Edward Jones 1099-R 2013-2026 free printable template

Show details

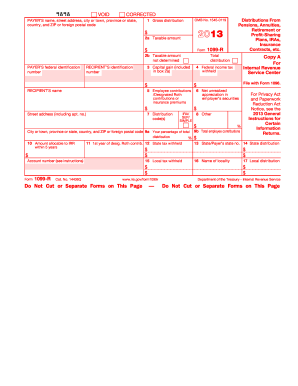

Form 1099-R reports distributions and excess contributions you withdrew from your self-directed retirement account, as well as conversions and recharacterizations completed during 2013. The information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign edward jones transfer form

Edit your edward jones rollover form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your edward jones ira withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing edward jones ira distribution form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Edward Jones 1099-R. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Edward Jones 1099-R

How to fill out Edward Jones 1099-R

01

Obtain your Edward Jones 1099-R form from your online account or by request.

02

Review the form for your personal information to ensure it is accurate.

03

Identify the distribution amount reported in Box 1 of the 1099-R.

04

Check for any Federal Income Tax Withheld in Box 4, if applicable.

05

Record any special tax treatment noted in Box 2a.

06

Use the information from the form while filing your federal and state tax returns, especially in the income section.

07

Consider consulting a tax professional if you have questions about specific entries or implications.

Who needs Edward Jones 1099-R?

01

Any individual who has received a distribution from their retirement account managed by Edward Jones.

02

Individuals who have rolled over their retirement funds to another account.

03

Taxpayers who need to report retirement income on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Can I transfer Edward Jones to Fidelity?

But you could also do it yourself, simply by transferring your account to Fidelity or Vanguard which have lower fees. You'd have to make the investment decisions on your own, though. Your current broker might charge you commissions to liquidate the account and transfer the cash to a new company.

How do I transfer my IRA to another account?

Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

Can I transfer an IRA myself?

To roll over your 401(k) or do an IRA Transfer to a self-directed IRA, you'll need a copy of your ID to open an account and a recent statement for the account you are moving. It's important to open the self-directed IRA before moving the funds.

What is the phone number for Edward Jones IRA transfer?

Errors or Questions about Your Electronic Transfers For inquiries, please call our Client Relations department at (800) 441-2357.

Can I pull money out of my Edward Jones account?

Depending on your plan, there are two types of in-service withdrawals that may be offered: hardship withdrawals and non-hardship withdrawals. To qualify for a hardship withdrawal, you must have an immediate and heavy financial need, and the amount of the withdrawal must be necessary to satisfy the financial need.

How do I transfer from Edward Jones?

Simply call your financial advisor or transfer funds online through Online Access, and the transaction usually settles in one business day. Fees may apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Edward Jones 1099-R for eSignature?

Edward Jones 1099-R is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out Edward Jones 1099-R using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Edward Jones 1099-R and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit Edward Jones 1099-R on an Android device?

You can make any changes to PDF files, such as Edward Jones 1099-R, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Edward Jones 1099-R?

The Edward Jones 1099-R is a tax form issued to report distributions from retirement accounts such as IRAs, pensions, or other qualified plans. It provides information that taxpayers need to report any retirement income they received during the tax year.

Who is required to file Edward Jones 1099-R?

Edward Jones is required to file 1099-R forms for clients who have taken distributions from their retirement accounts. Additionally, clients who received a distribution must report it on their tax returns.

How to fill out Edward Jones 1099-R?

To fill out the Edward Jones 1099-R form, you typically need to provide information such as your name, Social Security number, the amount of the distribution, and the tax withheld, if any. Ensure to follow the instructions provided with the form carefully.

What is the purpose of Edward Jones 1099-R?

The purpose of the Edward Jones 1099-R is to provide both the taxpayer and the IRS with information about retirement distributions. It helps taxpayers report the correct income and understand their tax liabilities related to retirement income.

What information must be reported on Edward Jones 1099-R?

The information reported on the Edward Jones 1099-R includes the recipient's name, address, and Social Security number; the payer's name and identification number; the gross distribution amount; the taxable amount; and any federal income tax withheld.

Fill out your Edward Jones 1099-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Edward Jones 1099-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.