NY Life Insurance Company 21131-M 2012-2025 free printable template

Get, Create, Make and Sign new york life beneficiary

How to edit new york life beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york life beneficiary

How to fill out NY Life Insurance Company 21131-M

Who needs NY Life Insurance Company 21131-M?

Instructions and Help about new york life beneficiary

Hi my name is Mark, and I'm doing a job review on New York Life Northwestern Mutual Omaha mutual and mass mutual I've worked for one of these companies as an insurance salesman and financial representative for a couple of years they all work very similarly I've had a lot of friends in the industry move around, and they all say that the companies have the same business structure and very similar pay scales, so I'm going to do a little review here and kind of help people out who maybe are getting a job offer or have gotten the job offer and I decided whether to take it, so I've been at my company for two years and a lot of people might say that that's not very long but actually that's way above average for this industry I joined you know back when I joined I took a boot camp to train me with about 30 other people, and I'm the only person my company that's left from that boot camp so that kind of shows you a little about how above average I am right now in my company as far as staying the length staying for the term then you know of course right before that I did my interview process and my interview process I think was a three-step process with after I submitted my application and that was done online, and it was for a position for financial advisor actually and a lot of these companies will do that they'll have applicant they'll have job positions open for financial advisor even though you're not going to be a financial advisor for probably two or three years just because you don't have the experience, and you don't have the tests done and a lot of these companies actually have restrictions on how fast you can take those tests and become a full-fledged financial advisor, but they get a lot more applications and if they say financial advisor then if they do is they say insurance salesman nobody's going to apply to a job that says insurance salesman so just I guess be aware of that now I will say that these companies are not multi-level marketing companies though there are a lot of companies out there that are multi-level marketing companies in the insurance industry and if you see one of these multi-level marketing companies just run as fast as you can in the other direction the main difference is recruiting in my company it's my manager's job to do the recruiting, and he has to your know build up his team and keep that team at a certain level or else you know his paycheck decreases my job is to sell life insurance and other financial excuse me other financial products and a multi-level marketing insurance company they tell you to sell the insurance but every time every person that they talk to they're also trying to get them to join the company and sell for them because you get a lot more money for building up that team than you do for selling the actual product it's its pretty close to a pyramid scheme just don't get involved if you have experience in the multi-level marketing companies you'll, you owe a degree that people just don't make money...

People Also Ask about

What is a life beneficiary form?

How to fill out a beneficiary form for life insurance?

What is the purpose of a beneficiary form?

How do I fill out a life insurance beneficiary form?

What form do I need to name a beneficiary?

Do you need to fill out a beneficiary form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new york life beneficiary without leaving Google Drive?

Can I create an electronic signature for the new york life beneficiary in Chrome?

How can I fill out new york life beneficiary on an iOS device?

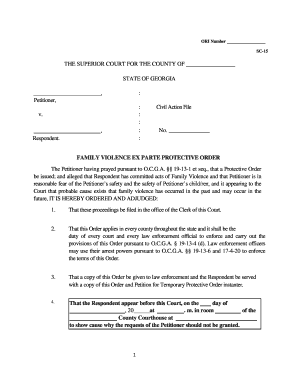

What is NY Life Insurance Company 21131-M?

Who is required to file NY Life Insurance Company 21131-M?

How to fill out NY Life Insurance Company 21131-M?

What is the purpose of NY Life Insurance Company 21131-M?

What information must be reported on NY Life Insurance Company 21131-M?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.