Get the free form uct 8306 2 e - docs legis wisconsin

Show details

DWD 136. 04. 2 If the department may not levy 25 of the individual s disposable earnings under sub. 03 Chapter DWD 136 WAGES EXEMPT FROM LEVY DWD 136. 001 Definitions. DWD 136. 01 Purpose. DWD 136. 02 Levy to recover forfeitures. DWD 136. 04. History CR 08 059 cr. Register November 2008 No. 635 eff. 12 1 08. prescribe a methodology for computing wages exempt from department levy under ss. DWD 136. 04 Pay periods other than weekly. In the case of ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form uct 8306 2

Edit your form uct 8306 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form uct 8306 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form uct 8306 2 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form uct 8306 2. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form uct 8306 2

How to fill out form uct 8306 3?

01

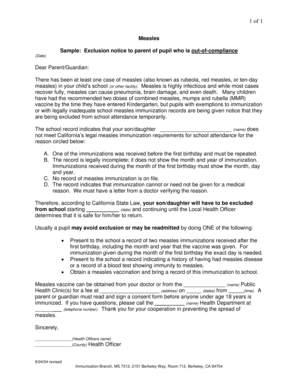

Begin by carefully reading the instructions provided with the form. Familiarize yourself with the purpose of the form and the information you need to provide.

02

Gather all the necessary information and documents required to complete the form. This may include personal details, financial information, or any other relevant information.

03

Fill in your personal details accurately, such as your name, address, and contact information. Ensure that you provide all the requested information and leave no sections unanswered.

04

Follow the instructions provided for each section of the form. If there are any specific formats or guidelines mentioned, make sure to adhere to them.

05

Double-check all the information you have entered to ensure its accuracy. Mistakes or omissions could lead to delays or rejection of the form.

06

If there are any supporting documents required, attach them securely to the form. Make sure they are legible and clearly labeled.

07

Review the completed form one last time before submitting it. Check for any errors, missing information, or inconsistencies.

08

Sign and date the form as required. If there are any additional signatures required, ensure that you obtain them before submitting the form.

09

Make a copy of the completed form and any supporting documents for your records.

10

Submit the form according to the specified instructions, whether it is by mail, in person, or online. Keep any confirmation or acknowledgment of submission for future reference.

Who needs form uct 8306 3?

01

Individuals who are required to report specific information to the relevant authorities.

02

Entities or organizations that are designated by law to collect and process the information provided on form uct 8306 3.

03

Those who want to avail or qualify for certain benefits, licenses, permits, or legal protections that require the submission of form uct 8306 3.

Fill

form

: Try Risk Free

People Also Ask about

How many weeks of unemployment in Wisconsin?

Amount and Duration of Unemployment Benefits in Wisconsin Your weekly benefit amount will be 40% of your average weekly wage, up to a maximum of $370 per week. The minimum weekly benefit is $54. Benefits are ordinarily available for up to 26 weeks, although this may be extended during periods of high unemployment.

How do I get my 1099 from Wisconsin unemployment?

o After the most recent tax year 1099-G forms are available mid-January, select 'Get your 1099-G' from 'My UI Home' in the online claimant portal (including prior years).

How do I find my 1099 online?

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

Does Wisconsin unemployment send tax forms?

The UI Division is required to send 1099-G information to the Internal Revenue Service and the Wisconsin Department of Revenue. For more information and frequently asked questions, visit the 1099-G Tax Information page.

How do I file for unemployment extension in Wisconsin?

Apply for extended benefits online or over the phone. The phone number to file an unemployment claim in Wisconsin is (800) 822-5246.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form uct 8306 2?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form uct 8306 2 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the form uct 8306 2 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form uct 8306 2 and you'll be done in minutes.

How do I fill out the form uct 8306 2 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form uct 8306 2 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is form uct 8306 2?

Form UCT 8306 2 is a tax form used in specific jurisdictions for reporting certain types of transactions or income.

Who is required to file form uct 8306 2?

Individuals or entities that engage in transactions subject to the reporting requirements of Form UCT 8306 2 are required to file this form.

How to fill out form uct 8306 2?

To fill out Form UCT 8306 2, you must provide accurate information regarding the transactions being reported, including all necessary identification and financial details as specified in the form's instructions.

What is the purpose of form uct 8306 2?

The purpose of Form UCT 8306 2 is to ensure compliance with tax laws by reporting relevant financial information and transactions to the tax authorities.

What information must be reported on form uct 8306 2?

Form UCT 8306 2 typically requires reporting details such as the nature of the transaction, amounts involved, parties to the transaction, and any other pertinent financial information as outlined in the instructions.

Fill out your form uct 8306 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Uct 8306 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.