Get the free cash receipt journal pdf - adf

Get, Create, Make and Sign cash receipt journal pdf

How to edit cash receipt journal pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash receipt journal pdf

How to fill out cash payment journal template:

Who needs cash payment journal template:

Instructions and Help about cash receipt journal pdf

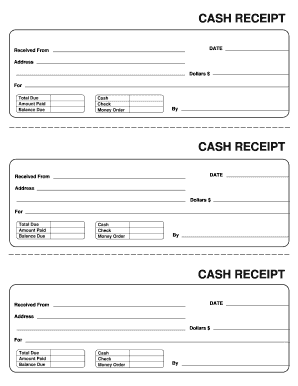

Welcome back right now we're going to look at how you journalize in the cash receipts journals and what I want you to remember is the cash receipts journal is used only when your company receives cash it doesn't matter what it's for if it receives cash it has to go in the cash receipts journal so your source documents for this journal most of the time is going to be a receipt, but sometimes you will have a cash register tape for your weekly cash sales so the first thing I'd like you to do is go to your documents and go to your F Drive where you saved your chapter 16 problems in that folder I want you to go to problem 16 5, and we're going to open that up and when you do, I want you to make sure that you're on the tab that says cash receipts journal at the bottom there is a sales journal, but we're not going to use that one at this time so what I want to do is direct your attention to the very top of the cash receipts journal the one thing that is always a given if you have cash receipts is that your cash in bank is going to be debited, so we do have a special column it says cash and Bank debited this column every time you use the cash receipts journal has to always always always have a number in it okay so for every transaction you have to debit cash and Bank if you're using the cash receipts journal so let's look at the titles across the top we have a date column again we have a document number which most of the time is going to be your receipt number if it's a tape number you'll use a capital T the account name now this is a little different from the sales journal because if you have a column that has an account name on it, you do not have to write it here, so we would have if we have a sale with its own account we would just put the person's name here how much the sale was how much the sales tax was that we charged them if we did charge the money and the total amount the account receivable owes us okay so in this particular case the account receivable is going to be paying so what I'd like you to do, and I will give you just a couple of minutes I want you to get your textbooks out, and I want you to turn to page 445 hit pause on the bottom of your screen until you have that done okay now that you have your textbook open what I want you to do is look at the very bottom on page 445 problem 16 5 says river's edge canoe and kayak uses special journals and accounts receivable subsidiary ledger for recording business transactions the accounts receivable subsidiary ledger accounts and certain general ledger accounts are included in your working papers that would be in Excel the current account balances are recorded in the accounts and if you click to your general ledger you can see that we've got balances in there for you already ok alright so turn the page and at the top of page 446 I want to emphasize that the instructions at the top in this chapter become very important because it tells you exactly what to do step by step so that you don't get...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cash receipt journal pdf?

Can I create an electronic signature for signing my cash receipt journal pdf in Gmail?

How do I fill out the cash receipt journal pdf form on my smartphone?

What is cash receipt journal pdf?

Who is required to file cash receipt journal pdf?

How to fill out cash receipt journal pdf?

What is the purpose of cash receipt journal pdf?

What information must be reported on cash receipt journal pdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.