AU D1217 2013 free printable template

Show details

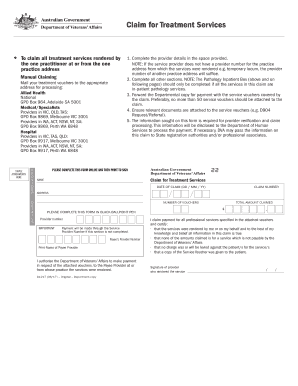

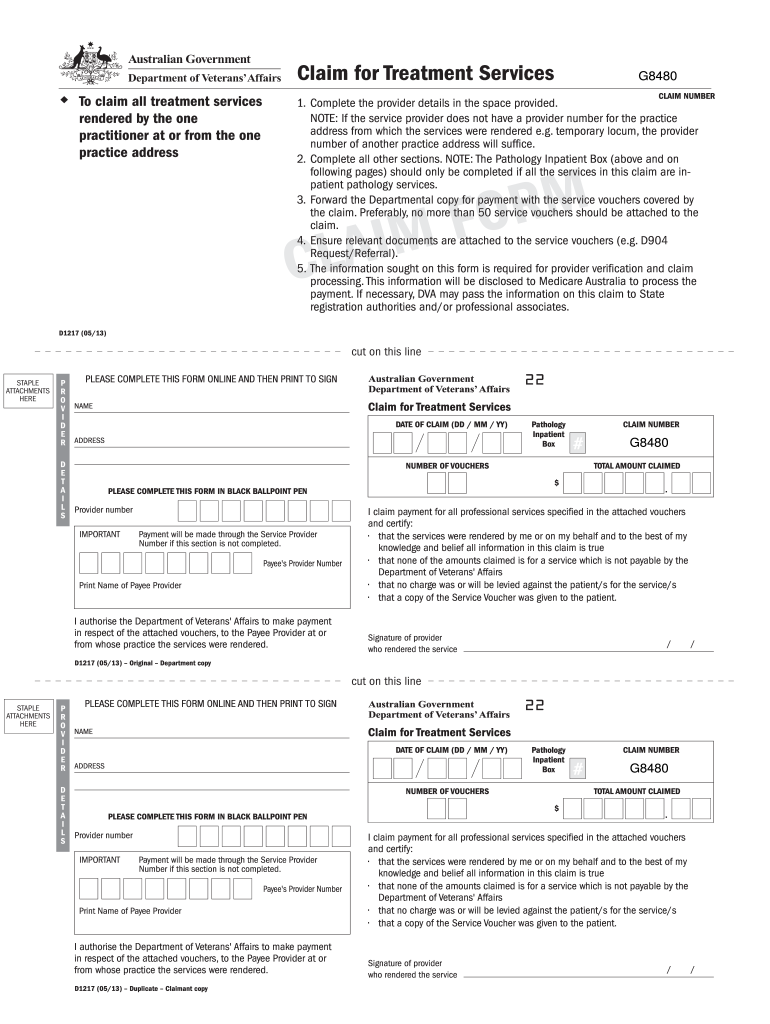

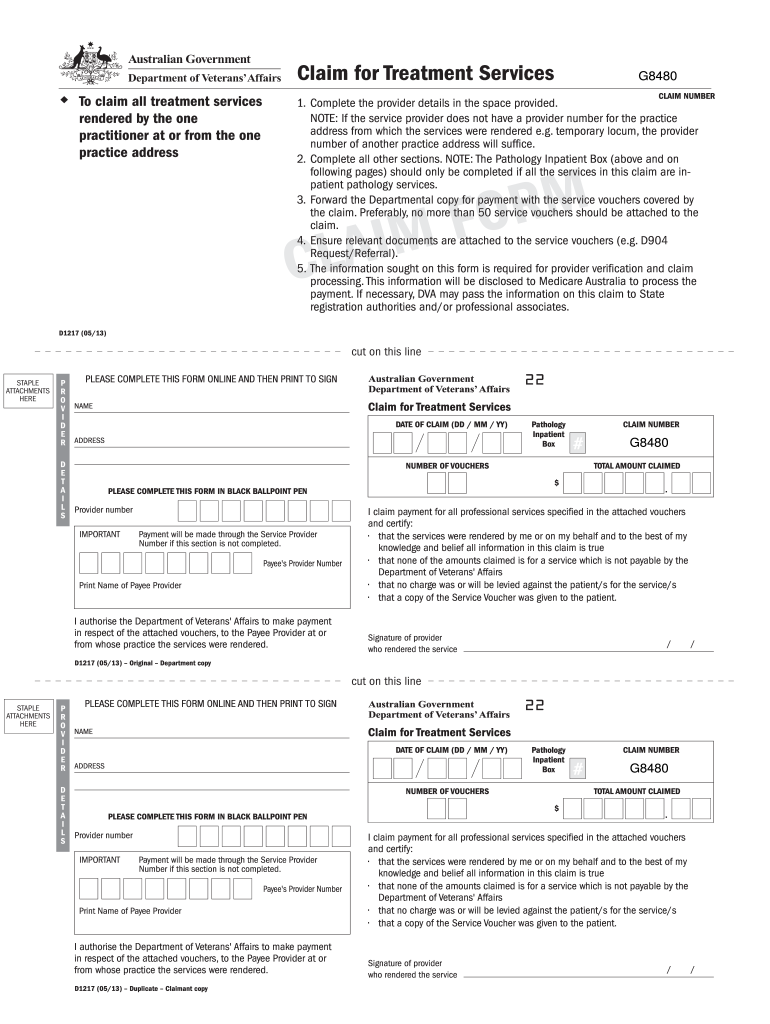

Claim for Treatment Services To claim all treatment services rendered by the one practitioner at or from the one practice address G8480 CLAIM NUMBER 1. Complete the provider details in the space provided.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU D1217

Edit your AU D1217 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU D1217 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU D1217 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU D1217. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU D1217 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU D1217

How to fill out AU D1217

01

Obtain the AU D1217 form from the relevant authority or website.

02

Fill in your personal details in the designated fields, such as name, address, and contact information.

03

Provide specific information related to the purpose of the form, following the instructions provided.

04

Review the form for any errors or missing information.

05

Sign and date the form in the required section.

06

Submit the completed form to the appropriate office or as instructed.

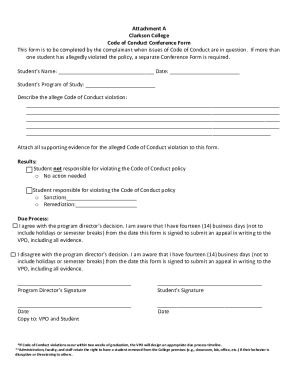

Who needs AU D1217?

01

Individuals or businesses seeking to apply for a specific government service or benefit related to AU D1217.

02

Anyone required to report certain information or comply with regulatory requirements as outlined in the form.

Fill

form

: Try Risk Free

People Also Ask about

How do I manually claim DVA?

Please call 1800 550 457 if you require manual claim forms.

What does the DVA do?

D.Va is a former professional gamer who now uses her skills to pilot a state-of-the-art mech in defense of her homeland.

How do I check my DVA eligibility?

Contact DVA on 1300 550 457 (option 3 then, option 1) to verify entitlement for services are covered by DVA. Note: Contribution to costs for travel to treatment may be available.

How do I send an invoice to DVA?

All Invoices submitted to DVA must include the following details: Business Name & Address. Australian Business Number. The words 'Tax Invoice' & your Invoice Number. Client Name, DVA File Number & TRN (listed above) Date the HHS was provided. Address where the HHS was provided. Description of the HHS provided.

What is DVA code 581?

581 - Condition treated has not been stated. Accepted Disability Text has not been filled out for this claim/invoice, this can be found under the Client Information area in the invoice.

How many points is tinnitus?

TFI score is on the boundary of an impairment rating impairment ratingcriteriatfi scoreTWOVery mild tinnitus: not present ever day.18 - 31FIVETinnitus ever day, but tolderable for much of the time.32 - 53TENSevere tinnitus, e.g. of similar severity to that requiring a masking device, present every day.54 - 722 more rows • Aug 19, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AU D1217 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AU D1217, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send AU D1217 for eSignature?

When you're ready to share your AU D1217, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the AU D1217 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your AU D1217 and you'll be done in minutes.

What is AU D1217?

AU D1217 is a specific form used for reporting certain financial information related to Australian taxation.

Who is required to file AU D1217?

Individuals and entities who meet specific criteria set by the Australian Taxation Office (ATO) are required to file AU D1217.

How to fill out AU D1217?

To fill out AU D1217, you need to provide personal and financial information as required, ensuring that all sections are completed accurately according to ATO guidelines.

What is the purpose of AU D1217?

The purpose of AU D1217 is to collect relevant financial data for compliance with Australian tax laws and to ensure accurate assessment of tax obligations.

What information must be reported on AU D1217?

The information that must be reported on AU D1217 includes income details, deductions, and other relevant financial activities as specified by the ATO.

Fill out your AU D1217 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU d1217 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.