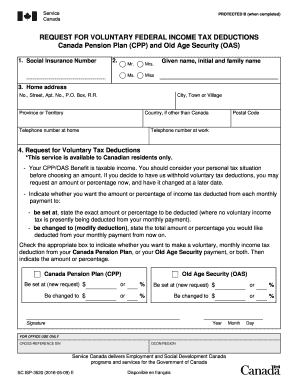

Canada SC ISP-3520 E 2013 free printable template

Show details

SC ISP-3520 (2013-05-13) E. Disposable en Fran AIs ... Canada Pension Plan (CPP) and Old Age Security (OAS). 1. ... Your CPP/OAS Benefit is taxable income. You should consider ... Need help completing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada SC ISP-3520 E

Edit your Canada SC ISP-3520 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada SC ISP-3520 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada SC ISP-3520 E online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada SC ISP-3520 E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SC ISP-3520 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada SC ISP-3520 E

How to fill out Canada SC ISP-3520 E

01

Obtain the Canada SC ISP-3520 E form from the official website or your local Service Canada office.

02

Read the instructions carefully to understand the purpose of the form.

03

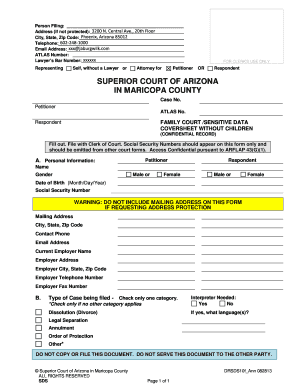

Fill out your personal information, including your full name, address, and contact details in the designated sections.

04

Provide details regarding your employment history and any relevant eligibility criteria as required.

05

Include your Social Insurance Number (SIN) where asked.

06

Carefully review the form to ensure all information is accurate and complete.

07

Sign and date the form at the bottom to certify the information provided.

08

Submit the completed form either in person at a Service Canada office or through the prescribed mailing address.

Who needs Canada SC ISP-3520 E?

01

Individuals applying for benefits related to unemployment, parental leave, or other specific government programs that require this form.

02

Anyone who needs to provide proof of their eligibility for services related to social insurance in Canada.

Fill

form

: Try Risk Free

People Also Ask about

How much tax do I have to withhold from my pension?

A mandatory 20% federal tax withholding rate is applied to certain lump-sum paid benefits, such as the Basic Death Benefit, Retired Death Benefit, Option 1 balance, and Temporary Annuity balance. Certain lump-sum benefits are eligible to be rolled over to an IRA to avoid the 20% federal tax withholding.

Can you receive CPP and OAS outside Canada?

Canadian Government Income Security Programs As a non-resident of Canada, you may be entitled to apply for Canada Pension Plan (CPP) payments and Old Age Security Pension (OAS) payments. Canada also has agreements with a number of other countries that offer comparable pension programs.

How do I request to withhold federal income tax?

More In Forms and Instructions Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

Is the Canadian old age pension taxable in the US?

By provision of the income tax treaty between the U.S. and Canada, benefits paid under the Canada Pension Plan (CPP), Quebec Pension Plan (QPP), and Old Age Security (OAS) program to a U.S. resident are taxable, if at all, only in the United States.

Do you get your money back from withholding tax?

What is withholding tax? Withholding tax is tax your employer withholds from your paycheck and sends to the IRS on your behalf. If too much money is withheld throughout the year, you'll receive a tax refund.

Do I have to pay US taxes on foreign pension?

Income received from foreign pensions or annuities may be fully or partly taxable, even if you do not receive a Form 1099 or other similar document reporting the amount of the income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada SC ISP-3520 E from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your Canada SC ISP-3520 E into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send Canada SC ISP-3520 E for eSignature?

When your Canada SC ISP-3520 E is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in Canada SC ISP-3520 E?

The editing procedure is simple with pdfFiller. Open your Canada SC ISP-3520 E in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is Canada SC ISP-3520 E?

Canada SC ISP-3520 E is a form used by individuals or entities in Canada to report specific information regarding certain transactions and activities that may be subject to taxation or regulatory oversight.

Who is required to file Canada SC ISP-3520 E?

Any individual or entity that engages in transactions or activities defined by the Canadian tax authorities as requiring reporting through the SC ISP-3520 E form is required to file it.

How to fill out Canada SC ISP-3520 E?

To fill out Canada SC ISP-3520 E, you must provide the required personal or entity information, details of the transactions or activities, and any supporting documentation as instructed on the form.

What is the purpose of Canada SC ISP-3520 E?

The purpose of Canada SC ISP-3520 E is to ensure compliance with Canadian tax laws and regulations by accurately reporting relevant transactions and activities to the taxing authorities.

What information must be reported on Canada SC ISP-3520 E?

Information that must be reported on Canada SC ISP-3520 E includes identification details of the filer, descriptions of the transactions, amounts involved, and any other relevant data as specified by the form guidelines.

Fill out your Canada SC ISP-3520 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada SC ISP-3520 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.