Get the free texas franchise tax no tax due information report - window state tx

Show details

This document is used to report that a business entity qualifies for a no tax due status under the Texas Franchise Tax guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas franchise tax no

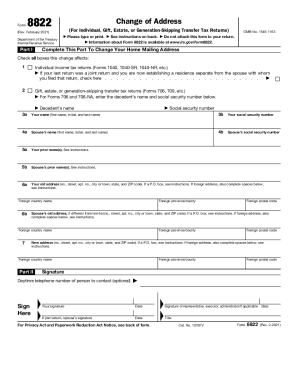

Edit your texas franchise tax no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas franchise tax no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas franchise tax no online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

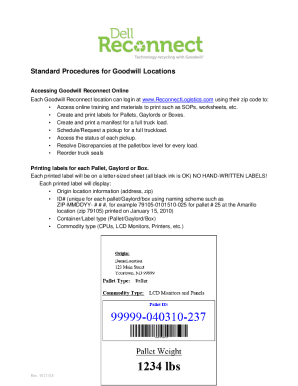

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas franchise tax no. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas franchise tax no

To fill out 05 163, follow these points:

01

Start by gathering all the necessary information and documents required for completing the form.

02

Begin filling out the form by providing the requested personal information, such as your name, address, and contact details.

03

Proceed to the specific sections of the form and carefully input the required details according to the instructions provided.

04

Double-check all the entries made to ensure accuracy and completeness.

05

Once you have filled out all the necessary sections, review the form one final time to ensure everything is filled out correctly.

06

Sign and date the form, if required.

07

Submit the completed form to the appropriate recipient or authority.

05 163 is typically needed by individuals or organizations that require the submission of specific information or data, which the form 05 163 is designed to capture. The exact need for this form may vary depending on the specific context or purpose, such as tax filing, employment applications, or record-keeping requirements. It is important to understand the specific requirement or request that necessitates the completion of form 05 163.

Fill

form

: Try Risk Free

People Also Ask about

How much do you have to make to pay Texas franchise tax?

Key Takeaways. In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax. The maximum franchise tax in Texas is 0.75%.

What is the no tax due threshold for Texas franchise in 2023?

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the

What is the Texas franchise no tax due threshold?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

What is the Texas franchise tax no tax due threshold?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,000,000Tax Rate (retail or wholesale)0.5%Tax Rate (other than retail or wholesale)1.0%Compensation Deduction Limit$320,0002 more rows

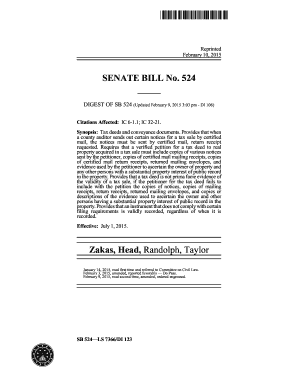

What is Texas Form 05 163?

Form 05-163 “No Tax Due Report” generates automatically if the following occurs: Taxpayer is a passive entity. Taxpayer is a newly established Texas Veteran Owned Business (must be pre-qualified). Taxpayer is a Real Estate Investment Trust that meets the qualifications.

What is Texas Form 05 167?

Form 05-167 - Texas Franchise Tax Ownership Information Report — The Ownership Information Report (OIR) is to be filed for each taxable entity other than a legally formed corporation, limited liability company, limited partnership, professional association, or financial institution.

Can I file no tax due franchise tax in Texas?

If annualized total revenue is less than the no-tax-due threshold amount, then the taxable entity files Form 05-163, Texas Franchise Tax No Tax Due Report (PDF). If the tax due is less than $1,000, but annualized total revenue is greater than the no-tax-due threshold amount, then a No Tax Due Report cannot be filed.

How do I reinstate a forfeited LLC in Texas?

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb),

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit texas franchise tax no in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your texas franchise tax no, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the texas franchise tax no electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your texas franchise tax no in minutes.

How do I complete texas franchise tax no on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your texas franchise tax no. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is no tax due information?

No tax due information refers to a declaration or report submitted by individuals or entities confirming that they do not owe any taxes for a specified period.

Who is required to file no tax due information?

Typically, individuals or businesses that have no taxable income or tax liability during a reporting period are required to file no tax due information.

How to fill out no tax due information?

To fill out no tax due information, you must complete the designated form provided by the tax authority, providing your identification details and confirming that you have no tax due.

What is the purpose of no tax due information?

The purpose of no tax due information is to inform the tax authority that an individual or entity has no tax liability, ensuring compliance and maintaining accurate tax records.

What information must be reported on no tax due information?

Information that must be reported includes the taxpayer's name, contact details, tax identification number, and a statement confirming no tax liability exists for the reporting period.

Fill out your texas franchise tax no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Franchise Tax No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.