Get the free pdffiller

Show details

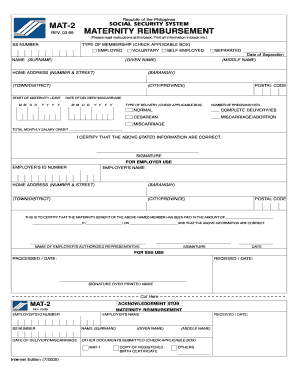

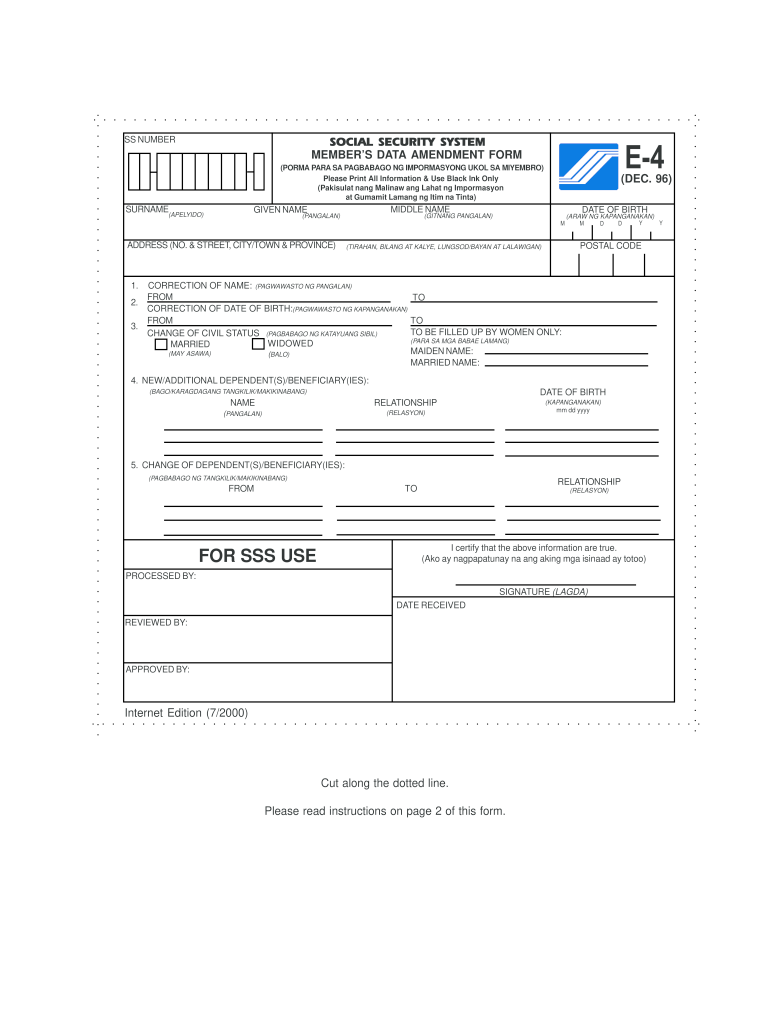

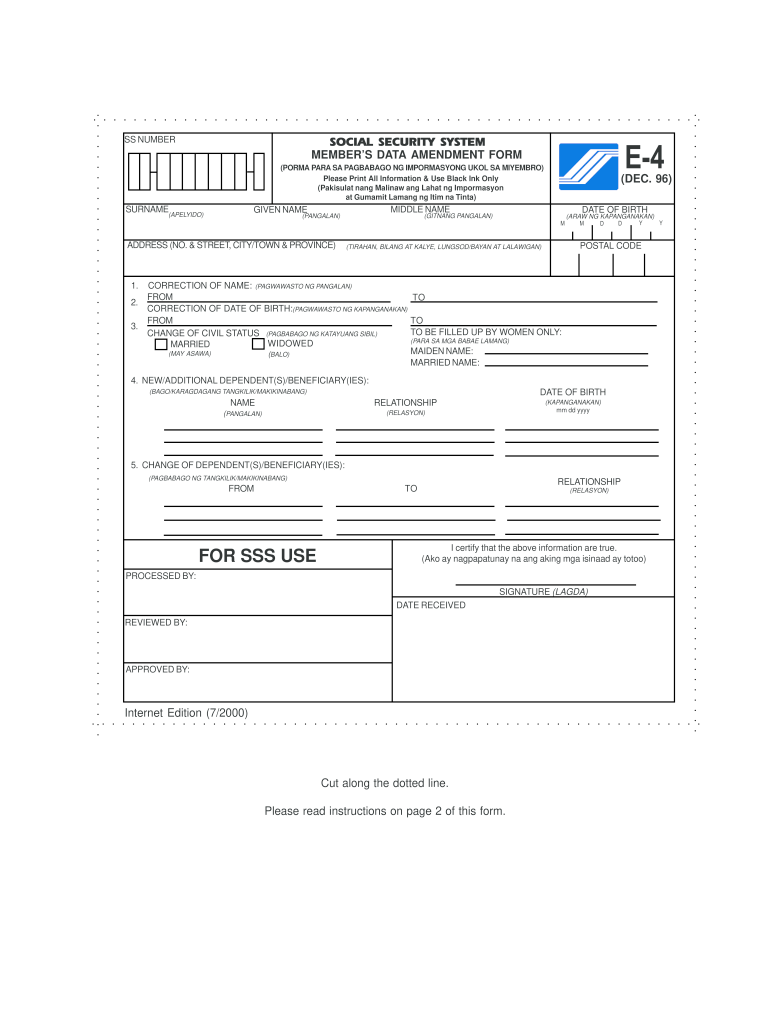

SOCIAL SECURITY SYSTEM MEMBER S DATA AMENDMENT FORM PANGALAN MIDDLE NAME GIVEN NAME APELYIDO DEC. 96 DATE OF BIRTH GITNANG PANGALAN ARAW NG KAPANGANAKAN Y M D SURNAME E-4 PORMA PARA SA PAGBABAGO NG IMPORMASYONG UKOL SA MIYEMBRO Please Print All Information Use Black Ink Only Pakisulat nang Malinaw ang Lahat ng Impormasyon at Gumamit Lamang ng Itim na Tinta SS NUMBER CORRECTION OF NAME PAGWAWASTO NG PANGALAN FROM TO TO BE FILLED UP BY WOMEN ONLY CHANGE OF CIVIL STATUS PAGBABAGO NG KATAYUANG...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sss verification slip sample form

Edit your sss e4 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sss verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sss verification slip online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit e4 form sss. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ss form e 4

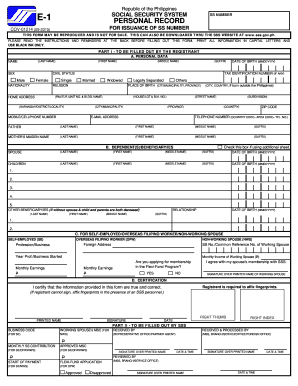

How to fill out e4 form sss?

01

Make sure you have all the necessary personal information ready, such as your full name, address, contact number, and Social Security System (SSS) number.

02

Start by filling out the top part of the form, which requires your personal details. Provide accurate information to avoid any issues or delays.

03

Proceed to the Employment History section and enter relevant details about your previous and current employment, including the dates, employer name, office address, and your position.

04

Fill in the Compensation section by providing accurate details about your salary or wages, such as the amount, frequency, and mode of payment.

05

If you have any dependents, fill out the Authorized Dependents section by providing their names, dates of birth, and relationship to you.

06

In the Sickness and Maternity Benefits section, indicate whether you are applying for sickness or maternity benefits. Provide the necessary details such as the start and end dates of the sickness or maternity leave.

07

Finally, review all the information you have entered to ensure its accuracy. Sign and date the form before submitting it to the SSS office or through any online submission channels.

Who needs e4 form sss?

01

Employed individuals who are registered members of the Social Security System (SSS) need the e4 form.

02

Self-employed or voluntary members of the SSS also require the e4 form.

03

Any employee who wishes to avail of sickness or maternity benefits through the SSS needs to fill out the e4 form.

04

Members who need to update their employment or personal information with the SSS may also be required to submit the e4 form.

Fill

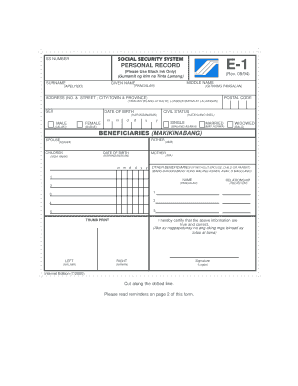

sss e1 form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sss form e 4 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your sss e 4 form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find sss e1?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the sss e4 form sample fill up in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute what is sss e4 form online?

Easy online sss form e4 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

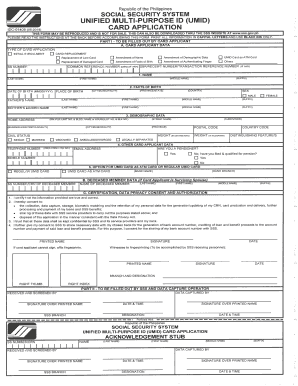

What is sss e4 form?

The SSS E4 form is a document used by the Social Security System in the Philippines to report contributions and other relevant information about employees enrolled in the system.

Who is required to file sss e4 form?

Employers who have employees enrolled in the Social Security System are required to file the SSS E4 form to report their contributions and information.

How to fill out sss e4 form?

To fill out the SSS E4 form, employers need to provide details about their employees, including names, SSS numbers, contributions, and other relevant employment information. It must be completed accurately and submitted in accordance with SSS guidelines.

What is the purpose of sss e4 form?

The purpose of the SSS E4 form is to provide the Social Security System with necessary information about employee contributions to ensure proper record-keeping and benefit distribution.

What information must be reported on sss e4 form?

The SSS E4 form must report information including employee names, Social Security numbers, monthly salary, contributions made by the employer and employee, and other relevant employment details.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sss Disbursement Form is not the form you're looking for?Search for another form here.

Keywords relevant to e1 form sss

Related to e4 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.