Get the free notice of assessment

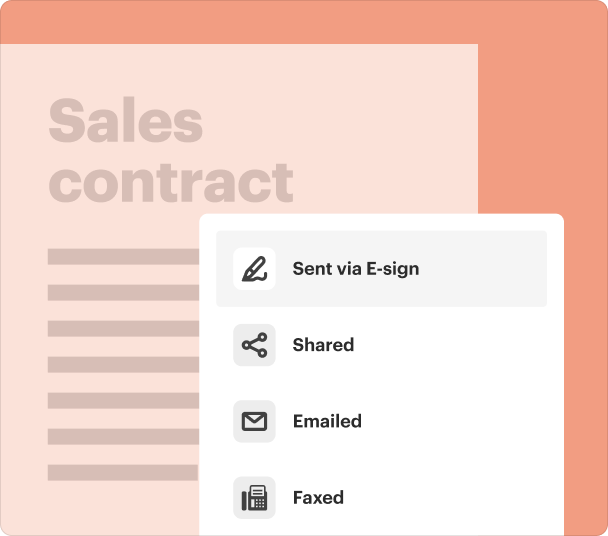

Fill out, sign, and share forms from a single PDF platform

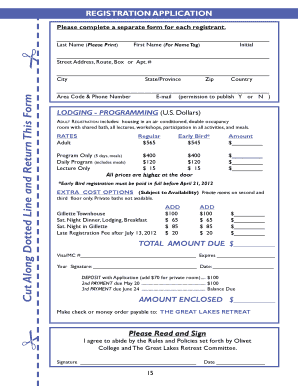

Edit and sign in one place

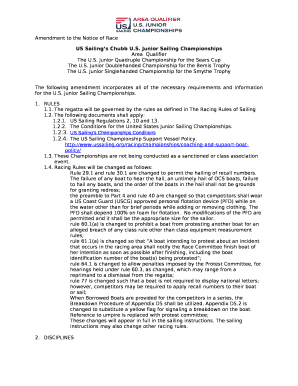

Create professional forms

Simplify data collection

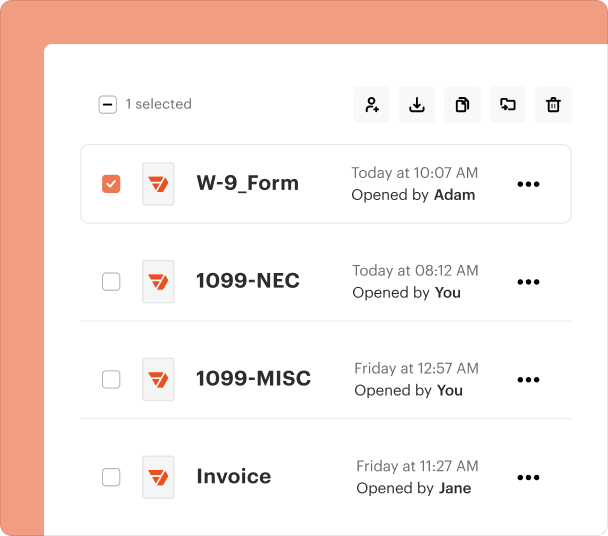

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

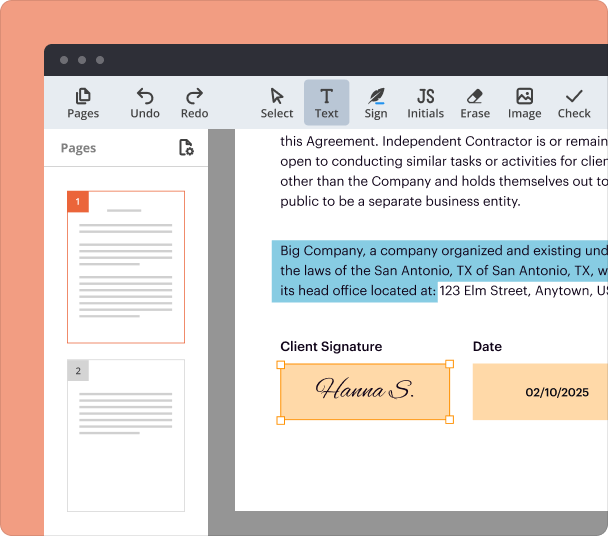

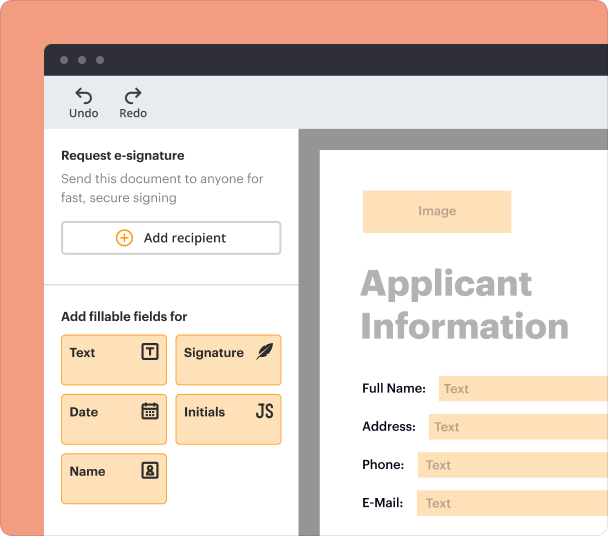

Understanding the notice of assessment sample form

Purpose of the notice of assessment sample form

The notice of assessment sample form is a vital document used primarily in the tax assessment process. It serves as a formal notification to taxpayers regarding their tax obligations, outlining the income assessed, deductions considered, and any taxes owed. This document is crucial for individuals to understand their tax status and to ensure compliance.

Key features of the notice of assessment sample form

This form encompasses several essential components. It typically includes details of the taxpayer, assessment year, total income assessed, applicable tax rates, and the final amount owed or refunded. Additionally, it might highlight any discrepancies or adjustments made compared to previously filed tax returns.

When to use the notice of assessment sample form

Taxpayers should utilize the notice of assessment sample form when they receive a notification from the tax authority regarding their assessment. It is particularly important for those who have experienced changes in income, have claims of deductions to verify, or when clarifying any disputes related to their tax filings.

Who needs the notice of assessment sample form

This form is essential for individuals and business entities subject to taxation within the United States. Taxpayers who have filed an annual tax return and have had their returns reviewed by the Internal Revenue Service (IRS) or state tax agencies will require this document for their records.

How to fill the notice of assessment sample form

Filling out the notice of assessment sample form involves carefully reviewing the assessment details provided by the tax agency. Taxpayers should ensure that their personal information is correct, confirm the income and deductions reported, and understand the calculation of any taxes owed. Accuracy is crucial to avoid potential penalties.

Common errors and troubleshooting

Common mistakes on the notice of assessment sample form include incorrect personal information, misreported income, and overlooked deductions. Taxpayers should double-check all figures and ensure that any additional documentation needed to support claims is attached. If discrepancies arise, contacting the tax agency promptly is advisable.

Frequently Asked Questions about notice of assessment sample form

Why is the notice of assessment important?

The notice of assessment is important as it provides taxpayers with official details of their tax status, obligations, and any amounts owed or refunded. Understanding this document is essential for compliance.

What should I do if I disagree with my notice of assessment?

If there is a disagreement, it is best to contact the issuing tax authority to discuss the discrepancies and provide any supporting documentation to resolve the matter.

pdfFiller scores top ratings on review platforms