Get the free form 4562 2010

Show details

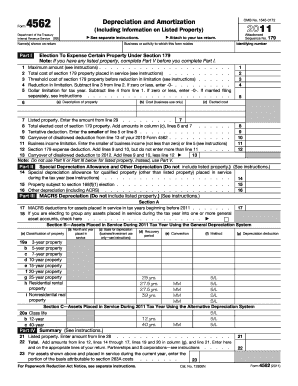

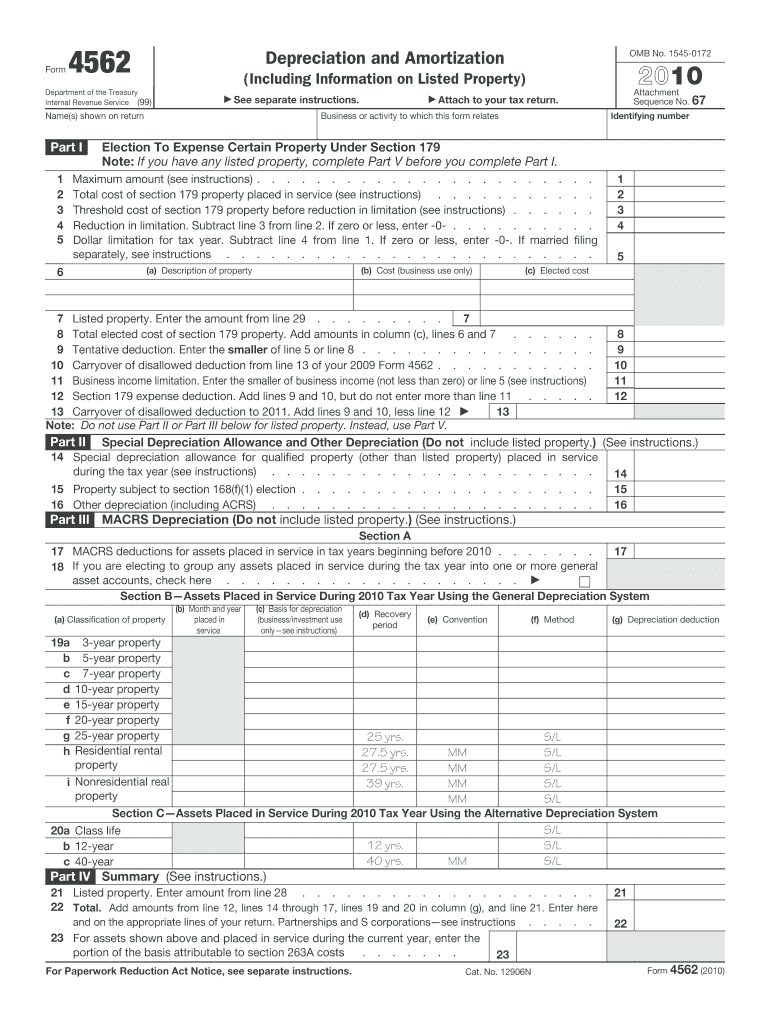

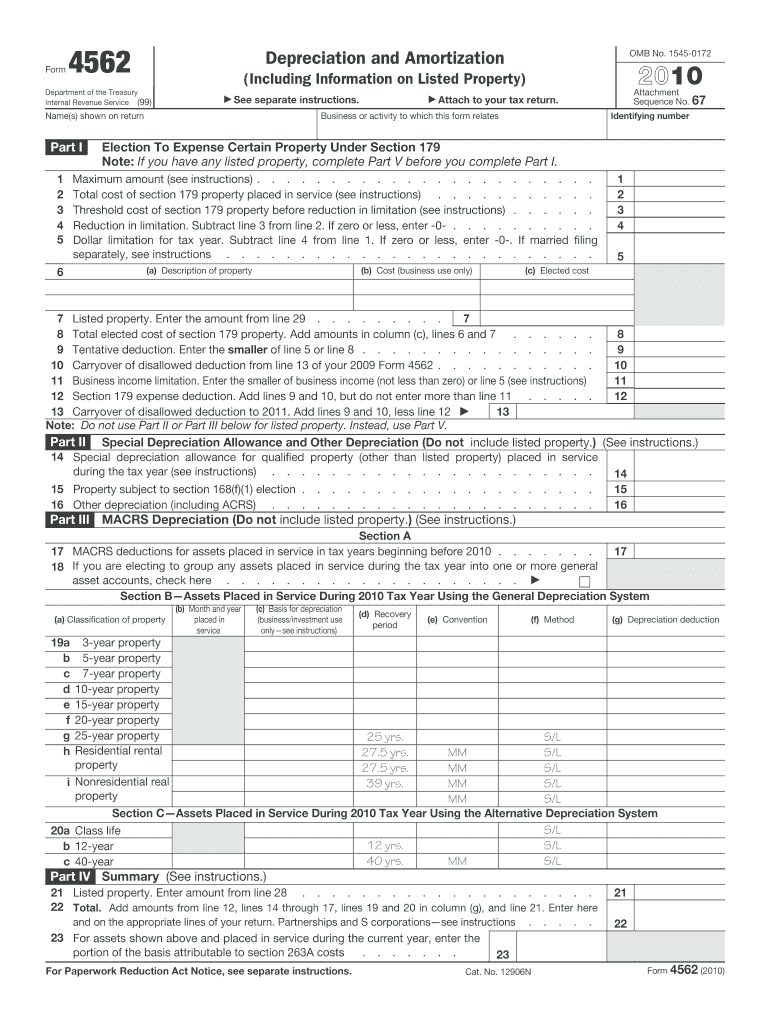

Cat. No. 12906N Form 4562 2010 Page 2 entertainment recreation or amusement. Part V Note For any vehicle for which you are using the standard mileage rate or deducting lease expense complete only 24a 24b columns a through c of Section A all of Section B and Section C if applicable.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 4562 2010

Edit your form 4562 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4562 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4562 2010 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4562 2010. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 4562 2010

How to fill out form 4562 2010?

01

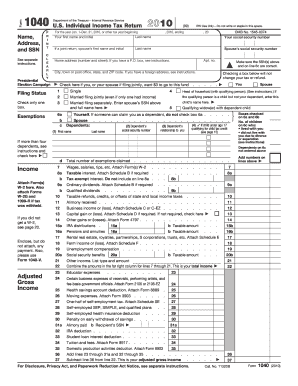

Start by entering your name, social security number, and address in the designated spaces at the top of the form.

02

Provide the necessary information about the property for which you are claiming depreciation or amortization. This includes the description, date placed in service, and cost or basis of the property.

03

Calculate the depreciation or amortization expense for each property using the appropriate method, such as straight-line or accelerated.

04

Enter any Section 179 expense deduction if applicable.

05

If you have any listed property, such as a car used for business purposes, provide the required details such as the date placed in service, business-use percentage, and total mileage.

06

Include any special depreciation allowances or bonus depreciation if applicable.

07

Summarize the totals in the appropriate sections, including the total depreciation or amortization expenses.

08

Attach form 4562 to your tax return and retain a copy for your records.

Who needs form 4562 2010?

01

Business owners who have acquired property for business use and are claiming depreciation or amortization expenses on their tax returns.

02

Individuals who have listed property, such as cars used for business purposes, and need to report the relevant details for tax purposes.

03

Individuals or businesses who qualify for special depreciation allowances or bonus depreciation and need to include these deductions on their tax returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 4562 2010 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 4562 2010 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit form 4562 2010 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 4562 2010 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the form 4562 2010 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 4562 2010 in seconds.

What is form 4562?

Form 4562 is an Internal Revenue Service (IRS) form used to claim depreciation and amortization on assets for tax purposes.

Who is required to file form 4562?

Taxpayers who claim depreciation on property placed in service during the year, as well as those who claim a Section 179 deduction, are required to file Form 4562.

How to fill out form 4562?

To fill out Form 4562, taxpayers need to provide information about the property being depreciated or amortized, including the date placed in service, the cost basis, and the method of depreciation. Detailed instructions from the IRS should be followed for accurate completion.

What is the purpose of form 4562?

The purpose of Form 4562 is to report depreciation and amortization expenses to help determine taxable income and to comply with IRS regulations.

What information must be reported on form 4562?

Form 4562 requires reporting such information as the description of the property, date placed in service, cost or other basis, method of depreciation used, and any deductions claimed under Section 179.

Fill out your form 4562 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4562 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.