Get the free Natural Gas Property Tax Return - Form 62A384-G - Kentucky ... - revenue ky

Show details

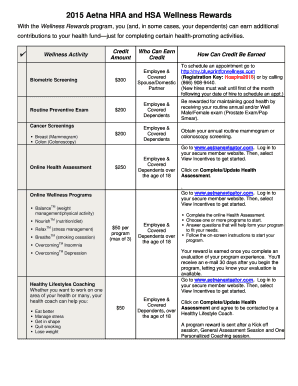

62A384-G 1-10 File with Department of Revenue Station 33 501 High Street Frankfort Kentucky 40620 502 564-8334 NATURAL GAS PROPERTY TAX RETURN Commonwealth of Kentucky DEPARTMENT OF REVENUE Property Assessed January 1 Name Number and Street City Social Security Number State ZIP Code Telephone Number Federal Identi cation Number INSTRUCTIONS Under Kentucky law KRS 132.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign natural gas property tax

Edit your natural gas property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your natural gas property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing natural gas property tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit natural gas property tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out natural gas property tax

How to Fill Out Natural Gas Property Tax:

01

Gather the necessary documents: Before you start filling out the natural gas property tax forms, make sure you have all the required documents handy. This may include your property deed, lease agreements, and any other relevant paperwork.

02

Identify your property details: Begin by providing accurate details about the natural gas property you own. This may include the address, legal property description, and the name of the owner or owners.

03

Determine the taxable value: Calculate the taxable value of your natural gas property for the specific tax year. This value is often determined by the local tax authority and may be based on factors such as production, reserves, or market value.

04

Provide production and revenue information: Fill out the sections that require you to provide details about your natural gas production and associated revenue. This may involve reporting the total volume of gas produced, sales revenue, and any deductions or exemptions that apply.

05

Deduct allowable expenses: If there are any allowable expenses that can be deducted from your natural gas property tax liability, ensure you include them in the appropriate sections. These expenses may include operating costs, maintenance expenses, or property taxes paid to other jurisdictions.

06

Complete any additional forms or schedules: Depending on your jurisdiction, there may be additional forms or schedules that need to be completed alongside the main property tax form. Make sure to fill out these forms accurately and attach them as required.

07

Review and submit the form: Before submitting the natural gas property tax form, carefully review all the information you have provided. Ensure there are no errors or omissions that could lead to complications later on. Once you are confident that everything is accurate, submit the form to the relevant tax authority.

Who needs natural gas property tax?

01

Natural gas property owners: Natural gas property tax applies to individuals or entities that own land or resources where natural gas is extracted or produced. These owners are responsible for reporting their production, revenue, and other relevant information to calculate the property tax liability.

02

Energy companies and operators: If you are an energy company or operator involved in the extraction or production of natural gas, you may be required to pay property tax on the gas properties you operate. This ensures that the tax burden is shared by both the landowners and the companies benefiting from natural gas production.

03

Local government and tax authorities: Natural gas property tax is essential for local governments and tax authorities to generate revenue. The tax collected helps fund various public services and infrastructure projects in the area where the natural gas properties are located.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is natural gas property tax?

Natural gas property tax is a tax imposed on the value of natural gas properties.

Who is required to file natural gas property tax?

Natural gas companies are required to file natural gas property tax.

How to fill out natural gas property tax?

To fill out natural gas property tax, companies need to report the value of their natural gas properties and pay the relevant tax.

What is the purpose of natural gas property tax?

The purpose of natural gas property tax is to generate revenue for the government based on the value of natural gas properties.

What information must be reported on natural gas property tax?

Companies must report the value of their natural gas properties and any other relevant financial information.

How can I modify natural gas property tax without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including natural gas property tax, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find natural gas property tax?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific natural gas property tax and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the natural gas property tax in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your natural gas property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Natural Gas Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.