IE IT38 2007-2025 free printable template

Show details

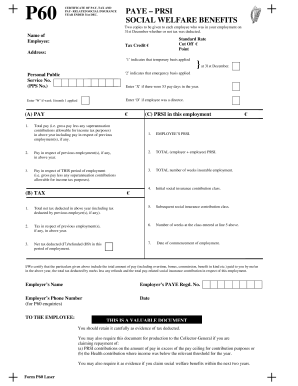

Revenue. ie Edition 2007 Agent s code Agent s ref. no Agent s tel. no. Form IT38 PART 5 DETAILS OF BENEFIT Market value at Particulars of the property comprising the gift/inheritance at the valuation date PANEL A Agricultural property include only property to which agricultural relief applies Note Page 5 Appendix A must also be completed Total A Business property include only relevant business property and exclude any business assets which qualify for agricultural relief All other property...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs gov it38

Edit your irs gov it38 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs gov it38 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs gov it38 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs gov it38. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs gov it38

How to fill out IE IT38

01

Gather your personal information including name, address, and PPS number.

02

Collect your income information, including any additional sources of income.

03

Complete the sections regarding your income and expenses accurately.

04

Make sure to calculate any applicable tax credits that you are entitled to.

05

Double-check the form for any errors or missing information.

06

Submit the completed IE IT38 form to the appropriate tax office.

Who needs IE IT38?

01

Individuals who have income from employment, self-employment, or other sources.

02

Those who are claiming tax credits or reliefs.

03

People who are subject to a tax return requirement by the Revenue Commissioners.

Fill

form

: Try Risk Free

People Also Ask about

Does inheritance need to be declared on tax return?

Regarding your question, “Is inheritance taxable income?” Generally, no, you usually don't include your inheritance in your taxable income. However, if the inheritance is considered income in respect of a decedent, you'll be subject to some taxes.

What form do I report inheritance to IRS?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

How do I show inheritance on my tax return?

If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Example: You inherit and deposit cash that earns interest income. Include only the interest earned in your gross income, not the inhereted cash.

How much money can you inherit without having to pay taxes on it?

ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.

What is an IT38?

If you receive a gift or inheritance, you may have a requirement to file Form IT38 and pay Capital Acquisitions Tax (CAT). CAT applies to gifts and inheritances and are taxable in Ireland where any one of the following three conditions exists: the disponer is resident or ordinarily resident in Ireland for tax purposes.

What tax form is used for inheritance?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs gov it38 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your irs gov it38 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit irs gov it38 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing irs gov it38 right away.

How do I fill out irs gov it38 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign irs gov it38 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IE IT38?

IE IT38 is a tax form used in Ireland for reporting certain income and calculating the appropriate tax liabilities for individuals.

Who is required to file IE IT38?

Individuals who have income from sources other than employment or pension, such as self-employed individuals, may be required to file IE IT38.

How to fill out IE IT38?

To fill out IE IT38, individuals must provide their personal details, report income earned from various sources, and calculate taxes owed based on the provided income figures.

What is the purpose of IE IT38?

The purpose of IE IT38 is to enable individuals to report their income accurately and ensure they pay the correct amount of tax due to the revenue authorities.

What information must be reported on IE IT38?

IE IT38 requires reporting personal identification details, sources of income, tax credits, allowable deductions, and any other relevant financial information.

Fill out your irs gov it38 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Gov it38 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.