Canada T2202A 2013 free printable template

Show details

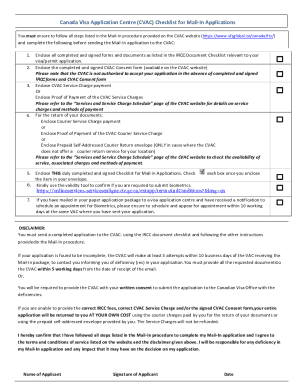

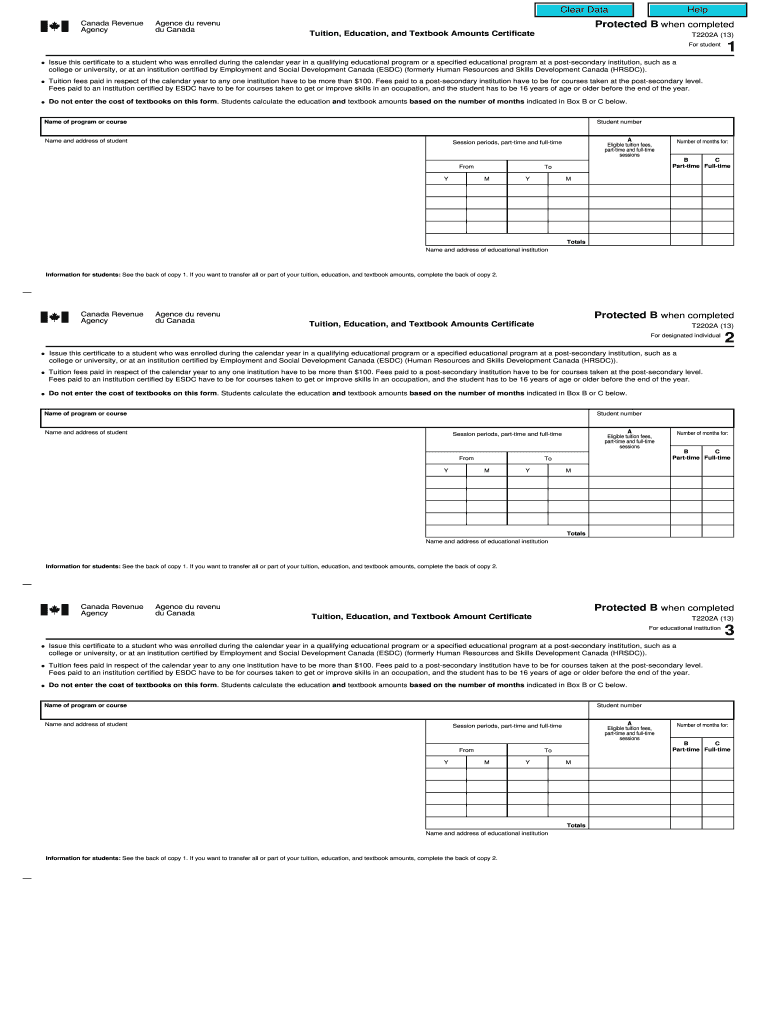

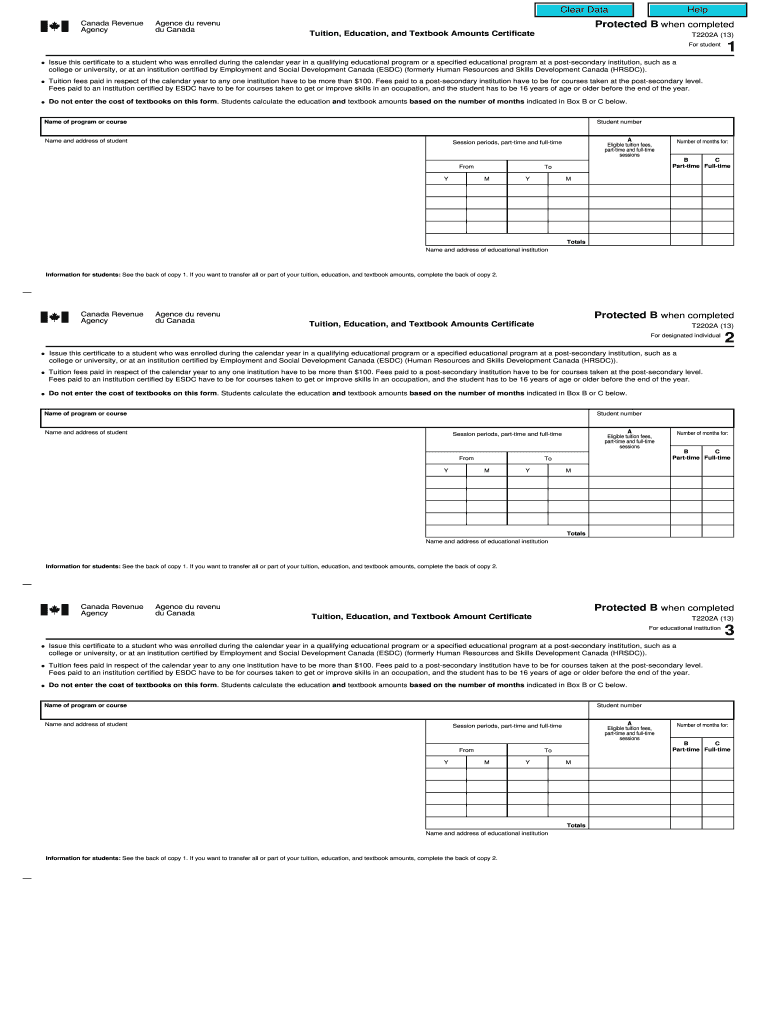

Clear Data Help Protected B when completed Tuition, Education, and Textbook Amounts Certificate T2202A (13) For student Tuition fees paid in respect of the calendar year to any one institution have

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2202A

Edit your Canada T2202A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2202A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T2202A online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T2202A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2202A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2202A

How to fill out Canada T2202A

01

Obtain the T2202A form from your educational institution or download it from the Canada Revenue Agency (CRA) website.

02

Fill in your personal information, including your name, address, and social insurance number (SIN).

03

Ensure you enter the correct tax year that you are claiming for.

04

Indicate the total number of months you were a qualifying student in that tax year.

05

Record the amount of tuition fees paid in the appropriate section. This includes eligible tuition amounts for courses taken.

06

Double-check your entries for accuracy and completeness before submission.

07

Submit the completed T2202A form along with your income tax return to the CRA.

Who needs Canada T2202A?

01

Students who have paid qualifying tuition fees to eligible educational institutions in Canada need the T2202A form to claim tuition tax credits.

02

Anyone who is filing their income tax return and has been enrolled in post-secondary education during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a T2202 form from Seneca?

Information Log in to Student Home. Select Financial Account. Select Account Services, then select T2202 Tax Receipt. Select the magnifying glass icon, then select the year you would like to download the receipt for. Select View/Print T2202 Tax Slip.

How to download T2202 from Seneca College?

Information Log in to Student Home. Select Financial Account. Select Account Services, then select T2202 Tax Receipt. Select the magnifying glass icon, then select the year you would like to download the receipt for. Select View/Print T2202 Tax Slip.

Who is eligible for the Canada training credit?

To be eligible, you need to be a worker: with at least $10,000 in earnings for work (including maternity or parental leave benefits) with an income below about $150,000. between the ages of 25 and 64.

What is a T2202 tax form in Canada?

The T2202 - Tuition and Enrolment Certificate and Summary form, is an official statement for income tax purposes. It is issued to all students who have paid tuition and fees for qualifying courses that are eligible for a claim on their income tax return.

How to download Seneca College fees receipt?

Bring your nine-digit student ID number. For your records, be sure to have the teller stamp your invoice, or retain a copy of the transaction slip. Download the Seneca Mobile app from the Google Play or iTunes app stores.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada T2202A from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including Canada T2202A, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get Canada T2202A?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific Canada T2202A and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute Canada T2202A online?

pdfFiller has made it easy to fill out and sign Canada T2202A. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is Canada T2202A?

Canada T2202A, also known as the Tuition and Enrolment Certificate, is a tax form issued by Canadian post-secondary educational institutions. It certifies that a student has paid tuition fees and indicates the number of months of enrolment.

Who is required to file Canada T2202A?

Students who have paid tuition fees for post-secondary education in Canada and wish to claim the tuition tax credit on their income tax return are required to file Canada T2202A.

How to fill out Canada T2202A?

To fill out Canada T2202A, students must obtain the form from their educational institution, ensure that their personal information is correct, and report the tuition fees paid and the months enrolled. The institution typically pre-fills much of this information.

What is the purpose of Canada T2202A?

The purpose of Canada T2202A is to provide students with the necessary documentation to claim tuition tax credits when filing their income tax returns, thereby reducing their taxable income.

What information must be reported on Canada T2202A?

Canada T2202A must report information including the student's name, the name and address of the educational institution, the amount of qualified tuition fees paid, and the number of months the student was enrolled in the program.

Fill out your Canada T2202A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2202a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.