SSA-10 2014 free printable template

Show details

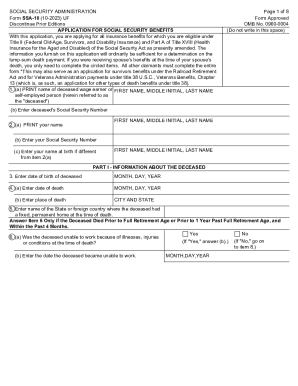

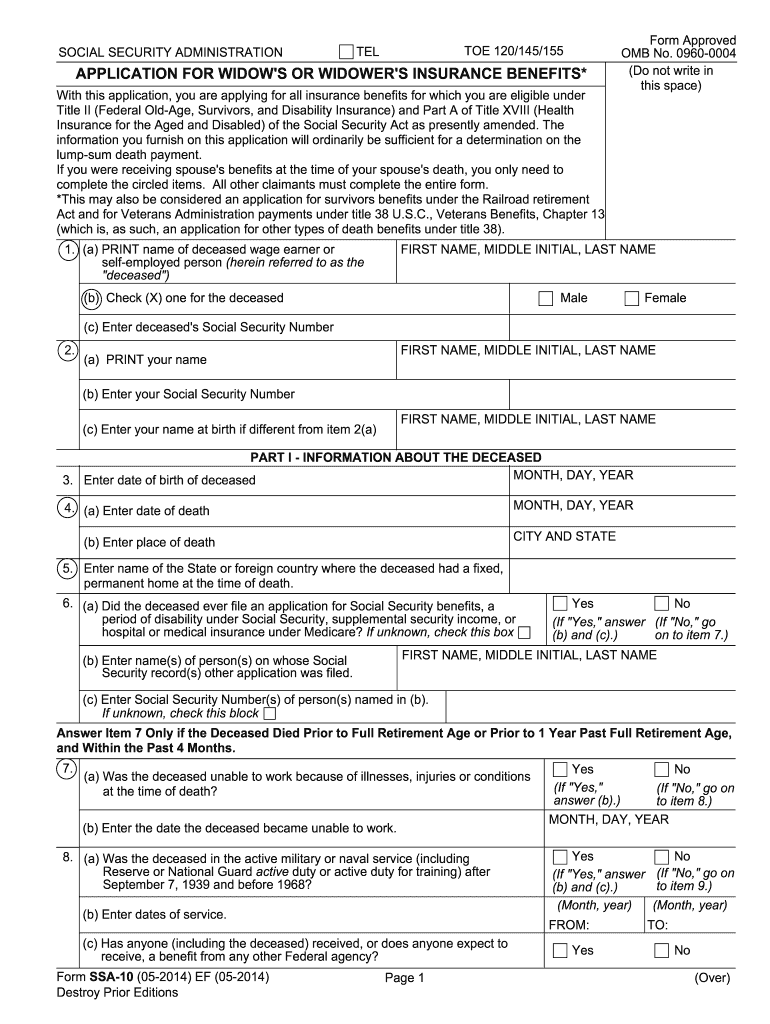

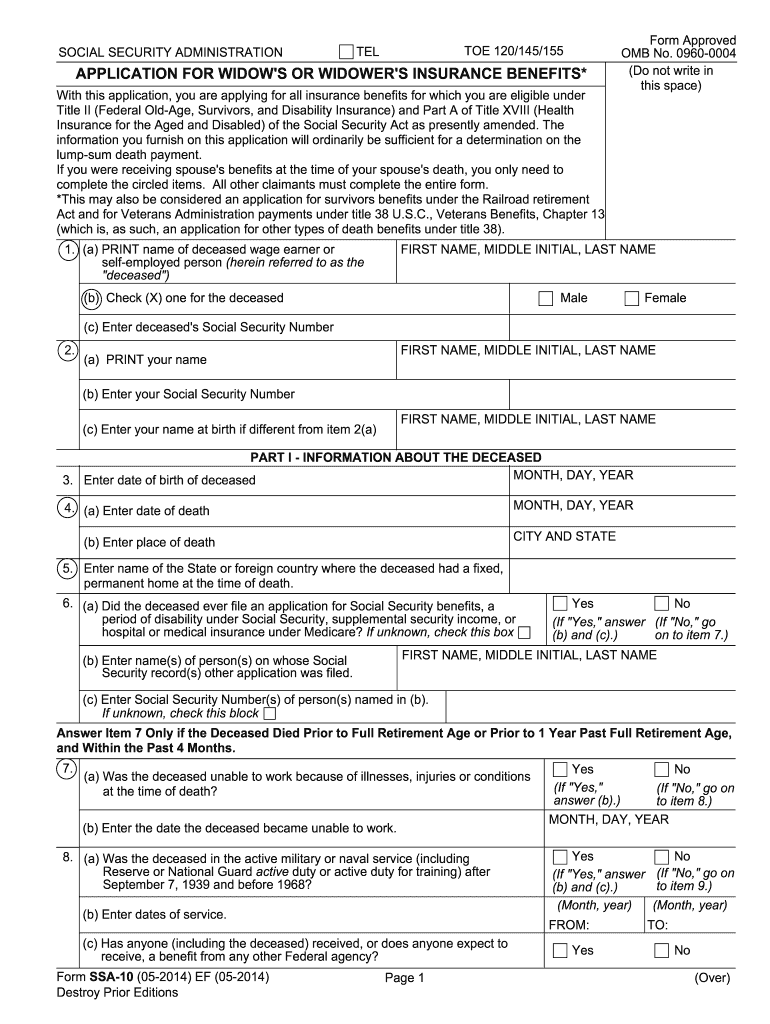

C Has anyone including the deceased received or does anyone expect to receive a benefit from any other Federal agency Page 1 Form SSA-10 05-2014 EF 05-2014 Destroy Prior Editions If go on Month year FROM TO Over ANSWER ITEM 9 ONLY IF DEATH OCCURRED WITHIN THE LAST 2 YEARS. Amount 9. SOCIAL SECURITY ADMINISTRATION TEL TOE 120/145/155 APPLICATION FOR WIDOW S OR WIDOWER S INSURANCE BENEFITS Form Approved OMB No* 0960-0004 Do not write in this space With this application you are applying for all...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form ssa 10

Edit your form ssa 10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ssa 10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ssa 10 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ssa 10. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ssa 10

How to fill out SSA-10

01

Start by obtaining the SSA-10 form from the Social Security Administration website or a local office.

02

Fill in your personal information in Section 1, including your name, Social Security number, and date of birth.

03

In Section 2, provide details about the deceased individual, including their name and Social Security number.

04

Complete Section 3 by stating the relationship you had with the deceased person.

05

In Section 4, indicate your contact information and any other pertinent details as required.

06

Review all completed sections to ensure accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the completed form to the appropriate SSA office via mail or in person.

Who needs SSA-10?

01

Individuals who are applying for Social Security benefits based on the work record of a deceased spouse or parent will need to fill out the SSA-10 form.

Fill

form

: Try Risk Free

People Also Ask about

How can I maximize my spousal Social Security benefits?

Both wait until age 70 to claim benefits If you or your spouse (or even both of you!) can wait until you're 70, you'll receive your highest Social Security payments—up to 132% of your primary insurance amount (PIA) if your full retirement age (FRA) is 66, and 124% of your PIA if your FRA is 67.

At what age can I draw my deceased husband's Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Who is not eligible for Social Security survivor benefits?

If you remarry before age 60 (age 50 if you have a disability), you cannot receive benefits as a surviving spouse while you are married. If you remarry after age 60 (age 50 if you have a disability), you will continue to qualify for benefits on your deceased spouse's Social Security record.

What is the loophole for Social Security spousal benefits?

The Restricted Application Loophole One Social Security loophole allowed married individuals to begin receiving a spousal benefit at full retirement age, while letting their own retirement benefit grow. This was done by filing what is called a restricted application.

What is a SSA 10 form?

Form SSA-10. | Information You Need to Apply for Widow's, Widower's or Surviving Divorced Spouse's Benefits. Social Security Administration.

When can a wife collect half of her husband's Social Security?

A widow is eligible for between 71 percent (at age 60) and 100 percent (at full retirement age) of what the spouse was getting before they died. We must pay your own retirement benefit first, then supplement it with whatever extra benefits you are due as a widow.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ssa 10 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form ssa 10 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify form ssa 10 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form ssa 10. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send form ssa 10 to be eSigned by others?

To distribute your form ssa 10, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

What is SSA-10?

SSA-10 is a form used by the Social Security Administration (SSA) for individuals to apply for Social Security Disability Insurance (SSDI) benefits on behalf of disabled children.

Who is required to file SSA-10?

The SSA-10 form must be filed by parents or guardians on behalf of a child who is disabled and is seeking SSDI benefits.

How to fill out SSA-10?

To fill out the SSA-10 form, applicants must provide personal information about the child, including identification details, medical information regarding the disability, and any related earnings or work history.

What is the purpose of SSA-10?

The purpose of the SSA-10 form is to determine the eligibility of a disabled child for Social Security Disability Insurance benefits.

What information must be reported on SSA-10?

The SSA-10 requires reporting information such as the child's name, Social Security number, medical conditions, treatment history, work history of the parents or guardians, and financial information.

Fill out your form ssa 10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ssa 10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.