Get the free simple independent contractor agreement pdf form

Get, Create, Make and Sign

How to edit simple independent contractor agreement pdf online

How to fill out simple independent contractor agreement

How to fill out blank contractor agreement?

Who needs blank contractor agreement?

Video instructions and help with filling out and completing simple independent contractor agreement pdf

Instructions and Help about contractor agreement pdf form

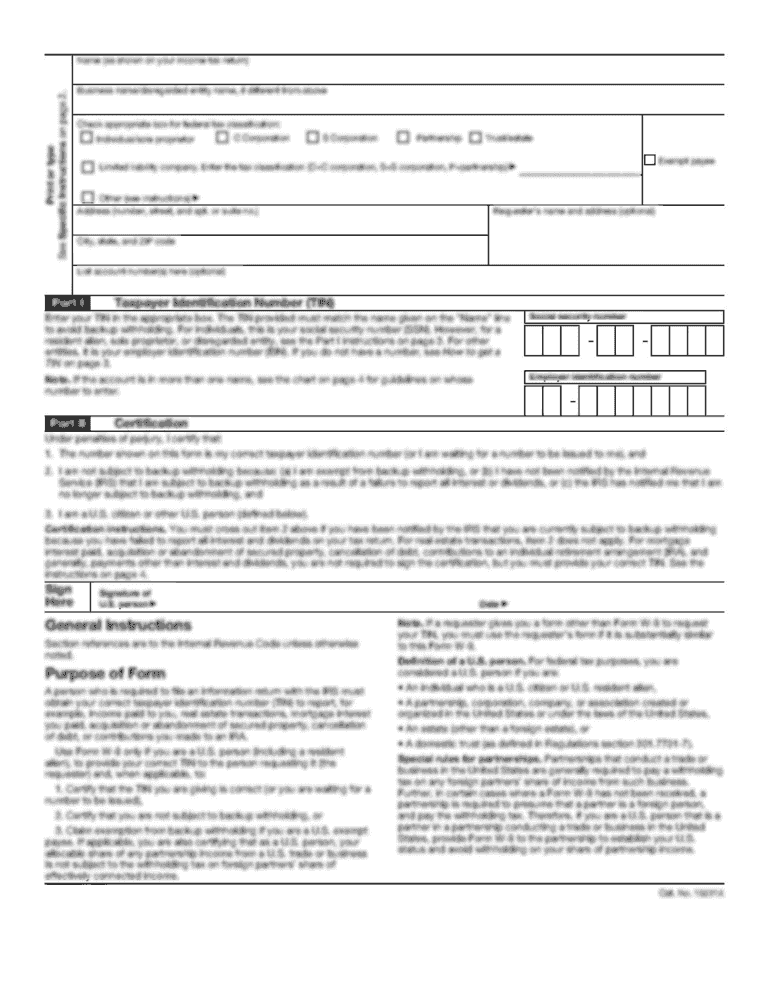

An independent contractor is a natural person business or corporation that provides goods or services to another entity under terms specified in a contract or within a verbal agreement unlike an employee an independent contractor does not work regularly for an employer but works as and when required during which time he or she may be subject to law of agency independent contractors are usually paid on a freelance basis contractors often work through a limited company or franchise which they themselves own or may work through an umbrella company in the United States any company or organization engaged in a trade or business that pays more than $600 to an independent contractor in one year is required to report this to the Internal Revenue Service as well as to the contractor using form 1099 MIS C this form is merely a report of the money paid independent contractors do not have income taxes withheld from their pay as regular employees do independent contractor versus employee in the United States the IRS the federal income tax purposes applies a right to control test which includes consideration of specific factors in the work relationship sometimes it is not a straightforward matter to determine who is an independent contractor and who should be classified as an employee to make a determination the IRS advises taxpayers to look at three aspects of the employment arrangement financial control behavioral control and relationship between the parties while some independent contractors may work for a number of different organizations throughout the year there are also many who retain independent contractor status even though they work for the same organization for the entire year generally speaking independent contractors retain control over their schedule and number of hours worked jobs excepted and performance of their job in addition they may have a major investment in equipment furnish all their own supplies provide their own insurance repairs and all other expenses related to their business they may also perform a special service that is not in the normal course of business of the employer this contrasts with a situation for regular employees who usually work at the schedule required by the employer and whose performance is directly supervised by the employer however many companies specify the contractor's schedule require purchase of vehicles from the company and prohibit work for other companies recently worker classification initiatives have been a top priority for the IRS the Department of Labor and state agencies in 2011 the IRS and the Department of Labor entered into a memorandum of understanding in an effort to jointly increase worker miss classification audits examples of occupations were independent contractor arrangements are typical advantages and disadvantages life as an independent contractor has both benefits and hindrances advantages since they are rarely tied to an employer they are free to set their own rules of business...

Fill fill in the blank contract : Try Risk Free

People Also Ask about simple independent contractor agreement pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your simple independent contractor agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.