Get the free international import certificate

Show details

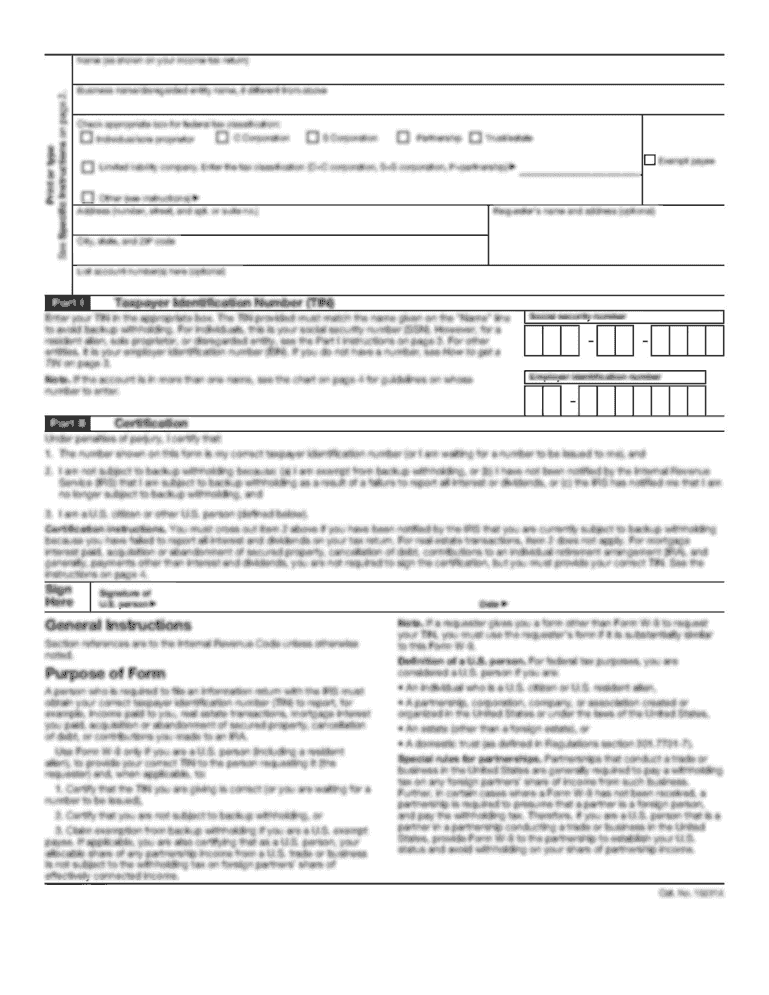

?????? ? ?????? ? INTERNATIONAL IMPORT CERTIFICATE REPUBLIC OF BULGARIA I C DU ? INTERMINISTERIAL COMMISSION FOR EXPORT CONTROL AND NON-PROLIFERATION OF WEAPONS OF MASS DESTRUCTION 1. IMPORTER/CONSIGNEE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international import certificate

Edit your international import certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international import certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international import certificate online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international import certificate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international import certificate

How to fill out international import certificate:

01

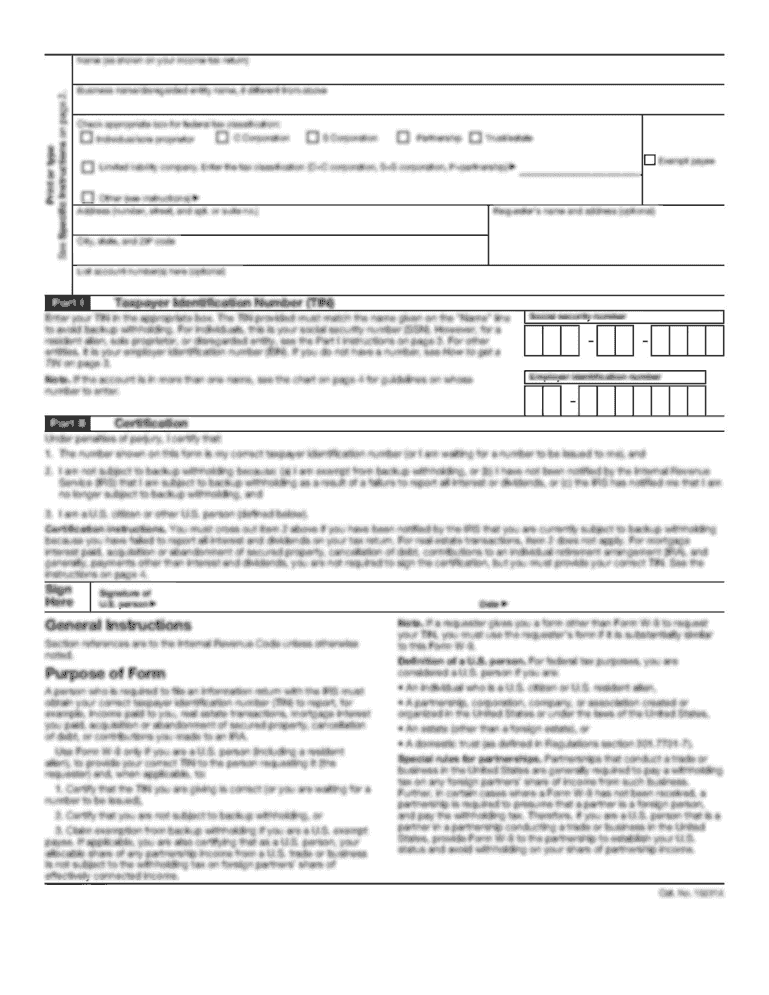

Begin by gathering all the necessary information and documents related to the import, including the details of the importing and exporting parties, the commodity being imported, and the terms of the trade agreement.

02

Fill out the header section of the certificate with the relevant information, such as the name and address of the exporter and importer, the country of origin and destination, and any applicable trade agreement or tariff classification.

03

Provide a detailed description of the imported commodity, including its quantity, value, and unit of measurement. It is important to be accurate and specific, as any discrepancies may result in delays or issues during customs clearance.

04

Indicate the mode of transport and route of the shipment, including the name of the vessel or carrier, the departure and arrival ports, and the expected date of arrival.

05

Include any special instructions, requirements, or declarations required for customs purposes, such as certifications, licenses, or permits. These may vary depending on the type of goods being imported or the regulations of the importing country.

06

Review the completed certificate for any errors or omissions and make any necessary corrections before signing and dating the document.

07

Submit the completed international import certificate to the relevant customs authorities or agencies, following their specific procedures and requirements.

Who needs international import certificate:

01

Businesses or individuals engaged in international trade who are importing goods from a foreign country.

02

Importers who are subject to customs regulations and requirements of their own country or the country they are importing into.

03

Governments and customs authorities that use import certificates as a way to monitor and control international trade, enforce trade regulations, and collect accurate trade statistics.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to export a certificate?

The Export-Certificate cmdlet exports a certificate from a certificate store to a file. The private key is not included in the export. If more than one certificate is being exported, then the default file format is SST . Otherwise, the default format is CERT .

How do I get an international import certificate?

To obtain such a certificate you will have to fill in and execute the U.S. International Import Certificate form (Form BIS-645P/ATF-4522/DSP-53) and submit it to the U.S. government agency that has jurisdiction over the items you are importing.

How do I get an import certificate?

Import and Export Certificate - Microsoft Windows Open the MMC (Start > Run > MMC). Go to File > Add / Remove Snap In. Double Click Certificates. Select Computer Account. Select Local Computer > Finish. Click OK to exit the Snap-In window. Click [+] next to Certificates > Personal > Certificates.

How do I import internationally?

The five basics steps you need to know before becoming an importer are as follows: Decide the country. Different countries have different export/import regulations. Search for suppliers. Search the duty and taxes. Find a reliable freight forwarder and customs broker. Ship the goods on time.

What is a import certificate?

Important note: An International Import Certificate is meant to allow a foreign supplier to obtain the approvals it needs from its own government to allow the export of goods or technology to Canada. An International Import Certificate does not authorize the import of goods into Canada.

What are the 4 types of imports?

Types of import Industrial and consumer goods. Intermediate goods and services.

What are import licenses in the United States?

An import license is a documentation of acknowledgment that the government recognizes the business and the certain goods that the company imports. A US import license is considered a non-tariff barrier to discriminate between the imported goods and domestic goods to protect the domestic industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the international import certificate form on my smartphone?

Use the pdfFiller mobile app to fill out and sign international import certificate on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit international import certificate on an iOS device?

You certainly can. You can quickly edit, distribute, and sign international import certificate on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out international import certificate on an Android device?

Use the pdfFiller mobile app and complete your international import certificate and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is international import certificate?

An international import certificate is a document required by customs authorities that serves as proof that the imported goods comply with certain regulations, trade agreements, or standards.

Who is required to file international import certificate?

Importers or businesses involved in the international trade of goods are typically required to file an international import certificate.

How to fill out international import certificate?

To fill out an international import certificate, you need to provide information such as the details of the importer, the description and quantity of the goods, the country of origin, and any applicable customs codes.

What is the purpose of international import certificate?

The purpose of the international import certificate is to ensure compliance with trade regulations, facilitate the monitoring of goods, and prevent illegal or non-compliant imports.

What information must be reported on international import certificate?

The information that must be reported on an international import certificate typically includes the name and address of the importer, description of the goods, valuation, quantity, country of origin, and any regulatory compliance details.

Fill out your international import certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Import Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.