form for ss form rs 1 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sss self employed registration, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out rs1 form on an Android device?

Use the pdfFiller Android app to finish your sss rs1 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is sss self employed application?

The SSS self employed application is a process for individuals who are self-employed to register with the Social Security System (SSS) in order to avail of the benefits and coverage provided by the agency.

Who is required to file sss self employed application?

Individuals who are self-employed, such as freelancers, business owners, and other professionals who do not have employer-based SSS coverage are required to file the SSS self employed application.

How to fill out sss self employed application?

To fill out the SSS self employed application, individuals must complete the designated application form, provide necessary identification documents, business permits, and other related information regarding their self-employment.

What is the purpose of sss self employed application?

The purpose of the SSS self employed application is to ensure that self-employed individuals can access social security benefits, including retirement, disability, and sickness benefits, as well as to contribute to the national social insurance program.

What information must be reported on sss self employed application?

The information that must be reported includes personal identification details, business information, income declaration, and the duration of self-employment, along with any applicable documents to support the application.

Fill out your a self employed person online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sss Form is not the form you're looking for?Search for another form here.

Keywords relevant to sss application form

Related to sss registration form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.