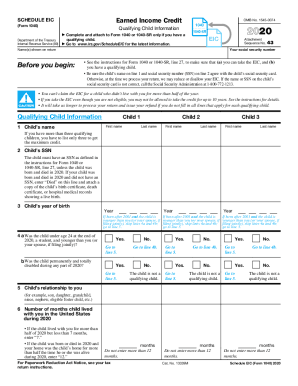

Worksheet A - Earned Income Credit (EIC) - Lines 64a and 64b 2011-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

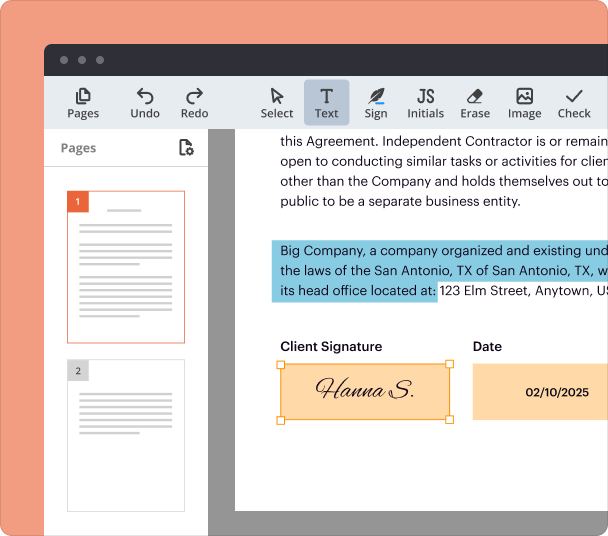

Edit and sign in one place

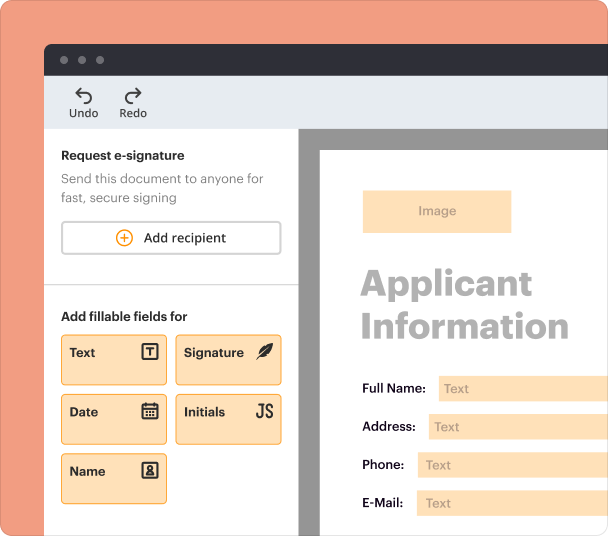

Create professional forms

Simplify data collection

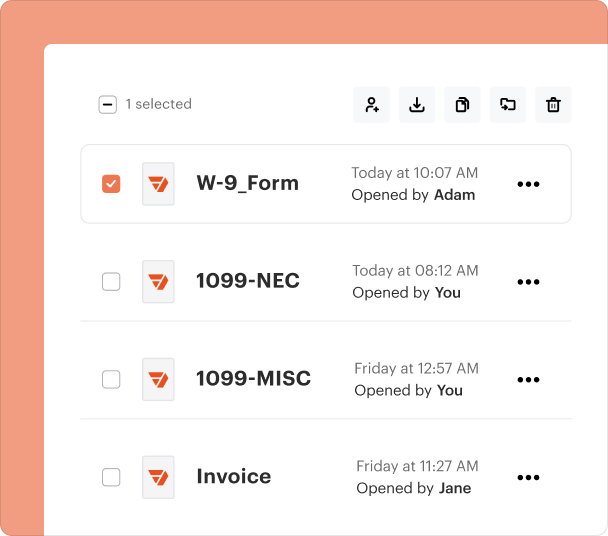

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding Worksheet A for Earned Income Credit (EIC)

What is Worksheet A for Earned Income Credit?

Worksheet A is a tax form utilized by individual taxpayers in the United States to determine their eligibility for the Earned Income Credit (EIC). This sheet calculates the amount of credit a taxpayer may claim based on their earned income and filing status. It is specifically designed for those who meet the requirements and want to ensure they maximize their tax benefits under federal regulations.

Key Features of Worksheet A

Worksheet A includes several key features that facilitate the calculation of the Earned Income Credit. It provides clear lines for entering earned income, pertinent questions to assess eligibility, and reference tables to help determine the correct credit amount. The layout is straightforward, guiding users through each step to minimize confusion and ensure accurate reporting.

Eligibility Criteria for Worksheet A

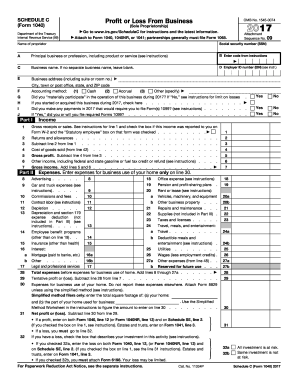

To use Worksheet A, taxpayers must meet specific eligibility requirements. These include having earned income from employment or self-employment, meeting the income limits set by the IRS, and filing with the correct status. Additionally, taxpayers must check the worksheet’s criteria, confirming if they have qualifying children or not, which affects the credit amount.

How to Fill Out Worksheet A

Filling out Worksheet A requires careful attention to detail. Taxpayers should start by entering their total earned income on the specified lines. They will then answer questions that determine eligibility, referring to the IRS guidelines. It's essential to consult the EIC Table for the correct credit amount based on income and filing status, ensuring the proper column is used. Completing each line accurately will provide clarity and help avoid errors.

Common Errors and Troubleshooting

When completing Worksheet A, taxpayers may encounter common errors that can impact their EIC claims. Common mistakes include incorrect income entries, failing to check eligibility questions thoroughly, or overlooking the correct reference in the EIC Table. Taxpayers should review their completed worksheet for accuracy, confirming that all required fields are filled and the calculations match IRS guidelines to prevent issues during processing.

Submission Methods for Worksheet A

After completing Worksheet A, taxpayers may submit it along with their tax return. It can be filed electronically or via paper mail, depending on the preferred filing method. When filing electronically, the software often guides users through entering the necessary information from Worksheet A. Those who file by mail should ensure they include all required documentation to support their EIC claim, alongside the completed tax return.

Frequently Asked Questions about Eic Worksheet B 2021

Who can benefit from using Worksheet A?

Individuals with earned income who wish to claim the Earned Income Credit may benefit from using Worksheet A. This form is particularly useful for taxpayers with qualifying children and those meeting specific income thresholds.

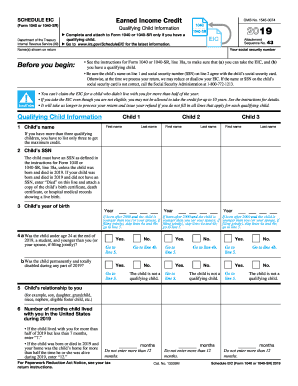

Are there any updates to Worksheet A for different tax years?

Worksheet A can have variations from year to year, reflecting changes in tax law and EIC eligibility standards. Users should ensure they are using the correct version for the applicable tax year, which can be found on the IRS website or through tax preparation resources.

pdfFiller scores top ratings on review platforms