Canada RC59 E 2008 free printable template

Show details

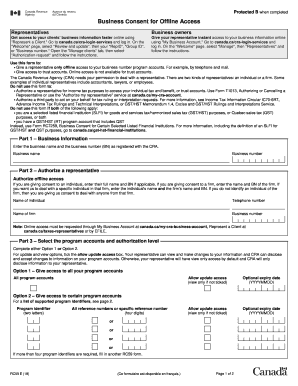

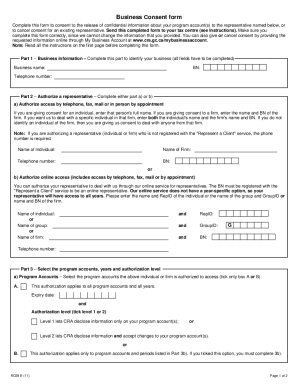

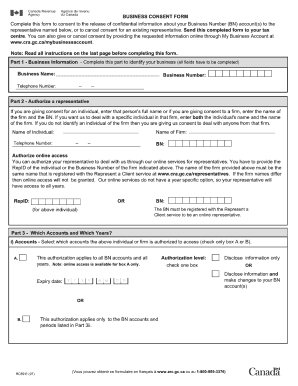

Business Consent form

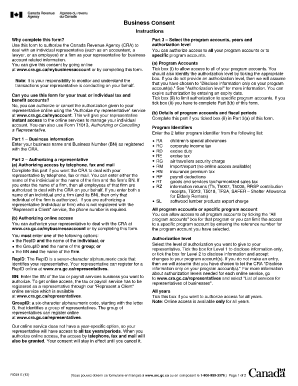

Instructions

Why complete this form?

If you want us at the Canada Revenue Agency (CRA) to deal with an

individual (such as an accountant, a lawyer, or an employee) or with a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC59 E

Edit your Canada RC59 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC59 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada RC59 E online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada RC59 E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC59 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC59 E

How to fill out Canada RC59 E

01

Obtain the Canada RC59 E form from the Canada Revenue Agency (CRA) website.

02

Fill in the 'Applicant Information' section with your name, address, and contact information.

03

Indicate the type of account or service being requested in the appropriate section.

04

Complete the 'Authorization' section by specifying the individual or organization you are authorizing to act on your behalf.

05

Sign and date the form to validate your request.

06

Submit the completed form to CRA by mail or through their online portal, if applicable.

Who needs Canada RC59 E?

01

Individuals or businesses who need to authorize a representative to manage their tax affairs with the CRA.

02

Tax professionals or accountants who require access to client’s tax information.

03

Anyone seeking to grant permission for someone else to handle their tax-related matters.

Fill

form

: Try Risk Free

People Also Ask about

What form do I need to authorize a representative CRA?

By signing Form AUT-01, Authorize a Representative for Offline Access, you are authorizing the representative to have access to information regarding trust accounts. Send the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

What replaced RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail - Canadian Charity Law.

What is an RC59 form?

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

What is CRA form RC59?

Notice to the reader: You can now authorize your representative online using My Business Account. Your Business Consent form must be properly completed before the CRA can process your request. Incomplete forms will not be processed and will be returned to you.

What is RC59 form?

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

Can I still use RC59?

You can also request an electronic signature on this form. The CRA no longer accepts forms RC59 (Business Consent for Offline Access) and RC59X (Cancel Business Consent or Delegated Authority).

What is the replacement for RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail. CRA has said that they will no longer accept the RC59 Business Consent for Offline Access and now as of today one will need to use the new Form AUT-01 Authorize a Representative for Access by Phone and Mail.

How do I authorize a business representative for CRA?

To authorize a representative to have offline access to your: Business account information, use Form AUT-01, Authorize a Representative for Offline Access, and mail the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada RC59 E directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your Canada RC59 E and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in Canada RC59 E?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Canada RC59 E to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in Canada RC59 E without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing Canada RC59 E and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is Canada RC59 E?

Canada RC59 E is a form used by certain organizations to request registration for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) program in Canada.

Who is required to file Canada RC59 E?

Organizations that need to register for the GST/HST program, such as non-profit organizations, charities, and certain businesses providing taxable supplies, are required to file Canada RC59 E.

How to fill out Canada RC59 E?

To fill out Canada RC59 E, you need to provide the organization's legal name, business number (if applicable), address, contact information, and details regarding the nature of the supplies made or intended to be made.

What is the purpose of Canada RC59 E?

The purpose of Canada RC59 E is to allow organizations to register for the GST/HST program and subsequently collect and remit the tax on qualifying transactions.

What information must be reported on Canada RC59 E?

On Canada RC59 E, you must report the organization's legal name, business number, address, contact information, and a description of the activities and supplies that the organization provides.

Fill out your Canada RC59 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc59 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.