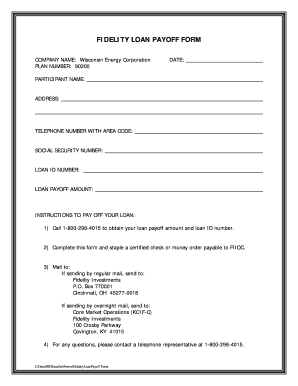

Get the free payoff letter template

Show details

Countrywide Home Loans, Inc. Payoff Department 400 Countrywide Way Simi Valley, CA 93065-6298 1-800-669-6607 Fax: 1-805-520-5459 PAYOFF DEMAND STATEMENT Date: April 6,2004, Statement Void After: April

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 10 day payoff letter form

Edit your payoff letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan payoff letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage payoff letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payoff statement template form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

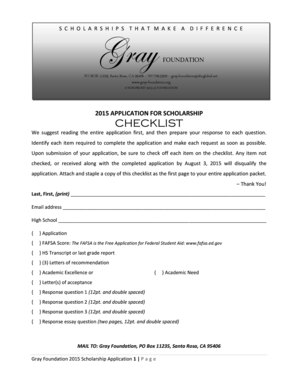

How to fill out loan payoff letter template form

How to fill out a payoff letter template:

01

Start by filling in your personal information, including your name, address, and contact information. This will help the recipient identify who the letter is from.

02

Next, include the recipient's information, such as their name, address, and contact information. Make sure to double-check the accuracy of this information to ensure the letter reaches the intended recipient.

03

Include the date at the top of the letter to indicate when it was written. This can be beneficial for record-keeping purposes.

04

Begin the letter by addressing the recipient. Use a formal salutation, such as "Dear [Recipient's Name]". It's important to maintain a professional tone throughout the letter.

05

In the body of the letter, clearly state your intent to pay off a specific debt or loan. Provide details about the loan, including the loan number, amount owed, and any relevant account information. This will help the recipient locate your loan in their system.

06

Clearly articulate your request for a payoff amount. This is the total sum needed to fully satisfy the debt or loan. You can request this information from the recipient or provide your calculated amount if you have the necessary information.

07

Specify your preferred method of payment, such as a check, wire transfer, or online payment. If there are any specific instructions or deadlines for submitting the payment, be sure to communicate them clearly in the letter.

08

In closing, express your gratitude for their assistance and provide your contact information for any further questions or correspondence. Use a formal closing, such as "Sincerely" or "Best regards".

Who needs a payoff letter template:

01

Borrowers who wish to pay off their debts or loans in full.

02

Individuals or businesses who want to have a written record of their intent to pay off a debt or loan.

03

Financial institutions or lenders who require borrowers to provide a written request for a payoff amount.

Fill

private mortgage payoff letter template word

: Try Risk Free

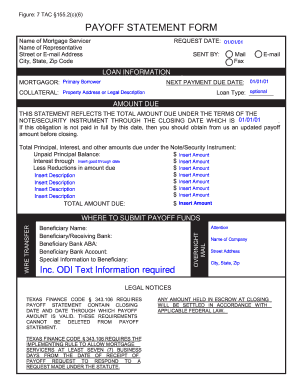

What is payoff letter?

This is a standard form of payoff letter. A payoff letter is typically requested by a borrower from its lender in connection with the repayment of the borrower's outstanding loans to the lender under a loan agreement and termination of the loan agreement and related security and guaranties.

People Also Ask about mortgage payoff letter template

What is a simple mortgage payoff letter?

A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. The payoff amount isn't just your outstanding balance; it also encompasses any interest you owe and potential fees your lender might charge.

What is an official payoff letter?

A payoff letter is typically requested by a borrower from its lender in connection with the repayment of the borrower's outstanding loans to the lender under a loan agreement and termination of the loan agreement and related security and guaranties.

Where can I find my 10-day payoff amount?

If you have a federal loan, you can find your 10-day payoff amount in the Loan Payoff Calculations section. Choose “Tools & Requests,” then “Interest Accrual Estimator.” Add this accrual estimate to your current loan balance, and this is your 10-day payoff amount.

Where can I get a 10-day payoff letter?

How to get your 10-day payoff letter. You'll need to request a 10-day payoff letter from your current loan servicer, which you may be able to do online. Not all lenders offer an online request option, however, so you may need to call or email your loan servicer directly to get this information.

How do I write a payoff letter?

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

How do I request a payoff letter?

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage payoff template directly from Gmail?

what is a 10 day payoff letter and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in loan payoff letter example?

The editing procedure is simple with pdfFiller. Open your mortgage payoff statement example in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in payoff demand letter without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your loan payoff statement, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is payoff letter template?

A payoff letter template is a standardized document that outlines the total amount required to pay off a loan or mortgage in full, including any interest or fees that may apply.

Who is required to file payoff letter template?

Typically, the borrower or their representative is required to request and file a payoff letter template with the lender to obtain the final payoff amount.

How to fill out payoff letter template?

To fill out a payoff letter template, include the borrower's information, loan details, request the total payoff amount, and specify the date by which the payment should be made. Always check if any additional information is needed by the lender.

What is the purpose of payoff letter template?

The purpose of a payoff letter template is to provide a clear and formal request for the total amount needed to settle a loan, and to ensure that both the borrower and lender have a mutual understanding of the obligation.

What information must be reported on payoff letter template?

The payoff letter template must report the borrower's name, account number, loan type, total payoff amount, interest rate, payment due date, and any applicable fees or charges.

Fill out your payoff letter template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payoff Demand Template is not the form you're looking for?Search for another form here.

Keywords relevant to what is a payoff letter

Related to sample payoff letter

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.