Canada RC59 E 2011 free printable template

Show details

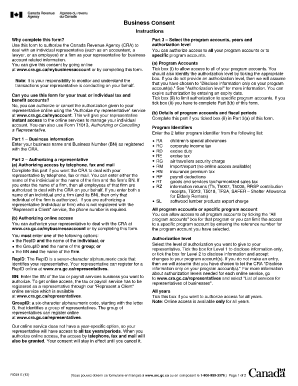

You can also enter an expiry date to automatically cancel authorization. If more authorizations or more than four program identifiers are needed complete another Form RC59. Where do you send your completed form Surrey Tax Centre 9755 King George Boulevard Surrey BC V3T 5E1 Winnipeg Tax Centre 66 Stapon Road Winnipeg MB R3C 3M2 Sudbury Tax Centre 1050 Notre Dame Avenue Sudbury ON P3A 5C1 Summerside Tax Centre 275 Pope Road Summerside PE C1N 6A2 Shawinigan-Sud Tax Centre Post Office Box 3000...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC59 E

Edit your Canada RC59 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC59 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC59 E online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada RC59 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC59 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC59 E

How to fill out Canada RC59 E

01

Obtain the Canada RC59 E form from the Canada Revenue Agency (CRA) website or a local CRA office.

02

Fill in your personal information including your name, address, and contact information.

03

Enter your Business Number (BN) if applicable.

04

Complete the section regarding the type of authorization you are providing (e.g., for your representative).

05

Sign and date the form to confirm your authorization.

06

Submit the form to the CRA through mail or electronically if options are available.

Who needs Canada RC59 E?

01

Individuals or businesses who want to authorize someone to act on their behalf in dealings with the Canada Revenue Agency.

02

Those who require their representative to receive information or perform transactions regarding their tax matters.

Fill

form

: Try Risk Free

People Also Ask about

What form do I need to authorize a representative CRA?

By signing Form AUT-01, Authorize a Representative for Offline Access, you are authorizing the representative to have access to information regarding trust accounts. Send the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

What replaced RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail - Canadian Charity Law.

What is an RC59 form?

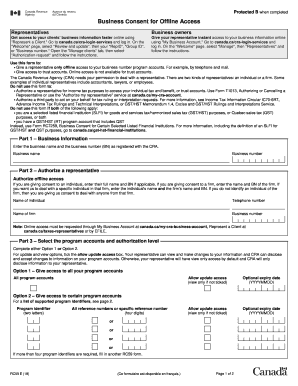

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

What is CRA form RC59?

Notice to the reader: You can now authorize your representative online using My Business Account. Your Business Consent form must be properly completed before the CRA can process your request. Incomplete forms will not be processed and will be returned to you.

What is RC59 form?

The RC59 (Corporate Form) is a CRA issued form used by businesses to give someone such as an accountant or lawyer access to their confidential business information.

Can I still use RC59?

You can also request an electronic signature on this form. The CRA no longer accepts forms RC59 (Business Consent for Offline Access) and RC59X (Cancel Business Consent or Delegated Authority).

What is the replacement for RC59?

CRA replaces RC59 with Form AUT-01 Authorize a Representative for Access by Phone and Mail. CRA has said that they will no longer accept the RC59 Business Consent for Offline Access and now as of today one will need to use the new Form AUT-01 Authorize a Representative for Access by Phone and Mail.

How do I authorize a business representative for CRA?

To authorize a representative to have offline access to your: Business account information, use Form AUT-01, Authorize a Representative for Offline Access, and mail the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada RC59 E without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your Canada RC59 E into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in Canada RC59 E?

The editing procedure is simple with pdfFiller. Open your Canada RC59 E in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete Canada RC59 E on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your Canada RC59 E. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Canada RC59 E?

Canada RC59 E is a form used by businesses to appoint or cancel an authorized representative for the Canada Revenue Agency (CRA).

Who is required to file Canada RC59 E?

Organizations or businesses that wish to authorize someone to act on their behalf with the CRA must file Canada RC59 E.

How to fill out Canada RC59 E?

To fill out the Canada RC59 E, provide the business's information, details of the authorized representative, specify the type of authorization, and sign the form.

What is the purpose of Canada RC59 E?

The purpose of Canada RC59 E is to formally authorize an individual or organization to communicate or act on behalf of a business regarding tax-related matters with the CRA.

What information must be reported on Canada RC59 E?

The information that must be reported includes the business's name, business number, contact details, the representative's name, and the scope of their authority.

Fill out your Canada RC59 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc59 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.