UK CISOL1 2008-2025 free printable template

Show details

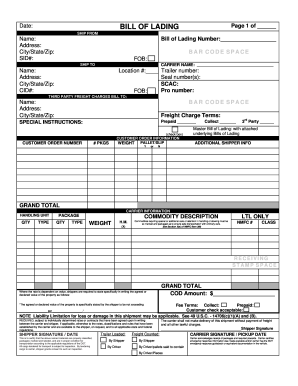

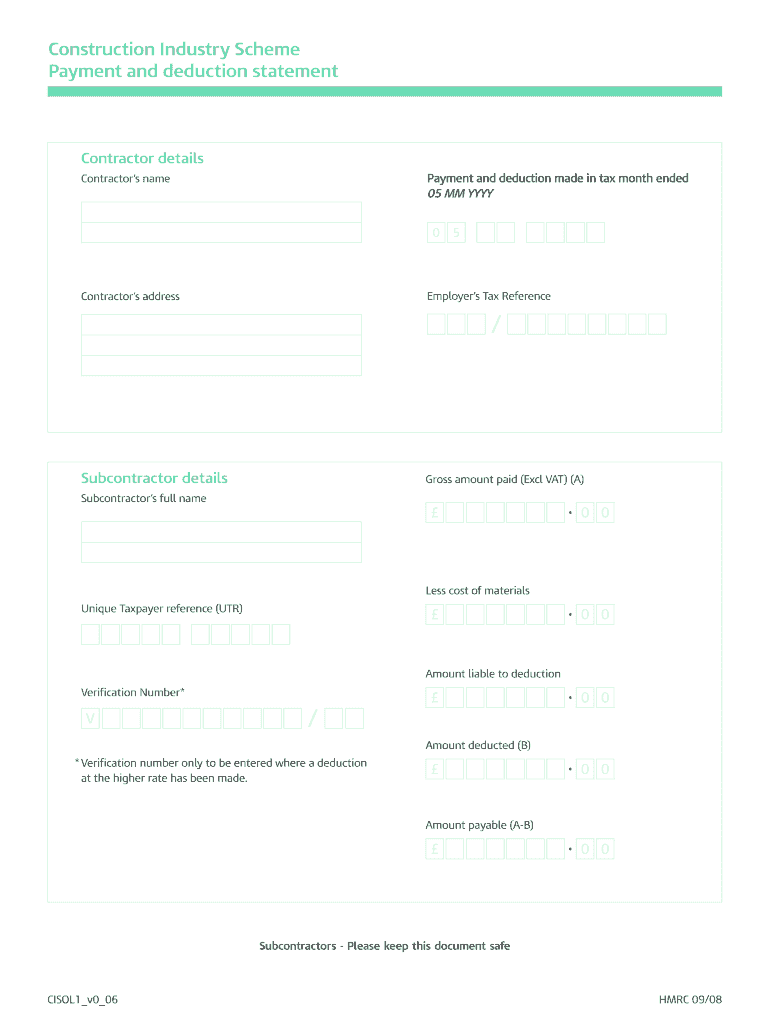

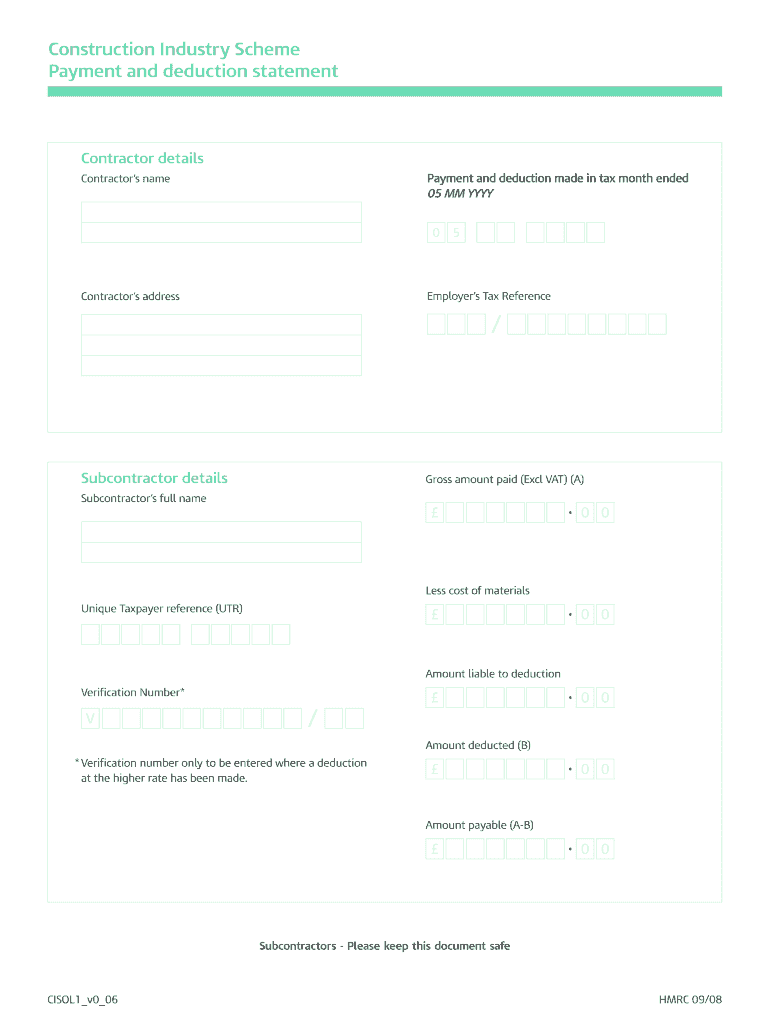

Construction Industry Scheme Payment and deduction statement Contractor details Payment and deduction made in tax month ended 05 MM YYY Contractor s name 0 5 Employers s Tax Reference Contractor s

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cis deduction statement form

Edit your cis deduction statement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cis deduction statement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cis deduction statement form online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cis deduction statement form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cis deduction statement form

How to fill out UK CISOL1

01

Obtain a copy of the UK CISOL1 form from the relevant authority or website.

02

Begin filling out the personal details section, including your name, address, and contact information.

03

Provide information about your employment status and the nature of your work.

04

Enter your National Insurance number if applicable.

05

Fill in any relevant financial information as required by the form.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form as per the instructions provided.

Who needs UK CISOL1?

01

Individuals working in the UK who need to register for tax purposes.

02

Employers who hire workers that are subject to the UK tax system.

03

Self-employed individuals looking to declare their income.

04

Contractors and subcontractors in the construction industry.

Video instructions and help with filling out and completing cis deduction statement

Instructions and Help about cis deduction statement form

Fill

form

: Try Risk Free

What is payment deduction statement?

When a contractor makes a CIS deduction they must provide the subcontractor with a CIS payment and deduction statement. This is the written evidence which the subcontractor can use to prove any tax deductions with HMRC.

People Also Ask about

What is a CIS statement?

CIS statements are receipts or written proofs of the tax deductions that contractors subtract from their subcontractors' payments, given to subcontractors within 14 days at every conclusion of the tax month.

What should be on a CIS invoice?

CIS invoices include the same information as VAT invoices, but also require a CIS deduction stated on the invoice. The amount is deducted from the subcontractor's fee and paid to HMRC for tax purposes. You may need to apply the domestic reverse charge to your CIS invoice after March 1st 2021.

What is a CIS deduction?

Under the Construction Industry Scheme ( CIS ), contractors deduct money from a subcontractor's payments and pass it to HM Revenue and Customs ( HMRC ). The deductions count as advance payments towards the subcontractor's tax and National Insurance. Contractors must register for the scheme.

How do you write a CIS statement?

Also known as a CIS payment and deduction statement, it'll include a breakdown of the following: Contractor's details. Subcontractor's details. Subcontractor's Unique Taxpayer Reference (UTR) Verification number (for CIS deductions based on the higher tax rate) Gross pay. CIS tax deduction amount. Business materials.

How do I send a CIS statement?

Go to the Reports tab and find the CIS Contractor option where you can see the monthly return, online filing, and statements. Fill out the required information and you can then easily send the statements. Whilst for subcontractors, it is your right to receive CIS statements from your contractors.

What reference to use when paying CIS?

How is tax paid under the Construction Industry Scheme (CIS)? Under the CIS, contractors are required to check whether workers are 'registered' with HMRC. In order for the contractor to do this, they will need your Unique Taxpayer Reference (UTR) and National Insurance number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cis deduction statement form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your cis deduction statement form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the cis deduction statement form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your cis deduction statement form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the cis deduction statement form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign cis deduction statement form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is UK CISOL1?

UK CISOL1 is a form used by UK companies to report the income and expenses associated with construction projects for tax purposes.

Who is required to file UK CISOL1?

Companies involved in construction operations that fall under the Construction Industry Scheme (CIS) are required to file UK CISOL1.

How to fill out UK CISOL1?

To fill out UK CISOL1, companies must provide details of their business, project types, income, and allowable expenses as per the guidelines set by HM Revenue and Customs.

What is the purpose of UK CISOL1?

The purpose of UK CISOL1 is to ensure compliance with tax regulations related to construction operations and to provide the government with accurate information for tax assessment.

What information must be reported on UK CISOL1?

UK CISOL1 must report information including the company’s details, project descriptions, income generated, costs incurred, and any deductions or tax withheld.

Fill out your cis deduction statement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cis Deduction Statement Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.