Canada GST191 E 2013 free printable template

Show details

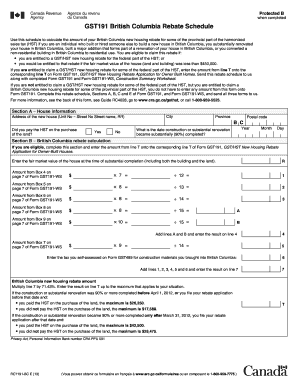

Protected B when completed GST/HST New Housing Rebate Application for Owner-Built Houses Use this form to calculate and claim your rebate if you are an individual who: built a new house; substantially

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada GST191 E

Edit your Canada GST191 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST191 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada GST191 E online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada GST191 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST191 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST191 E

How to fill out Canada GST191 E

01

Obtain the Canada GST191 E form from the Canada Revenue Agency website or via a local tax office.

02

Fill in your name and contact information at the top of the form.

03

Indicate your business number and the type of business you operate.

04

Specify the period for which you are filing the form.

05

Provide details on your sales and services including any exempt or zero-rated sales.

06

Complete the section related to input tax credits, if applicable.

07

Review all information for accuracy before submitting.

08

Submit the form to the appropriate tax office as instructed.

Who needs Canada GST191 E?

01

Individuals or businesses seeking a tax rebate or reduction related to GST/HST.

02

Businesses that have made exempt or zero-rated sales and want to claim tax credits.

03

Registered vendors who need to report their annual GST/HST amounts.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for HST rebate in Ontario?

To receive the GST/HST credit you have to be a resident of Canada for tax purposes, and at least 1 of the following applies, you: Are 19 years of age or older; Have (or previously had) a spouse or common-law partner; or. Are (or previously were) a parent and live (or previously lived) with your child.

How do I qualify for HST rebate in Ontario?

You may be entitled to claim the GST/HST new housing rebate if you: substantially renovated your existing house. converted a non-residential property into a house. built a major addition onto your existing house if, along with that addition, you also substancially renovated the existing house.

How do I claim my GST refund Canada?

To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

What is the HST rebate for small business in Ontario?

You can claim a rebate of 5/105 of the eligible expenses on which you paid the GST. The rebate amounts of the eligible expenses on which you paid the HST are: 13/113 for expenses on which you paid 13% HST. 15/115 for expenses on which you paid 15% HST.

What is the provincial new housing rebate for Prince Edward Island?

Depending on the efficiency of your new home, you could receive up to $5,000 in rebates. You will be eligible for two tiers of rebates depending on the efficiency standard you achieve. You may pursue certification through ENERGY STAR® or R2000, or alternatively, have your home rated through the EnerGuide Rating System.

How much is HST rebate in Ontario?

HST New Home Rebate An eligible new home buyer can claim a rebate of the PST & GST, calculated as follows: 75% of PST up to a maximum of $24,000 (reached at $424,850) 36% of GST if the price is <$350k up to a maximum of $6,300. Between $350k-$450k, a reduced sliding scale applies and above $450k, the rebate is $0.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada GST191 E?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Canada GST191 E in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit Canada GST191 E on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Canada GST191 E. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit Canada GST191 E on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Canada GST191 E from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Canada GST191 E?

Canada GST191 E is a form used by businesses in Canada to report and apply for a refund of goods and services tax (GST) or harmonized sales tax (HST) that has been paid on certain expenses.

Who is required to file Canada GST191 E?

Businesses that are registered for GST/HST and who have incurred expenses related to their commercial activities, which are subject to GST/HST, are required to file Canada GST191 E.

How to fill out Canada GST191 E?

To fill out Canada GST191 E, you need to provide details about your business, the amount of GST/HST paid, and the expenses for which you are claiming a refund. Follow the instructions on the form carefully and ensure that all relevant receipts and documentation are included.

What is the purpose of Canada GST191 E?

The purpose of Canada GST191 E is to allow businesses to claim refunds for the GST/HST they have paid on eligible expenses, thereby reducing their overall tax burden.

What information must be reported on Canada GST191 E?

The information that must be reported on Canada GST191 E includes your business identification, details of the expenses incurred, the amount of GST/HST paid, and any relevant receipts or supporting documentation.

Fill out your Canada GST191 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst191 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.