UK NatWest NWO50000 2014 free printable template

Show details

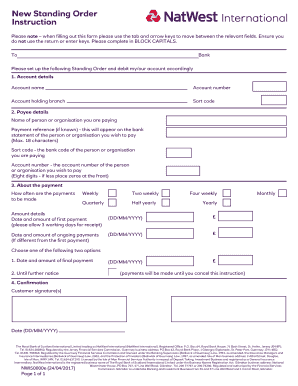

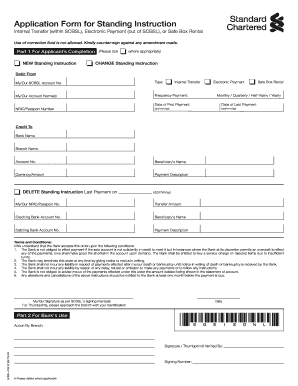

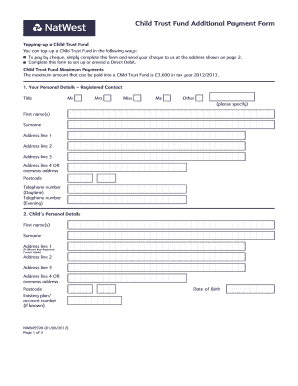

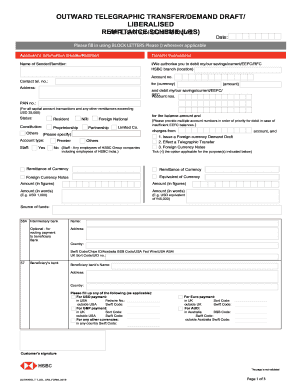

New Standing Order Instruction Please complete in BLOCK CAPITALS and in black ink. Please mark option boxes with an x. To Bank Please set up the following Standing Order and debit my/our account accordingly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK NatWest NWO50000

Edit your UK NatWest NWO50000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK NatWest NWO50000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK NatWest NWO50000 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK NatWest NWO50000. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK NatWest NWO50000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK NatWest NWO50000

How to fill out UK NatWest NWO50000

01

Gather your personal information, including your name, address, date of birth, and contact details.

02

Obtain your National Insurance number and any information regarding your income and financial status.

03

Complete the application form, ensuring all sections are filled in accurately.

04

Provide any required supporting documents, such as proof of identity and financial statements.

05

Double-check all entered information for accuracy.

06

Submit the application form either online or by post, following the submission guidelines provided.

Who needs UK NatWest NWO50000?

01

Individuals seeking financial support or loans from NatWest.

02

Customers who are looking to open a new account or apply for a specific financial product.

03

Anyone requiring assistance in managing their finances or obtaining credit solutions.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up a standing order with Natwest?

What you'll need Log in to the mobile app. Select the account that you want to set up the standing order to come from. Select the 'Standing order' section. Select 'Create' in the top right of the screen to add a new standing order. Choose your payee from the lists provided - either to a payee or one of your own accounts.

Can you request a standing order?

Any person or company with a current account can set up a standing order, either online, over the phone or in person at a branch of their bank. A standing order is different from a Direct Debit payment.

How long does it take for a bank to set up a standing order?

Standing orders are usually processed on the same day they are set up . However, allow between three to five working days for it to clear. If your payment is due to go out on a bank holiday or weekend, the money will leave your account on the next working day.

How do I change my Direct Debit to a standing order?

To change your direct debit, you'll need to contact the company that is making the payment. Unfortunately, the direct debit agreement is between you and them, and we can't make changes on your behalf.

How do I set up a standing payment?

A standing order mandate is a form with your own and the payee's bank details, as well as the amount, date of payments and occurrence. Once you fill in the mandate, you can send it to your bank to set up the standing order on your behalf. You can visit your nearest branch to set up a standing order.

How long does it take for a standing order to be paid Natwest?

Standing orders are usually cleared on the same working day, unless you submit your mandate on a bank holiday. However, delays can arise, so you should allow up to 5 days for everything to be processed.

Can I set up an international standing order?

International Standing Orders. These allow you to make overseas money transfers on a regular basis using your International Currency Account. They are ideal for paying bills, topping up an account in another country or sending money to family on a regular basis.

How do I set up a standing order online?

To set up a standing order in the Banking app: Log into the Banking app. From the menu, choose Payments & Transfers. Select Pay or Move Money. Choose the account you'd like the standing order to come from. Choose to pay a new or existing payee. Select the person you'd like to pay. Enter how much you want to pay.

How do I request a standing order payment?

How to set up a standing order. With some banks and building societies, you can set them up online or over the phone. Alternatively, you can complete a standing order form and give it to your bank. You'll need the account number and sort code of the person you're paying.

How do I set up a standing order at Natwest?

Using online banking. Select 'Payments and transfers' from the left hand menu. Under Standing orders click 'Create a new standing order'. Enter the details of the company or personal you are wanting to pay and click 'Next'.

How does a standing order work?

A standing order is a regular payment of the same amount that's paid on a specified date. It allows the bank to take money regularly from your account to pay another account. You can use a standing order for many payment types, including: Transferring money between your accounts.

How do I set up a standing order payment?

How to set up a standing order. With some banks and building societies, you can set them up online or over the phone. Alternatively, you can complete a standing order form and give it to your bank. You'll need the account number and sort code of the person you're paying.

What are the disadvantages of standing order?

Disadvantages of standing orders There is a lack of flexibility with the payments. When a standing order is set up, it's for a fixed amount and frequency. Payments are customer dependent. There can be payment delays and failures. There is more manual processing and admin.

How do I set up a standing order?

A standing order mandate is a form with your own and the payee's bank details, as well as the amount, date of payments and occurrence. Once you fill in the mandate, you can send it to your bank to set up the standing order on your behalf. You can visit your nearest branch to set up a standing order.

What does standing order mean Natwest?

A standing order is when you tell us to pay a fixed amount to someone straight from your account at regular intervals. The money is taken from your account automatically on a fixed date and will show up on your statement.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UK NatWest NWO50000 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UK NatWest NWO50000, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out the UK NatWest NWO50000 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign UK NatWest NWO50000. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out UK NatWest NWO50000 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UK NatWest NWO50000 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is UK NatWest NWO50000?

UK NatWest NWO50000 is a specific form or document used by NatWest Bank in the UK for certain banking or financial reporting purposes.

Who is required to file UK NatWest NWO50000?

Individuals or entities engaging in specific banking transactions or financial activities with NatWest Bank may be required to file UK NatWest NWO50000.

How to fill out UK NatWest NWO50000?

To fill out UK NatWest NWO50000, one must obtain the form from NatWest, complete the required fields accurately, and submit it according to the guidelines provided by the bank.

What is the purpose of UK NatWest NWO50000?

The purpose of UK NatWest NWO50000 is to gather necessary financial information from customers to ensure compliance with banking regulations and to facilitate proper banking operations.

What information must be reported on UK NatWest NWO50000?

The information that must be reported on UK NatWest NWO50000 typically includes personal identification details, transaction specifics, and other relevant financial data as required by the bank.

Fill out your UK NatWest NWO50000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK NatWest nwo50000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.